Question: Hello! Previous Chegg experts didn't get the answer right. Please help however you can being as I didn't post whole questions to answer! Compute Liquidity

Hello! Previous Chegg experts didn't get the answer right. Please help however you can being as I didn't post whole questions to answer!

Hello! Previous Chegg experts didn't get the answer right. Please help however you can being as I didn't post whole questions to answer!

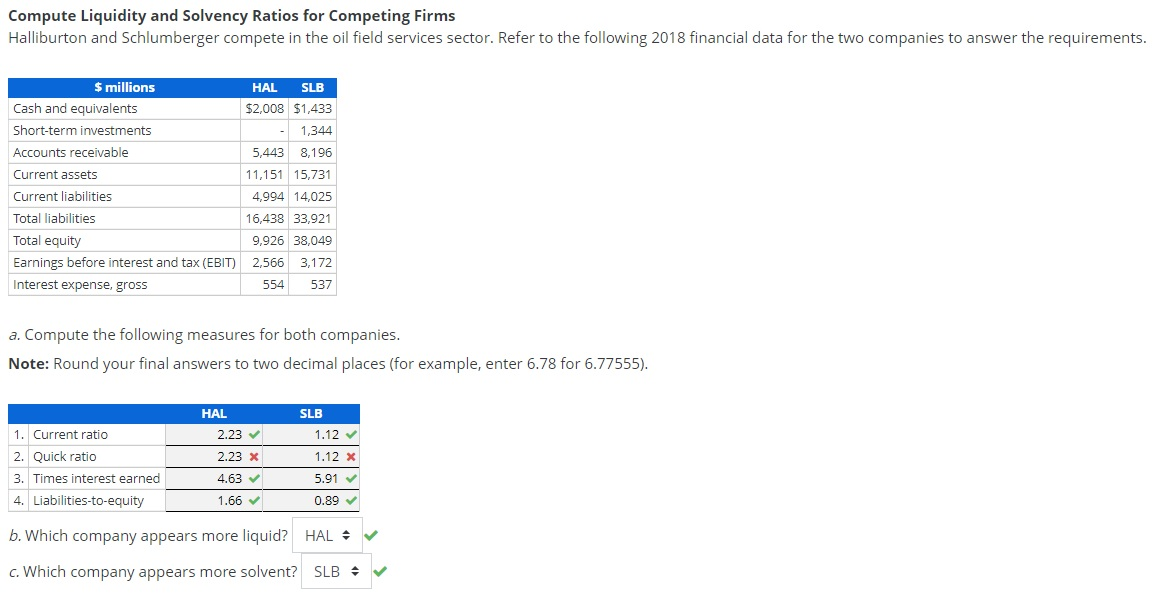

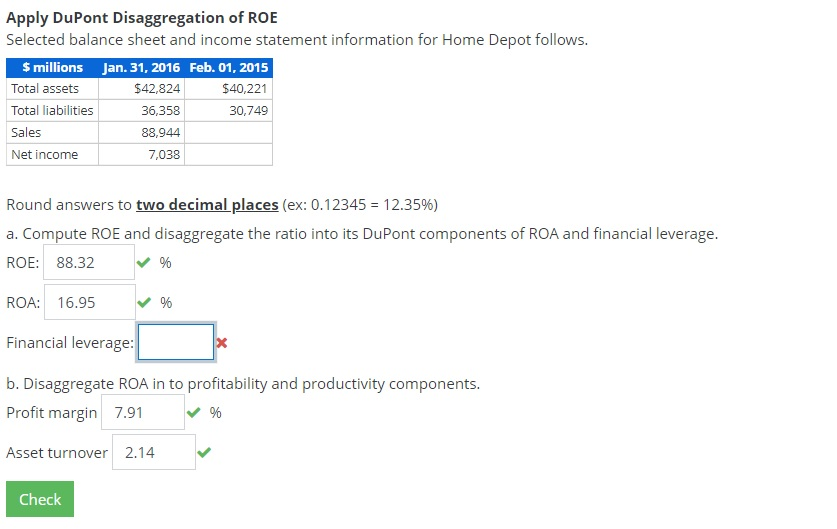

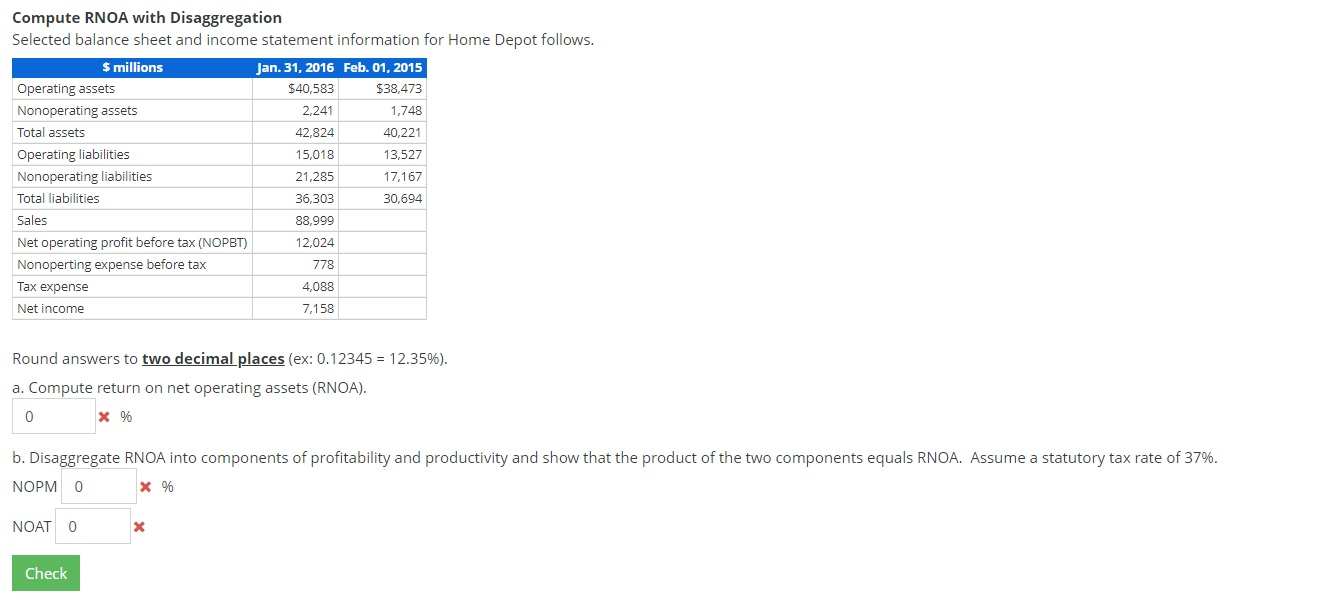

Compute Liquidity and Solvency Ratios for Competing Firms Halliburton and Schlumberger compete in the oil field services sector. Refer to the following 2018 financial data for the two companies to answer the requirements. $ millions HAL SLB Cash and equivalents $2,008 $1,433 Short-term investments - 1,344 Accounts receivable 5,443 8,196 Current assets 11,151 15,731 Current liabilities 4,994 14,025 Total liabilities 16,438 33,921 Total equity 9,926 38,049 Earnings before interest and tax (EBIT) 2,566 3,172 Interest expense, gross 554 537 a. Compute the following measures for both companies. Note: Round your final answers to two decimal places (for example, enter 6.78 for 6.77555). SLB 1.12 1. Current ratio 2. Quick ratio 3. Times interest earned 4. Liabilities-to-equity HAL 2.23 2.23 x 4.63 1.66 1.12 x 5.91 0.89 b. Which company appears more liquid? HAL c. Which company appears more solvent? SLB Apply DuPont Disaggregation of ROE Selected balance sheet and income statement information for Home Depot follows. $ millions Jan. 31, 2016 Feb. 01, 2015 Total assets $42,824 $40,221 Total liabilities 36,358 30,749 Sales 88,944 Net income 7,038 Round answers to two decimal places (ex: 0.12345 = 12.35%) a. Compute ROE and disaggregate the ratio into its DuPont components of ROA and financial leverage. ROE: 88.32 % ROA: 16.95 % Financial leverage: b. Disaggregate ROA in to profitability and productivity components. Profit margin 7.91 Asset turnover 2.14 Check Compute RNOA with Disaggregation Selected balance sheet and income statement information for Home Depot follows. $ millions Jan. 31, 2016 Feb. 01, 2015 Operating assets $40,583 $38,473 Nonoperating assets 2,241 1,748 Total assets 42,824 40,221 Operating liabilities 15,018 13,527 Nonoperating liabilities 21,285 17,167 Total liabilities 36,303 30,694 Sales 88,999 Net operating profit before tax (NOPBT) 12,024 Nonoperting expense before tax 778 Tax expense 4,088 Net income 7,158 Round answers to two decimal places (ex: 0.12345 = 12.35%). a. Compute return on net operating assets (RNOA). 0 X % b. Disaggregate RNOA into components of profitability and productivity and show that the product of the two components equals RNOA. Assume a statutory tax rate of 37%. NOPM X % 0 NOAT 0 X Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts