Question: hello, using the data from the first picture, please answer question from the second picture. Please show all work and formulas used! Use the following

hello, using the data from the first picture, please answer question from the second picture. Please show all work and formulas used!

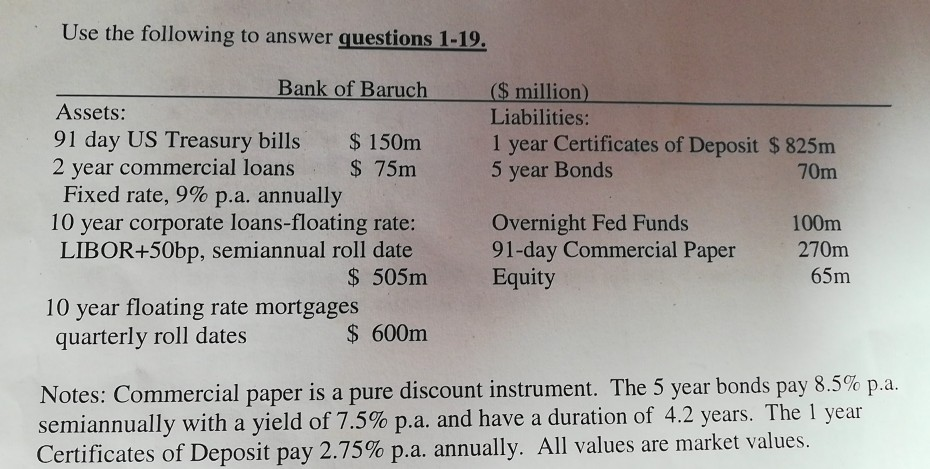

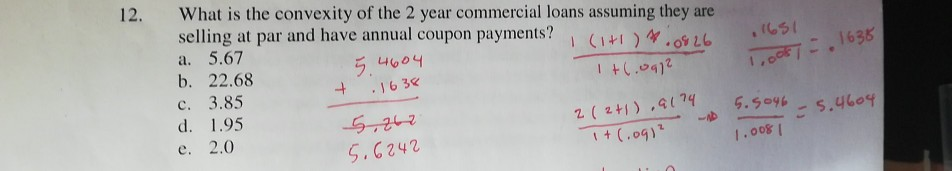

Use the following to answer questions 1-19. ($ million) Liabilities: 1 year Certificates of Deposit $ 825m 5 year Bonds 70m Bank of Baruch Assets: 91 day US Treasury bills $ 150m 2 year commercial loans $ 75m Fixed rate, 9% p.a. annually 10 year corporate loans-floating rate: LIBOR+50bp, semiannual roll date $ 505m 10 year floating rate mortgages quarterly roll dates $ 600m Overnight Fed Funds 91-day Commercial Paper Equity 100m 270m 65m Notes: Commercial paper is a pure discount instrument. The 5 year bonds pay 8.5% p.a. semiannually with a yield of 7.5% p.a. and have a duration of 4.2 years. The 1 year Certificates of Deposit pay 2.75% p.a. annually. All values are market values. 1651 .1638 1.00 What is the convexity of the 2 year commercial loans assuming they are selling at par and have annual coupon payments? (+) a. 5.67 5 4604 b. 22.68 +1.0912 + 1638 d. 1.95 e. 2.0 c. 3.85 2 -5.4604 5.262 5.6242 (2+1),al24 1+1.091 1.008

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts