Question: Hello please help me to answer this. Please provide clear solutions. Thank you! Problem 1-10 (AICPA Adapted) Tranvia Company revealed the following information on December

Hello please help me to answer this.

Please provide clear solutions. Thank you!

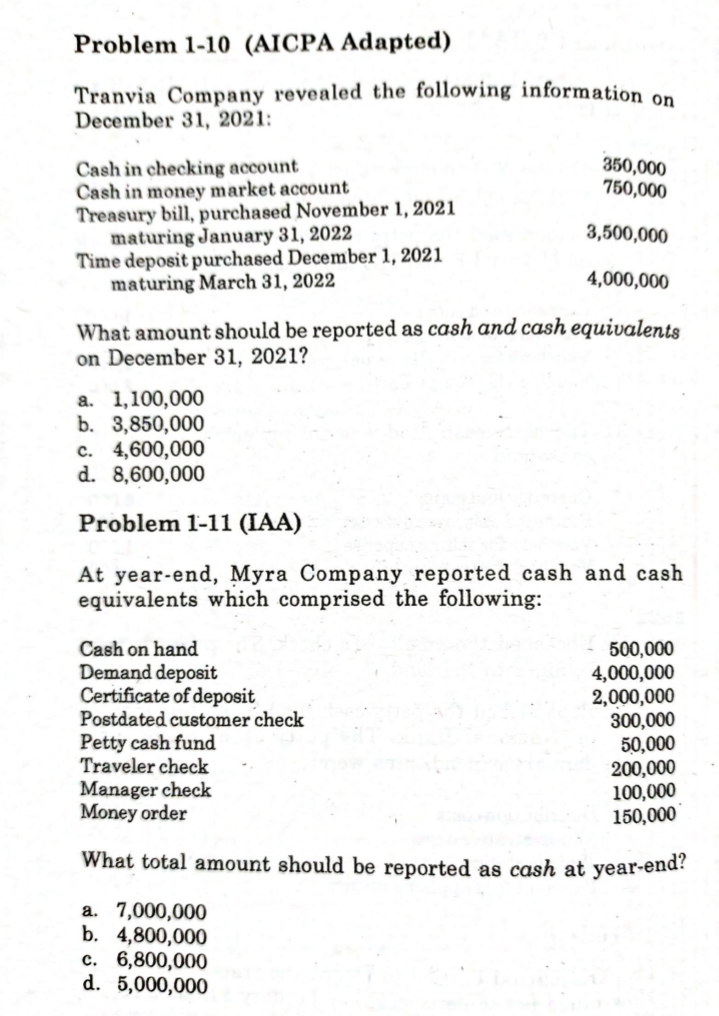

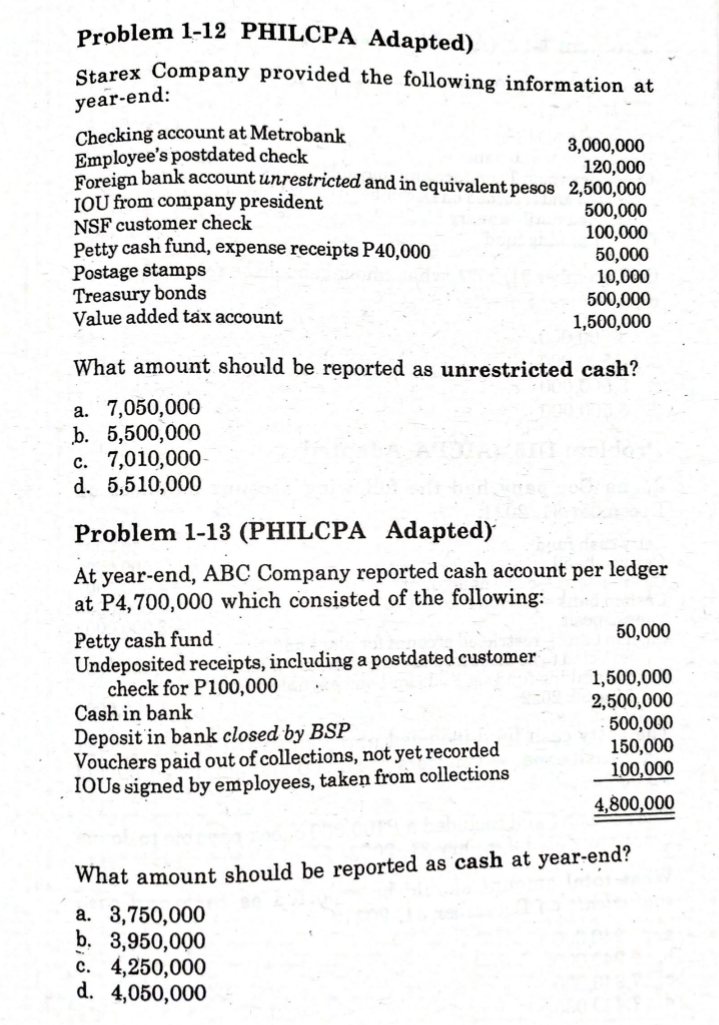

Problem 1-10 (AICPA Adapted) Tranvia Company revealed the following information on December 31, 2021: Cash in checking account 350,000 Cash in money market account 750,000 Treasury bill, purchased November 1, 2021 maturing January 31, 2022 3,500,000 Time deposit purchased December 1, 2021 maturing March 31, 2022 4,000,000 What amount should be reported as cash and cash equivalents on December 31, 2021? a. 1,100,000 b. 3,850,000 C. 4,600,000 d. 8,600,000 Problem 1-11 (IAA) At year-end, Myra Company reported cash and cash equivalents which comprised the following: Cash on hand 500,000 Demand deposit 4,000,000 Certificate of deposit 2,000,000 Postdated customer check 300,000 Petty cash fund 50,000 Traveler check 200,000 Manager check 100,000 Money order 150,000 What total amount should be reported as cash at year-end? a. 7,000,000 b. 4,800,000 C. 6,800,000 d. 5,000,000Problem 1-12 PHILCPA Adapted) Starex Company provided the following information at year-end: Checking account at Metrobank Employee's postdated check 3,000,000 Foreign bank account unrestricted and in equivalent pesos 2,500,000 120,000 IOU from company president NSF customer check 500,000 Petty cash fund, expense receipts P40,000 100,000 Postage stamps 50,000 Treasury bonds 10,000 Value added tax account 500,000 1,500,000 What amount should be reported as unrestricted cash? a. 7,050,000 b. 5,500,000 c. 7,010,000 d. 5,510,000 Problem 1-13 (PHILCPA Adapted) At year-end, ABC Company reported cash account per ledger at P4, 700,000 which consisted of the following: Petty cash fund 50,000 Undeposited receipts, including a postdated customer check for P100,000 1,500,000 Cash in bank 2,500,000 Deposit in bank closed by BSP 500,000 Vouchers paid out of collections, not yet recorded 150,000 IOUs signed by employees, taken from collections 100,000 4,800,000 What amount should be reported as cash at year-end? a. 3,750,000 b. 3,950,000 c. 4,250,000 d. 4,050,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts