Question: Hello, will you please help our with the following case, I need to create a Sales Budget, Production Budget, Material Budget, Labor Budget, Manufacturing Overhead

Hello, will you please help our with the following case,

I need to create a Sales Budget, Production Budget, Material Budget, Labor Budget, Manufacturing Overhead Budget, Adminstrative Budget, Income Statment, and Cash Budget with the following information. Also i have attached examples of each from the textbook to help.

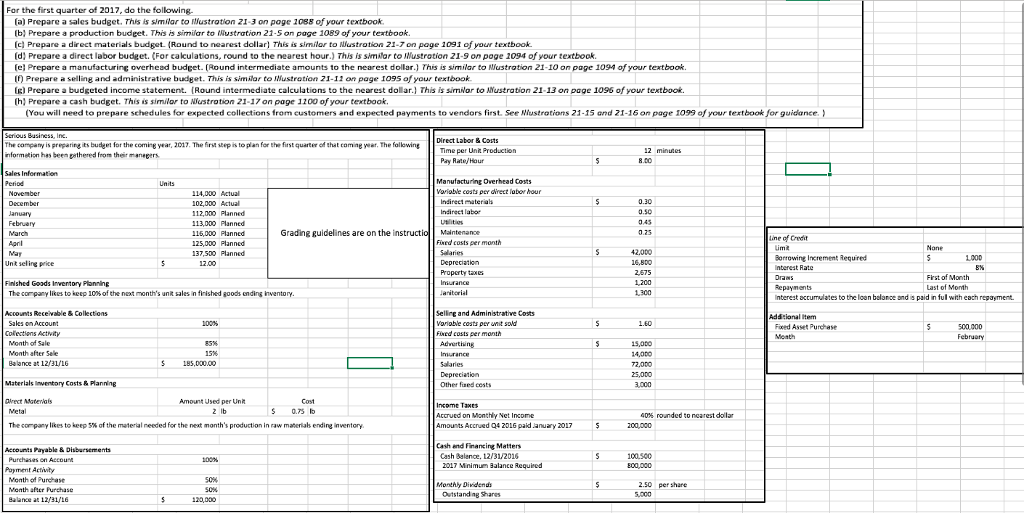

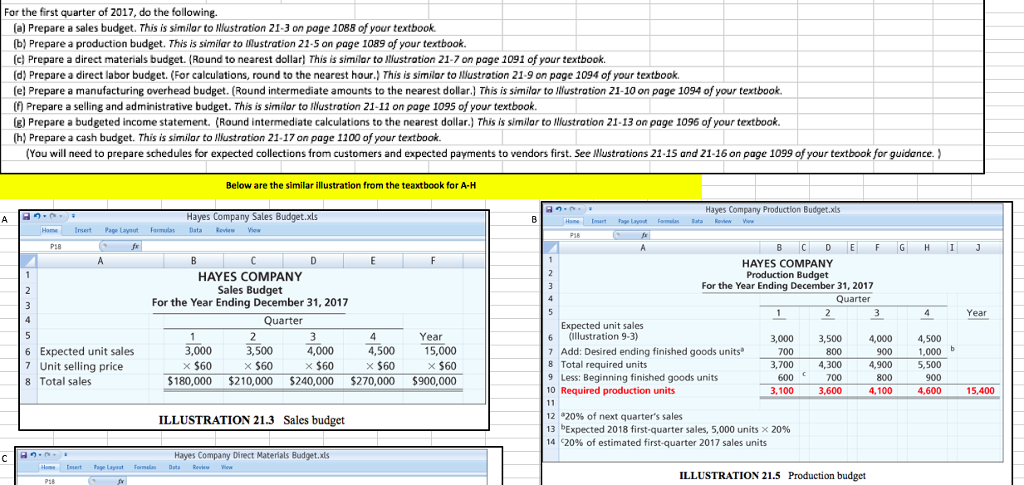

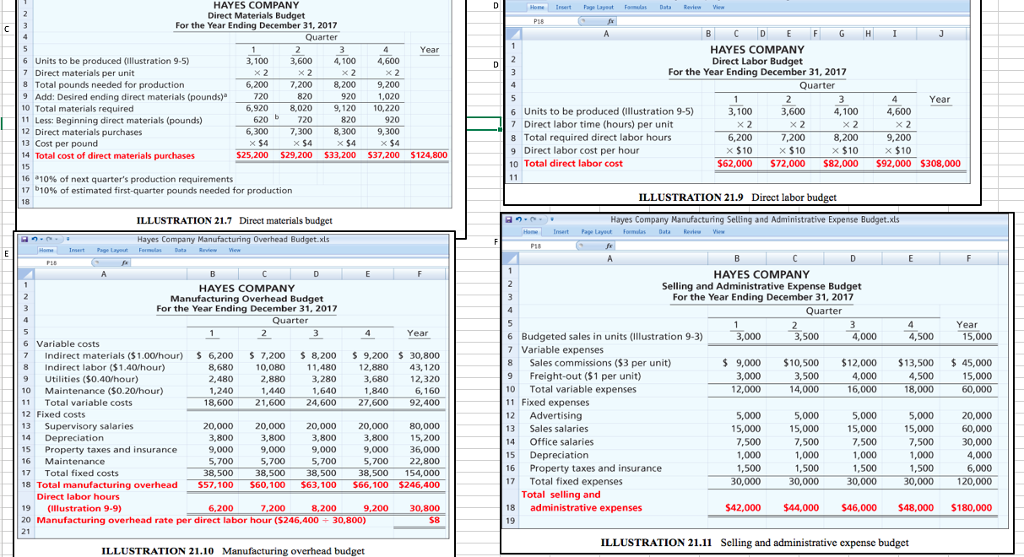

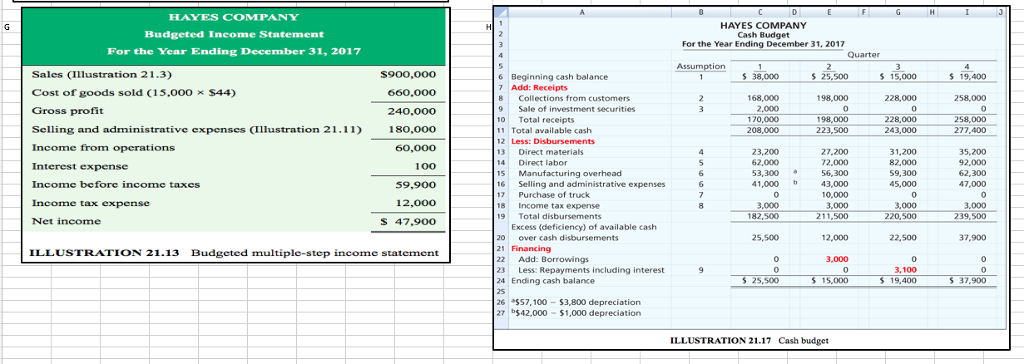

For the first quarter of 2017, do the following. (a) Prepare a sales budget. This is simflar to Mustration 21-3 on page 1088 of your textbook (b) Prepare a production budeet. This is similar to Nustration 21-Son page 1089 of your tertbook. [c] Prepare a direct materials budget(Round to nearest dollar] This is similar to llustration 21-7 on page 1091 of your textbook. (d: Prepare a direct labor budget. ?For calculations, round to the nearest hour.) This is sma or to JMustration 21-9 on poge 1094 of your textbook. e) Prepare a manufacturing overhead budget. ?Round intermediate amounts to the nearest dollar.) Th's is similar to Arustration 21.10 on page 1094 of your textbook. ) Prepare a selling and administrative budget. This is similar to Nustration 21-12 on page 1095 of your textbook () Prepare a budgeted income statement. (Round intermediate calculations to the nearest dollar.] This is simiwar to NNustration 21-13 on page 1096 f your textbook h) Prepare a cash budget. This is simuilor to Niustration 21-17 on page 1200 of your textbook You will need to prepare schedules for expected collections from customers and expected payments to vendors first. See strations 21-15 and 21-16 on page 1099 0 your textbook or gun znce. Serious 8usiness, in. The company is preparing its budget for the comin year 2017. Th? firs?eepis to plan for the first quarter of that coming year. Th. fallowing nformetion has been pathered from their manegers Time per Unit Production Pay Rate/Hour Manufacturing Overhead Costs Variabvle cost ts per drect labor hour 114,000 Actual 102,000 Actual 12,000 Planned 113,000 Planned 115,000 Planned 125,000 Flanned 137,500 Planned Indirect labo .50 Grading guidelines are on the instructio Mantenance Line of Cdt Fwed costs per month 42.000 Sorrowing Increment Requred nterest Rate Unit sel ing price Property taxe First of Month Last of Month Finished Goads Inventory Ponning The company likes to keep 10% of the next month's unit sales in firished goods ending inventory. 1,300 Interest accumulates to the loon belance and is paid in ful with each repayment. Sellirg and Administrative Costs Varioble costs per ed costs per m Accounts Receivable&Collections Adtional Item unit sold Foced Asset Purchase 500000 Cofectiens Activity Month of Sale Month after Sele Balance at 12/31/L6 S185,000.00 72,000 Materials Inwentory Costs & Planning Other faed cests ect Matemals Amount Used per Unk 0.75 Ib Accrued on Monthly Net Income mounts Accrued 04 2016 paild January 2017 40% rounded to nearest dollar beoorpany likes to keep S% of the material needed for the next month's production in raw materials ending inventory Cash and Financing Matters Cash Bglence. 12/31/2016 00 500 Purchases on Accou Poyment Actity Month of Purchase 2017 Mnimum Balance Required Monthy Dindends 2.50 per share Outstand ag Shares Balance at 12/31/L6 120,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts