Question: hello, these are the clearer version. pls make this as the reference instead! (same Qs but clearer). Yes, withdrawals down to Miscellaneous Expense doesnt have

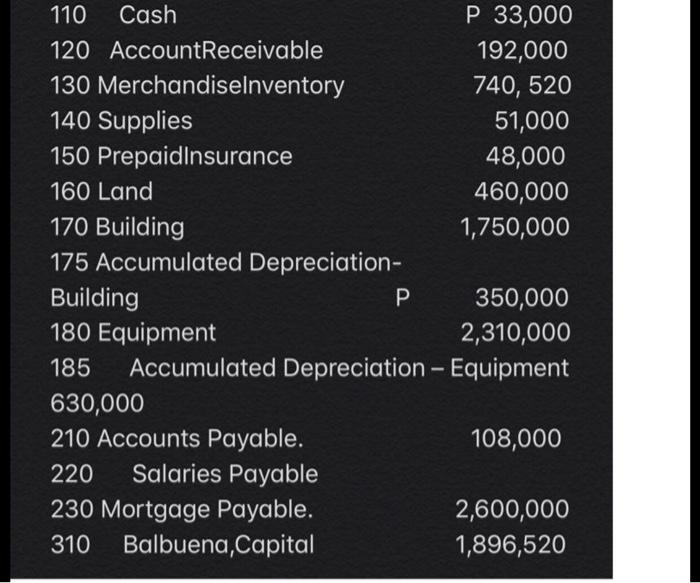

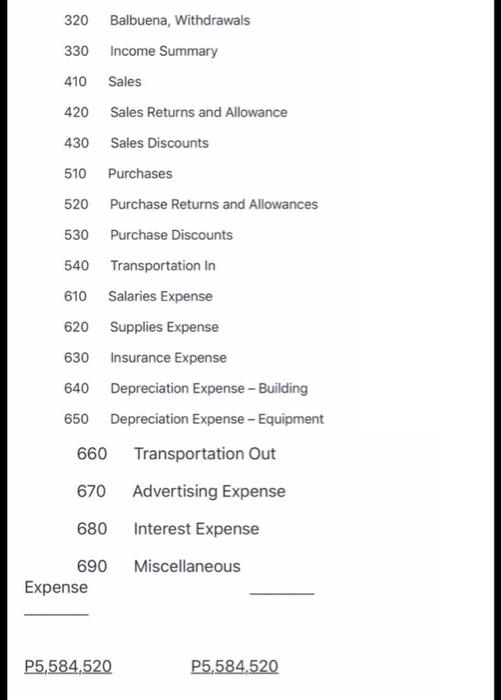

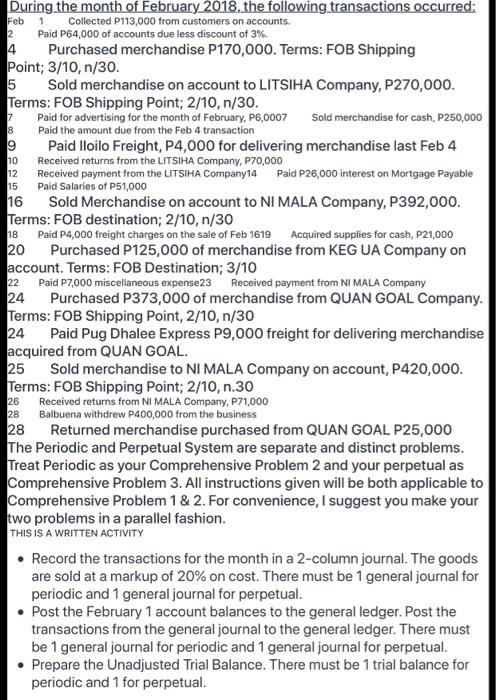

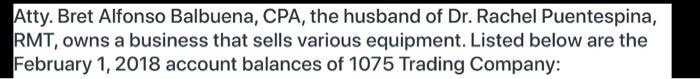

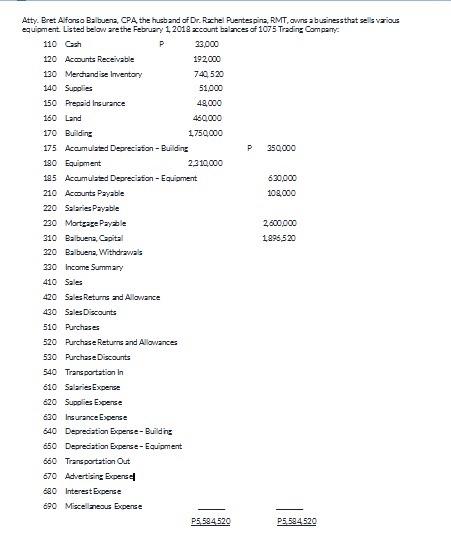

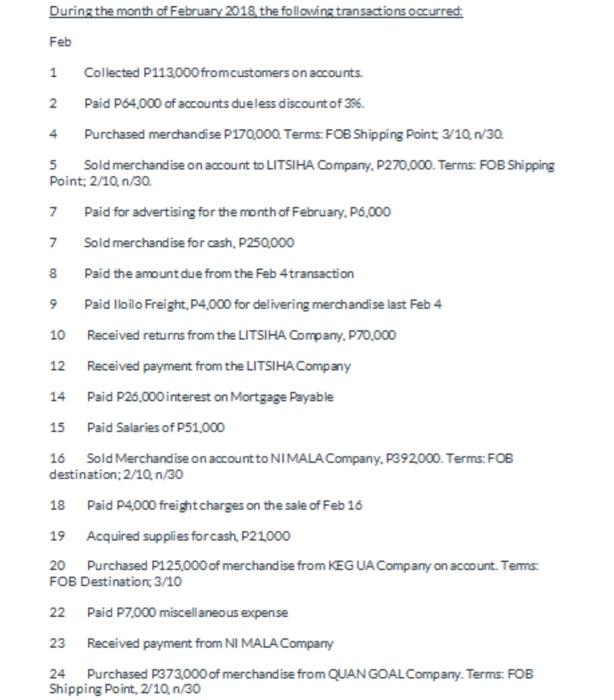

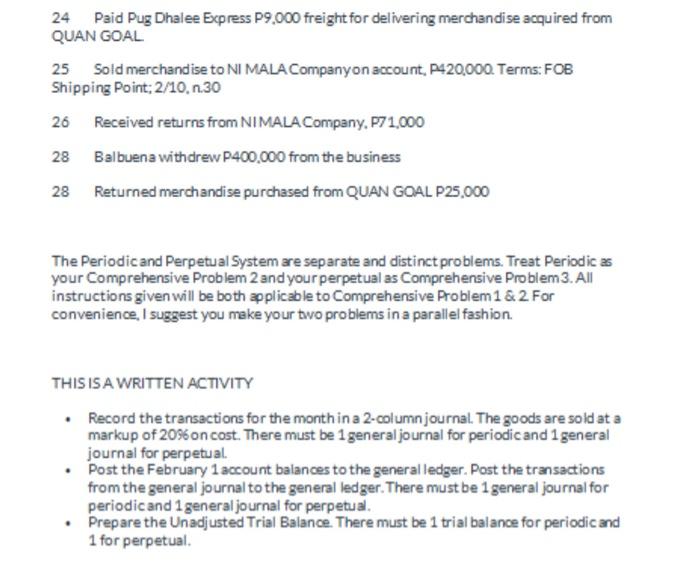

110 Cash P 33,000 120 AccountReceivable 192,000 130 Merchandiselnventory 740, 520 140 Supplies 51,000 150 PrepaidInsurance 48,000 160 Land 460,000 170 Building 1,750,000 175 Accumulated Depreciation- Building 350,000 180 Equipment 2,310,000 185 Accumulated Depreciation - Equipment 630,000 210 Accounts Payable. 108,000 220 Salaries Payable 230 Mortgage Payable. 2,600,000 310 Balbuena, Capital 1,896,520 320 Balbuena, Withdrawals 330 Income Summary 410 Sales 420 Sales Returns and Allowance 430 Sales Discounts 510 Purchases 520 Purchase Returns and Allowances 530 Purchase Discounts 540 Transportation in 610 Salaries Expense 620 Supplies Expense 630 Insurance Expense 640 Depreciation Expense - Building 650 Depreciation Expense - Equipment 660 Transportation Out 670 Advertising Expense Interest Expense 680 Miscellaneous 690 Expense P5,584,520 P5,584.520 1 Feb 2 7 8 18 20 22 During the month of February 2018, the following transactions occurred: Collected P113,000 from customers on accounts. Paid P64,000 of accounts due less discount of 3%. 4 Purchased merchandise P170,000. Terms: FOB Shipping Point; 3/10, n/30. 5 Sold merchandise on account to LITSIHA Company, P270,000 Terms: FOB Shipping Point; 2/10, n/30. Paid for advertising for the month of February, P6,0007 Sold merchandise for cash, P250,000 Paid the amount due from the Feb 4 transaction 9 Paid Iloilo Freight, P4,000 for delivering merchandise last Feb 4 10 Received returns from the LITSIHA Company, P70,000 12 Received payment from the LITSIHA Company 14 Paid P26,000 interest on Mortgage Payable 15 Paid Salaries of P51,000 16 Sold Merchandise on account to NI MALA Company, P392,000. Terms: FOB destination; 2/10,n/30 Paid P4,000 freight charges on the sale of Feb 1619 Acquired supplies for cash, P21,000 Purchased P125,000 of merchandise from KEGUA Company on account. Terms: FOB Destination; 3/10 Paid P7,000 miscellaneous expense23 Received payment from NI MALA Company 24 Purchased P373,000 of merchandise from QUAN GOAL Company. Terms: FOB Shipping Point, 2/10,n/30 24 Paid Pug Dhalee Express P9,000 freight for delivering merchandise acquired from QUAN GOAL. 25 Sold merchandise to NI MALA Company on account, P420,000. Terms: FOB Shipping Point: 2/10, n.30 Received returns from NI MALA Company, P71,000 Balbuena withdrew P400,000 from the business 28 Returned merchandise purchased from QUAN GOAL P25,000 The Periodic and Perpetual System are separate and distinct problems. Treat Periodic as your Comprehensive Problem 2 and your perpetual as Comprehensive Problem 3. All instructions given will be both applicable to Comprehensive Problem 1 & 2. For convenience, I suggest you make your two problems in a parallel fashion. THIS IS A WRITTEN ACTIVITY Record the transactions for the month in a 2-column journal. The goods are sold at a markup of 20% on cost. There must be 1 general journal for periodic and 1 general journal for perpetual Post the February 1 account balances to the general ledger. Post the transactions from the general journal to the general ledger. There must be 1 general journal for periodic and 1 general journal for perpetual. Prepare the Unadjusted Trial Balance. There must be 1 trial balance for periodic and 1 for perpetual. 26 28 Atty. Bret Alfonso Balbuena, CPA, the husband of Dr. Rachel Puentespina, RMT, owns a business that sells various equipment. Listed below are the February 1, 2018 account balances of 1075 Trading Company: Atty. Bret Alfonso Balbuena, CPA the husband of Dr. Rahel Puentespina, RMT, owns a businessthat is various equipment Listed below are the February 1 2018 account balance of 1075 Trading Company 110 Cash P 33,000 120 Accounts Receivable 192000 130 Merchandise Inventory 740, 520 140 Supplies 51,000 150 Prepaid Insurance 49,000 160 Land 450.000 170 Building 1.750,000 175 Accumulated Depreciation - Building P 350,000 180 Equipment 2.310,000 125 Accumulated Depreciation - Equipment 630,000 210 Accounts Payable 108,000 220 Salaries Payable 230 Mortgage Payable 2,600,000 310 Balbuena, Capital 1896.520 220 Balbuena Withdrawals 330 Income Summary 410 Sales 420 Sales Returns and Allowance 430 Sales Discounts 510 Purchases 520 Purchase Returns and Allowances 530 Purchase Discounts 540 Transportation in 610 Salaries Expense 620 Supplies Expense 630 Insurance Expense 640 Depreciation Expense-Building 650 Depreciation Experse-Equipment 660 Transportation Out 670 Advertising Expense 620 Interest Expense 690 Miscellaneous Expense P5.594520 P5.584520 4 8 9 During the month of February 2018 the following transactions occurred Feb 1 Collected P113,000 from customers on accounts. 2 Paid P64,000 of accounts dueless discount of 3%. Purchased merchandise P170.000. Terms: FOB Shipping Point 310.1/30 5 Sold merchandise on account to LITSIHA Company, P270.000. Terms: FOB Shipping Point: 2/10,n/30 7 Paid for advertising for the month of February, P6,000 7 Sold merchandise for cash, P250,000 Paid the amount due from the Feb 4 transaction Paid Iloilo Freight, P4,000 for delivering merchandise last Feb 4 10 Received returns from the LITSIHA Company. P70.000 12 Received payment from the LITSIHA Company 14 Paid P P25,000 interest on Mortgage Payable Paid Salaries of P51,000 16 Sold Merchandise on account to NIMALA Company. 2392000. Terms: FOB destination: 2/10,n/30 18 Paid P4.000 freight charges on the sale of Feb 16 19 Acquired supplies forcash P21000 20 Purchased P125,000 of merchandise from KEGUA Company on account. Terms: FOB Destination: 3/10 22 Paid P7.000 miscellaneous expense 23 Received payment from NI MALA Company 24 Purchased P373.000 of merchandise from QUAN GOAL Company. Terms: FOB Shipping Point, 2/10 n/30 15 24 Paid Pug Dhalee Excpress P9,000 freight for delivering merchandise acquired from QUAN GOAL 25 Sold merchandise to NI MALA Companyon account, P420,000. Terms: FOB Shipping Point: 2/10, n.30 26 Received returns from NIMALA Company, P71,000 28 Balbuena withdrew P400.000 from the business 28 Returned merchandise purchased from QUAN GOAL P25,000 The Periodic and Perpetual System are separate and distinct problems. Treat Periodic as your Comprehensive Problem 2 and your perpetual as Comprehensive Problem 3. All instructions given will be both applicable to Comprehensive Problem 1 & 2 For convenience, I suggest you make your two problems in a parallel fashion THIS IS A WRITTEN ACTIVITY Record the transactions for the month in a 2-column journal. The goods are sold at a markup of 20% on cost. There must be 1 general journal for periodic and 1 general journal for perpetual Post the February 1 account balances to the general ledger Post the transactions from the general journal to the general ledger. There must be 1 general journal for periodic and 1 general journal for perpetual Prepare the Unadjusted Trial Balance. There must be 1 trial balance for periodic and 1 for perpetual 110 Cash P 33,000 120 AccountReceivable 192,000 130 Merchandiselnventory 740, 520 140 Supplies 51,000 150 PrepaidInsurance 48,000 160 Land 460,000 170 Building 1,750,000 175 Accumulated Depreciation- Building 350,000 180 Equipment 2,310,000 185 Accumulated Depreciation - Equipment 630,000 210 Accounts Payable. 108,000 220 Salaries Payable 230 Mortgage Payable. 2,600,000 310 Balbuena, Capital 1,896,520 320 Balbuena, Withdrawals 330 Income Summary 410 Sales 420 Sales Returns and Allowance 430 Sales Discounts 510 Purchases 520 Purchase Returns and Allowances 530 Purchase Discounts 540 Transportation in 610 Salaries Expense 620 Supplies Expense 630 Insurance Expense 640 Depreciation Expense - Building 650 Depreciation Expense - Equipment 660 Transportation Out 670 Advertising Expense Interest Expense 680 Miscellaneous 690 Expense P5,584,520 P5,584.520 1 Feb 2 7 8 18 20 22 During the month of February 2018, the following transactions occurred: Collected P113,000 from customers on accounts. Paid P64,000 of accounts due less discount of 3%. 4 Purchased merchandise P170,000. Terms: FOB Shipping Point; 3/10, n/30. 5 Sold merchandise on account to LITSIHA Company, P270,000 Terms: FOB Shipping Point; 2/10, n/30. Paid for advertising for the month of February, P6,0007 Sold merchandise for cash, P250,000 Paid the amount due from the Feb 4 transaction 9 Paid Iloilo Freight, P4,000 for delivering merchandise last Feb 4 10 Received returns from the LITSIHA Company, P70,000 12 Received payment from the LITSIHA Company 14 Paid P26,000 interest on Mortgage Payable 15 Paid Salaries of P51,000 16 Sold Merchandise on account to NI MALA Company, P392,000. Terms: FOB destination; 2/10,n/30 Paid P4,000 freight charges on the sale of Feb 1619 Acquired supplies for cash, P21,000 Purchased P125,000 of merchandise from KEGUA Company on account. Terms: FOB Destination; 3/10 Paid P7,000 miscellaneous expense23 Received payment from NI MALA Company 24 Purchased P373,000 of merchandise from QUAN GOAL Company. Terms: FOB Shipping Point, 2/10,n/30 24 Paid Pug Dhalee Express P9,000 freight for delivering merchandise acquired from QUAN GOAL. 25 Sold merchandise to NI MALA Company on account, P420,000. Terms: FOB Shipping Point: 2/10, n.30 Received returns from NI MALA Company, P71,000 Balbuena withdrew P400,000 from the business 28 Returned merchandise purchased from QUAN GOAL P25,000 The Periodic and Perpetual System are separate and distinct problems. Treat Periodic as your Comprehensive Problem 2 and your perpetual as Comprehensive Problem 3. All instructions given will be both applicable to Comprehensive Problem 1 & 2. For convenience, I suggest you make your two problems in a parallel fashion. THIS IS A WRITTEN ACTIVITY Record the transactions for the month in a 2-column journal. The goods are sold at a markup of 20% on cost. There must be 1 general journal for periodic and 1 general journal for perpetual Post the February 1 account balances to the general ledger. Post the transactions from the general journal to the general ledger. There must be 1 general journal for periodic and 1 general journal for perpetual. Prepare the Unadjusted Trial Balance. There must be 1 trial balance for periodic and 1 for perpetual. 26 28 Atty. Bret Alfonso Balbuena, CPA, the husband of Dr. Rachel Puentespina, RMT, owns a business that sells various equipment. Listed below are the February 1, 2018 account balances of 1075 Trading Company: Atty. Bret Alfonso Balbuena, CPA the husband of Dr. Rahel Puentespina, RMT, owns a businessthat is various equipment Listed below are the February 1 2018 account balance of 1075 Trading Company 110 Cash P 33,000 120 Accounts Receivable 192000 130 Merchandise Inventory 740, 520 140 Supplies 51,000 150 Prepaid Insurance 49,000 160 Land 450.000 170 Building 1.750,000 175 Accumulated Depreciation - Building P 350,000 180 Equipment 2.310,000 125 Accumulated Depreciation - Equipment 630,000 210 Accounts Payable 108,000 220 Salaries Payable 230 Mortgage Payable 2,600,000 310 Balbuena, Capital 1896.520 220 Balbuena Withdrawals 330 Income Summary 410 Sales 420 Sales Returns and Allowance 430 Sales Discounts 510 Purchases 520 Purchase Returns and Allowances 530 Purchase Discounts 540 Transportation in 610 Salaries Expense 620 Supplies Expense 630 Insurance Expense 640 Depreciation Expense-Building 650 Depreciation Experse-Equipment 660 Transportation Out 670 Advertising Expense 620 Interest Expense 690 Miscellaneous Expense P5.594520 P5.584520 4 8 9 During the month of February 2018 the following transactions occurred Feb 1 Collected P113,000 from customers on accounts. 2 Paid P64,000 of accounts dueless discount of 3%. Purchased merchandise P170.000. Terms: FOB Shipping Point 310.1/30 5 Sold merchandise on account to LITSIHA Company, P270.000. Terms: FOB Shipping Point: 2/10,n/30 7 Paid for advertising for the month of February, P6,000 7 Sold merchandise for cash, P250,000 Paid the amount due from the Feb 4 transaction Paid Iloilo Freight, P4,000 for delivering merchandise last Feb 4 10 Received returns from the LITSIHA Company. P70.000 12 Received payment from the LITSIHA Company 14 Paid P P25,000 interest on Mortgage Payable Paid Salaries of P51,000 16 Sold Merchandise on account to NIMALA Company. 2392000. Terms: FOB destination: 2/10,n/30 18 Paid P4.000 freight charges on the sale of Feb 16 19 Acquired supplies forcash P21000 20 Purchased P125,000 of merchandise from KEGUA Company on account. Terms: FOB Destination: 3/10 22 Paid P7.000 miscellaneous expense 23 Received payment from NI MALA Company 24 Purchased P373.000 of merchandise from QUAN GOAL Company. Terms: FOB Shipping Point, 2/10 n/30 15 24 Paid Pug Dhalee Excpress P9,000 freight for delivering merchandise acquired from QUAN GOAL 25 Sold merchandise to NI MALA Companyon account, P420,000. Terms: FOB Shipping Point: 2/10, n.30 26 Received returns from NIMALA Company, P71,000 28 Balbuena withdrew P400.000 from the business 28 Returned merchandise purchased from QUAN GOAL P25,000 The Periodic and Perpetual System are separate and distinct problems. Treat Periodic as your Comprehensive Problem 2 and your perpetual as Comprehensive Problem 3. All instructions given will be both applicable to Comprehensive Problem 1 & 2 For convenience, I suggest you make your two problems in a parallel fashion THIS IS A WRITTEN ACTIVITY Record the transactions for the month in a 2-column journal. The goods are sold at a markup of 20% on cost. There must be 1 general journal for periodic and 1 general journal for perpetual Post the February 1 account balances to the general ledger Post the transactions from the general journal to the general ledger. There must be 1 general journal for periodic and 1 general journal for perpetual Prepare the Unadjusted Trial Balance. There must be 1 trial balance for periodic and 1 for perpetual

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts