Question: Hello, please help me answer the questions. Please show work so I can understand the process. Thank you so much! 2 54 401 Use the

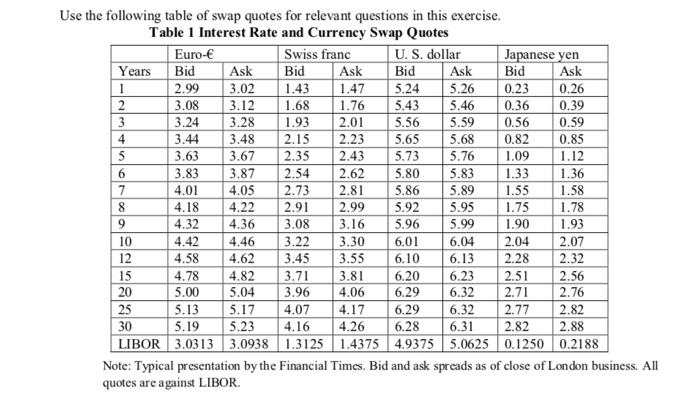

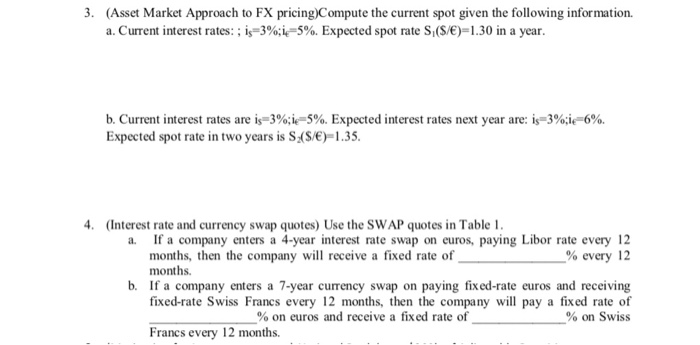

2 54 401 Use the following table of swap quotes for relevant questions in this exercise. Table 1 Interest Rate and Currency Swap Quotes Euro- Swiss franc U.S. dollar Japanese yen Years Bid Ask Bid Ask Bid Ask Bid Ask 2.99 3.021.431.47 5.24 5.26 0.23 0.26 3.08 3.12 1.68 1.76 5.43 5.46 0.36 0.39 3.24 3.28 1.93 2.01 5.56 5.59 0.56 0.59 3.44 3.48 2.15 2.23 5.65 5.68 0.82 0.85 3.63 3.67 2.35 2.43 5.73 5.76 1.09 1.12 3.83 3.87 2.62 5.80 5.83 1.33 1.36 14.05 2.73 2.81 5.89 1.55 1.58 4.18 4.22 2.91 2.99 5.95 1.75 1.78 4.36 3.08 3.16 1.90 3.22 6.04 4.62 3.45 3.55 6.13 4.78 4.82 3.71 3.81 6.20 6.23 56 5.00 5.04 3.96 4.06 6.296.322.71 2.76 5.135.174 .07 4.17 6.296 .32 2.77 2.82 30 5.195 .23 4.16 4.26 6.28 6.31 2.82 2.88 LIBOR 3.0313 3.0938 1.3125 1.4375 4.9375 5.0625 0.1250 0.2188 Note: Typical presentation by the Financial Times. Bid and ask spreads as of close of London business. All quotes are against LIBOR. 32 4 42 446 2.04 4.58 2.28 25 3. (Asset Market Approach to FX pricing)Compute the current spot given the following information. a. Current interest rates: ; is=3%;i-5%. Expected spot rate S ($/)-1.30 in a year. b. Current interest rates are is 3%; le-5%. Expected interest rates next year are: is 3%;16%. Expected spot rate in two years is Sz($/)-1.35. 4. (Interest rate and currency swap quotes) Use the SWAP quotes in Table 1 a. If a company enters a 4-year interest rate swap on euros, paying Libor rate every 12 months, then the company will receive a fixed rate of _% every 12 months. b. If a company enters a 7-year currency swap on paying fixed-rate curos and receiving fixed-rate Swiss Francs every 12 months, then the company will pay a fixed rate of _% on euros and receive a fixed rate of % on Swiss Francs every 12 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts