Question: Hello, because I didn't post full questions that needed to be answered and only parts, please help however you can! Previous chegg experts didn't get

Hello, because I didn't post full questions that needed to be answered and only parts, please help however you can! Previous chegg experts didn't get these correct and I am out of questions to ask. Thank you in advance

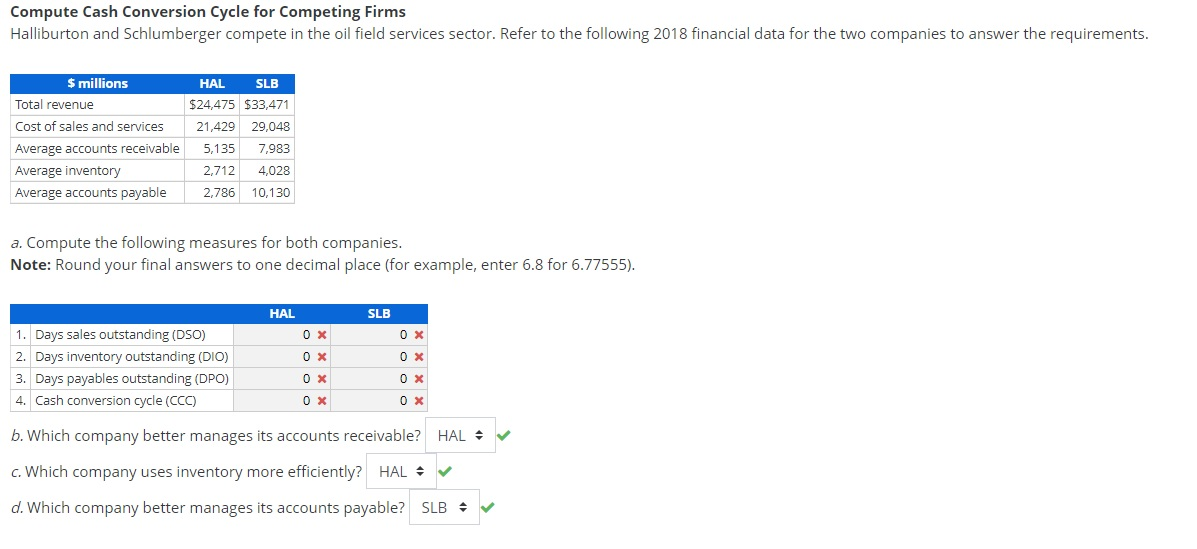

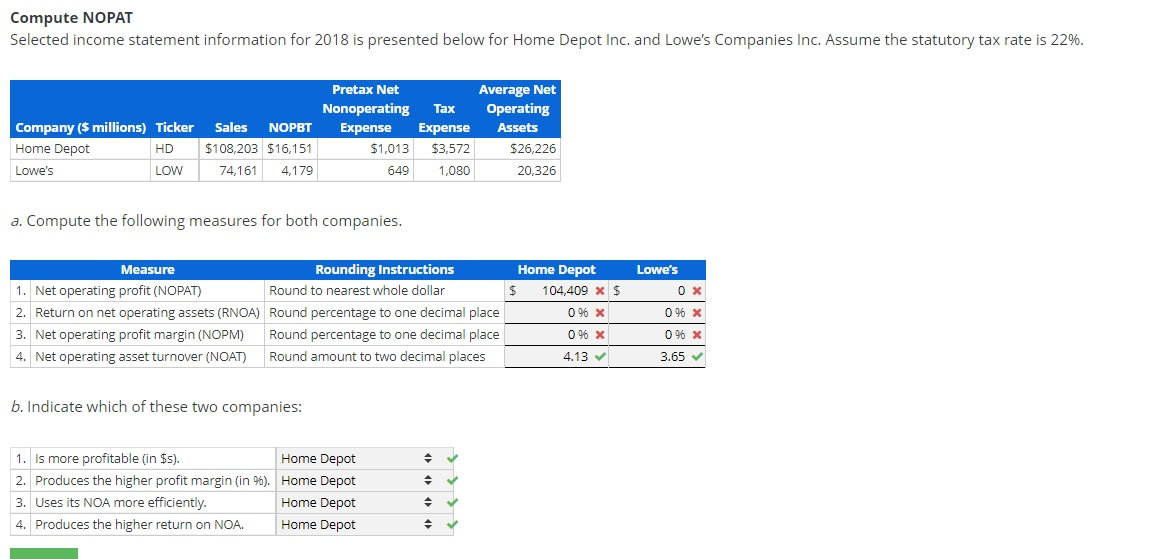

Compute Cash Conversion Cycle for Competing Firms Halliburton and Schlumberger compete in the oil field services sector. Refer to the following 2018 financial data for the two companies to answer the requirements. $ millions Total revenue Cost of sales and services Average accounts receivable Average inventory Average accounts payable HAL SLB $24,475 $33,471 21,429 29,048 5,135 7,983 2,712 4,028 2,786 10,130 a. Compute the following measures for both companies. Note: Round your final answers to one decimal place (for example, enter 6.8 for 6.77555). HAL SLB 0 X 0X 0 X 1. Days sales outstanding (DSO) 2. Days inventory outstanding (DIO) 3. Days payables outstanding (DPO) 4. Cash conversion cycle (CCC) 0 x 0X OX b. Which company better manages its accounts receivable? HAL * c. Which company uses inventory more efficiently? HAL * d. Which company better manages its accounts payable? SLB - Compute NOPAT Selected income statement information for 2018 is presented below for Home Depot Inc. and Lowe's Companies Inc. Assume the statutory tax rate is 22%. Company ($ millions) Ticker Home Depot HD Lowe's LOW Sales NOPBT $108,203 $16,151 74,161 4,179 Pretax Net Nonoperating Expense $1,013 649 Tax Expense $3,572 1,080 Average Net Operating Assets $26,226 20,326 a. Compute the following measures for both companies. Lowe's Measure Rounding Instructions 1. Net operating profit (NOPAT) Round to nearest whole dollar 2. Return on net operating assets (RNOA) Round percentage to one decimal place 3. Net operating profit margin (NOPM) Round percentage to one decimal place 4. Net operating asset turnover (NOAT) Round amount to two decimal places Home Depot $ 104,409 x $ 096 X 096 X 4.13 096 x 096 X 3.65 b. Indicate which of these two companies: 1. Is more profitable (in $5). Home Depot 2. Produces the higher profit margin (in 96). Home Depot 3. Uses its NOA more efficiently. Home Depot 4. Produces the higher return on NOA. Home Depot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts