Question: Help again on this part! i cant figure out why NWC is wrong for Year 5 when i followed the same steps as the previous

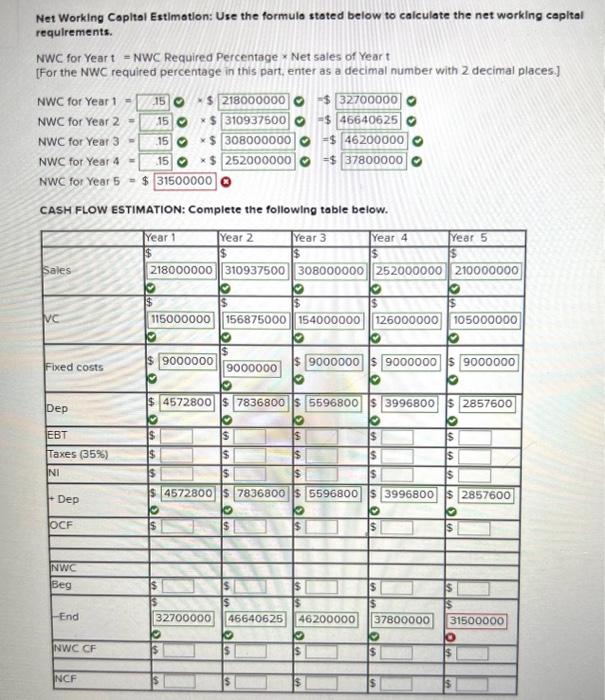

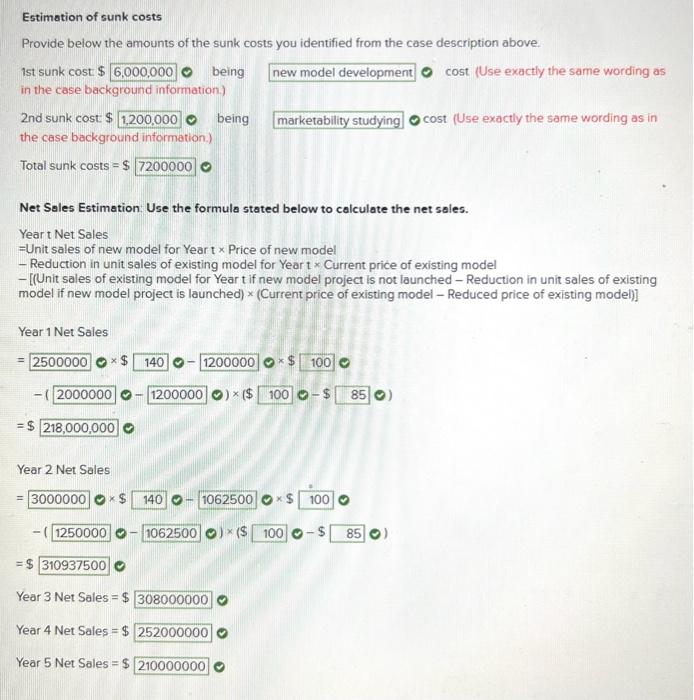

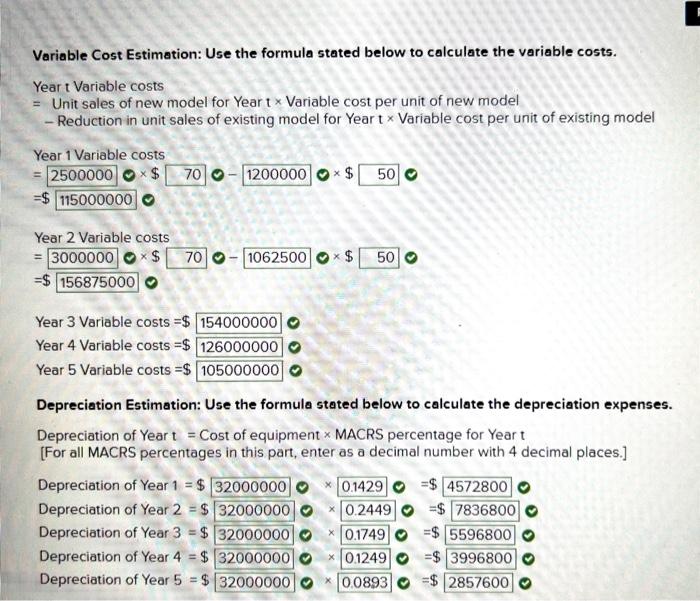

Net Working Capital Estimation: Use the formulo stated below to calculate the net working capital requirements. NWC for Year t= NWC Required Percentage Net sales of Year t [For the NWC required percentage in this part, enter as a decimal number with 2 decimal places.] CASH FLOW ESTIMATION: Complete the following table below. Estimation of sunk costs Provide below the amounts of the sunk costs you identified from the case description above. 1st sunk cost $ being cost (Use exactly the same wording as in the case background information.) 2nd sunk cost $ cost (Use exactly the same wording as in the case background information.) Total sunk costs =$ Net Sales Estimation. Use the formula stated below to calculate the net sales. Year t Net Sales =Unit sales of new model for Year t Price of new model - Reduction in unit sales of existing model for Year t Current price of existing model - [(Unit sales of existing model for Year t if new model project is not launched - Reduction in unit sales of existing model if new model project is launched) * (Current price of existing model - Reduced price of existing model)] Year 1 Net Sales Year 2 Net Sales =$ Year 3 Net Sales =$ Year 4 Net Sales =$ Year 5 Net Sales =$ Variable Cost Estimation: Use the formula stated below to calculate the variable costs. Year t Variable costs = Unit sales of new model for Year t Variable cost per unit of new model - Reduction in unit sales of existing model for Year t Variable cost per unit of existing model Year 1 Variable costs =0$0$ =$ Year 2 Variable costs =0$00$ =$ Year 3 Variable costs =$ Year 4 Variable costs =$ Year 5 Variable costs =$ Depreciation Estimation: Use the formula stated below to calculate the depreciation expenses. Depreciation of Year t = Cost of equipment MACRS percentage for Year t [For all MACRS percentages in this part, enter as a decimal number with 4 decimal places.] Depreciation of Year 1=$ Depreciation of Year 2=$ Depreciation of Year 3=$ Depreciation of Year 4=$ Depreciation of Year 5=$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts