Question: Hello, Questions 1-5 please Thank you!!!!!! 1) Explain why margin accounts are only required when clients write options but not when they buy options? 2)

Hello, Questions 1-5 please Thank you!!!!!!

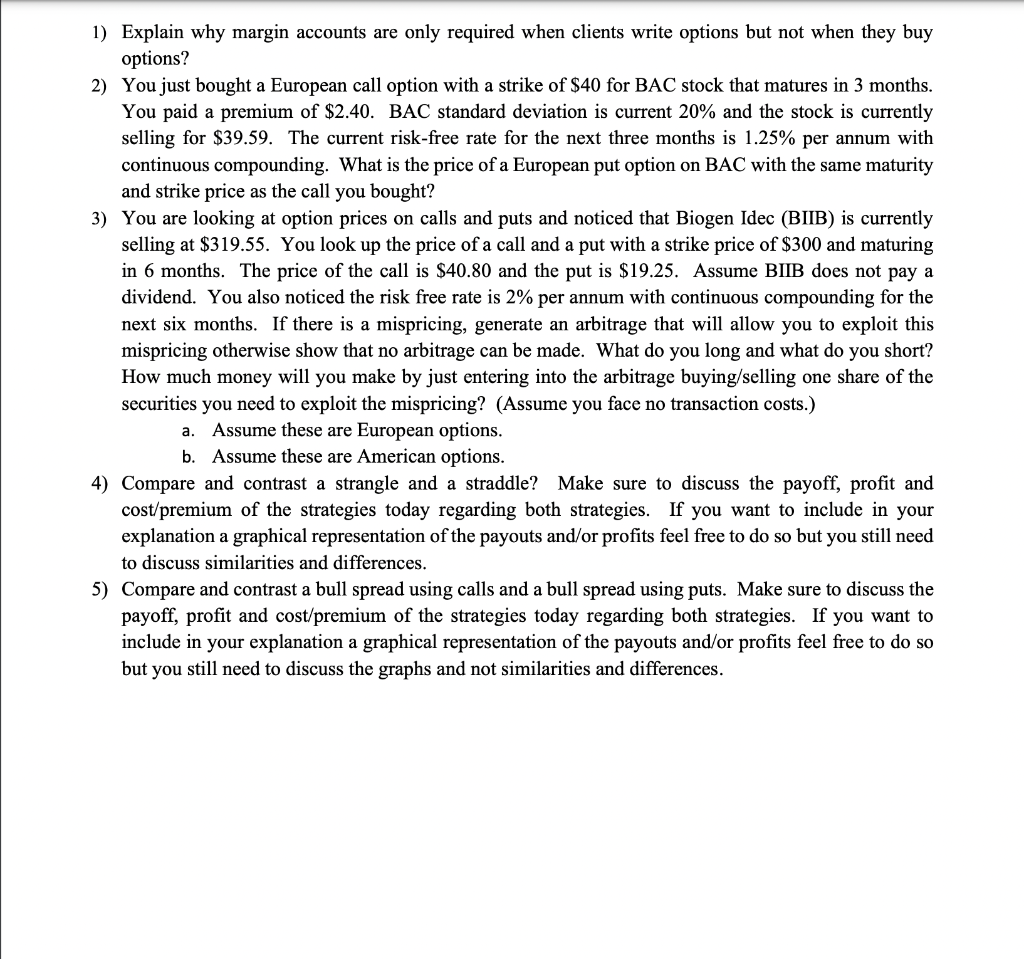

1) Explain why margin accounts are only required when clients write options but not when they buy options? 2) You just bought a European call option with a strike of $40 for BAC stock that matures in 3 months. You paid a premium of $2.40. BAC standard deviation is current 20% and the stock is currently selling for $39.59. The current risk-free rate for the next three months is 1.25% per annum with continuous compounding. What is the price of a European put option on BAC with the same maturity and strike price as the call you bought? 3) You are looking at option prices on calls and puts and noticed that Biogen Idec (BIIB) is currently selling at $319.55. You look up the price of a call and a put with a strike price of $300 and maturing in 6 months. The price of the call is $40.80 and the put is $19.25. Assume BIIB does not pay a dividend. You also noticed the risk free rate is 2% per annum with continuous compounding for the next six months. If there is a mispricing, generate an arbitrage that will allow you to exploit this mispricing otherwise show that no arbitrage can be made. What do you long and what do you short? How much money will you make by just entering into the arbitrage buying/selling one share of the securities you need to exploit the mispricing? (Assume you face no transaction costs.) Assume these are European options. b. Assume these are American options. 4) Compare and contrast a strangle and a straddle? Make sure to discuss the payoff, profit and cost/premium of the strategies today regarding both strategies. If you want to include in your explanation a graphical representation of the payouts and/or profits feel free to do so but you still need to discuss similarities and differences. 5) Compare and contrast a bull spread using calls and a bull spread using puts. Make sure to discuss the payoff, profit and cost/premium of the strategies today regarding both strategies. If you want to include in your explanation a graphical representation of the payouts and/or profits feel free to do so but you still need to discuss the graphs and not similarities and differences. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts