Question: Hello! Question 5-8 is actually one long question. Please round as per requested in the problem. QUESTION 5 Questions 5-8 are related and share the

Hello! Question 5-8 is actually one long question. Please round as per requested in the problem.

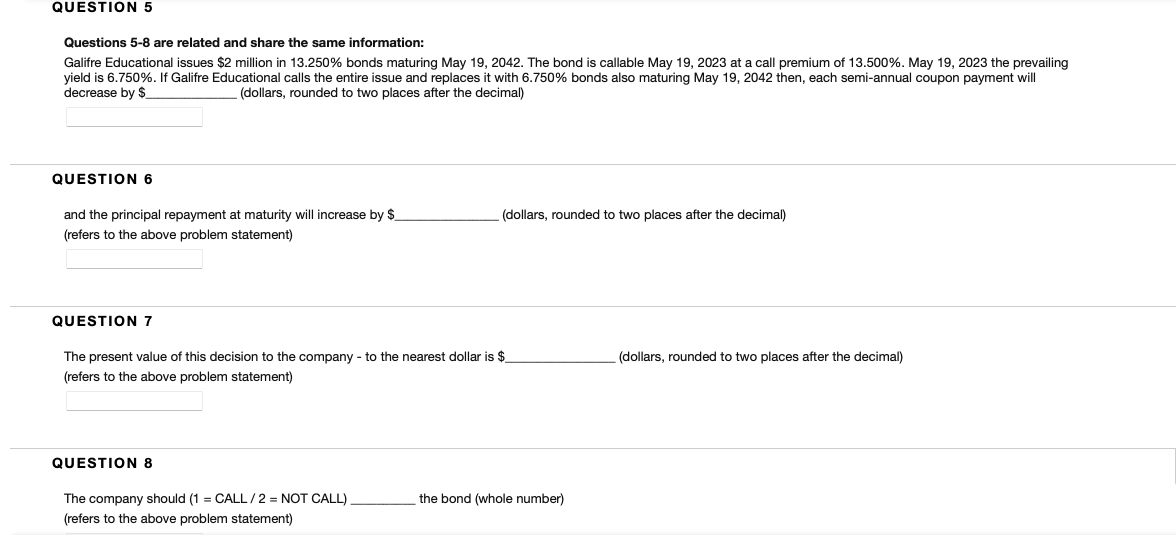

QUESTION 5 Questions 5-8 are related and share the same information: Galifre Educational issues $2 million in 13.250% bonds maturing May 19, 2042. The bond is callable May 19, 2023 at a call premium of 13.500%. May 19, 2023 the prevailing yield is 6.750%. If Galifre Educational calls the entire issue and replaces it with 6.750% bonds also maturing May 19, 2042 then, each semi-annual coupon payment will decrease by $ (dollars, rounded to two places after decimal) QUESTION 6 (dollars, rounded to two places after the decimal) and the principal repayment at maturity will increase by $_ (refers to the above problem statement) QUESTION 7 (dollars, rounded to two places after the decimal) The present value of this decision to the company - to the nearest dollar is $ (refers to the above problem statement) QUESTION 8 the bond (whole number) The company should (1 = CALL/2 = NOT CALL) (refers to the above problem statement) QUESTION 5 Questions 5-8 are related and share the same information: Galifre Educational issues $2 million in 13.250% bonds maturing May 19, 2042. The bond is callable May 19, 2023 at a call premium of 13.500%. May 19, 2023 the prevailing yield is 6.750%. If Galifre Educational calls the entire issue and replaces it with 6.750% bonds also maturing May 19, 2042 then, each semi-annual coupon payment will decrease by $ (dollars, rounded to two places after decimal) QUESTION 6 (dollars, rounded to two places after the decimal) and the principal repayment at maturity will increase by $_ (refers to the above problem statement) QUESTION 7 (dollars, rounded to two places after the decimal) The present value of this decision to the company - to the nearest dollar is $ (refers to the above problem statement) QUESTION 8 the bond (whole number) The company should (1 = CALL/2 = NOT CALL) (refers to the above problem statement)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts