Question: Hello, Please help me to answer this. Kindly provide clear solutions, thank you! Problem 1-18 (LAA) Yasmin Company provided the following on December 31, 2021;

Hello, Please help me to answer this.

Kindly provide clear solutions, thank you!

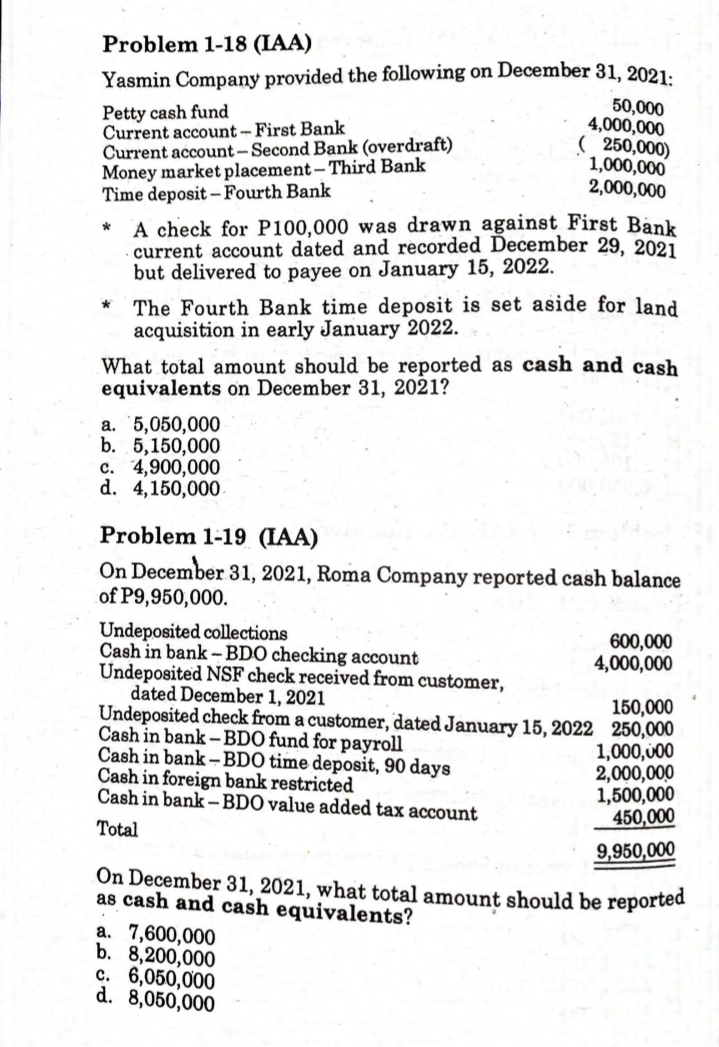

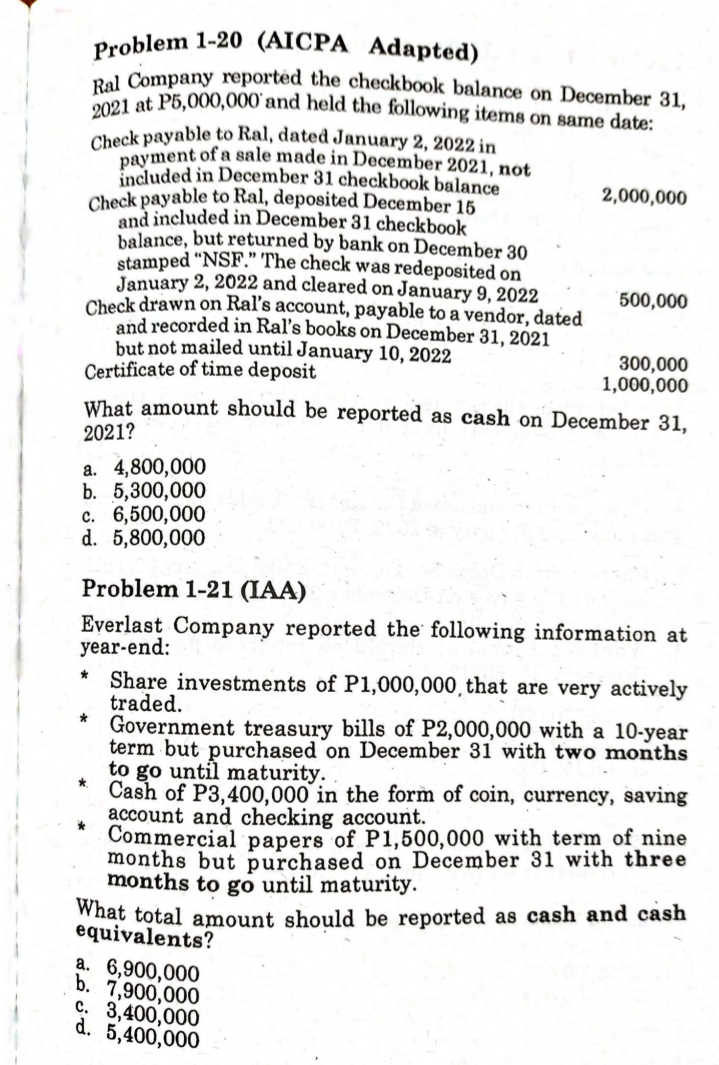

Problem 1-18 (LAA) Yasmin Company provided the following on December 31, 2021; Petty cash fund 50,000 Current account - First Bank 4,000,000 Current account - Second Bank (overdraft) ( 250,000) Money market placement- Third Bank 1,000,000 Time deposit - Fourth Bank 2,000,000 * A check for P100,000 was drawn against First Bank current account dated and recorded December 29, 2021 but delivered to payee on January 15, 2022. * The Fourth Bank time deposit is set aside for land acquisition in early January 2022. What total amount should be reported as cash and cash equivalents on December 31, 2021? a. '5,050,000 b. 5,150,000 C. 4,900,000 d. 4,150,000 Problem 1-19 (LAA) On December 31, 2021, Roma Company reported cash balance of P9,950,000. Undeposited collections 600,000 Cash in bank - BDO checking account 4,000,000 Undeposited NSF check received from customer, dated December 1, 2021 150,000 Undeposited check from a customer, dated January 15, 2022 250,000 Cash in bank - BDO fund for payroll Cash in bank - BDO time deposit, 90 days 1,000,000 Cash in foreign bank restricted 2,000,000 Cash in bank - BDO value added tax account 1,500,000 450,000 Total 9,950,000 On December 31, 2021, what total amount should be reported as cash and cash equivalents? a. 7,600,000 b. 8,200,000 C. 6,050,000 d. 8,050,000Problem 1-20 (AICPA Adapted) Ral Company reported the checkbook balance on December 31, 2021 at P5,000,000 and held the following items on same date: Check payable to Ral, dated January 2, 2022 in payment of a sale made in December 2021, not included in December 31 checkbook balance Check payable to Ral, deposited December 15 2,000,000 and included in December 31 checkbook balance, but returned by bank on December 30 stamped "NSF." The check was redeposited on January 2, 2022 and cleared on January 9, 2022 500,000 Check drawn on Ral's account, payable to a vendor, dated and recorded in Ral's books on December 31, 2021 but not mailed until January 10, 2022 300,000 Certificate of time deposit 1,000,000 What amount should be reported as cash on December 31, 2021? a. 4,800,000 b. 5,300,000 c. 6,500,000 d. 5,800,000 Problem 1-21 (IAA) Everlast Company reported the following information at year-end: * Share investments of P1,000,000, that are very actively traded. * Government treasury bills of P2,000,000 with a 10-year term but purchased on December 31 with two months to go until maturity. Cash of P3,400,000 in the form of coin, currency, saving account and checking account. Commercial papers of P1,500,000 with term of nine months but purchased on December 31 with three months to go until maturity. What total amount should be reported as cash and cash equivalents? a. 6,900,000 b. 7,900,000 C. 3,400,000 d. 5,400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts