Question: help and answer to question 3 3. Using information from your answers in Parts 1 and 2, journalize the credit sale on December 11 for

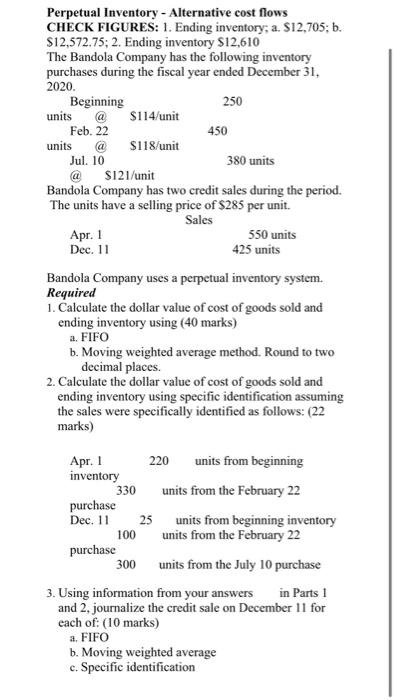

3. Using information from your answers in Parts 1 and 2, journalize the credit sale on December 11 for each of: (10 marks) a. FIFO b. Moving weighted average c. Specific identification Perpetual Inventory - Alternative cost flows CHECK FIGURES: 1. Ending inventory, a. S12,705; b. $12,572.75; 2. Ending inventory $12,610 The Bandola Company has the following inventory purchases during the fiscal year ended December 31, 2020. Beginning 250 units @ $114/unit Feb. 22 450 units $118/unit Jul. 10 380 units @ $121/unit Bandola Company has two credit sales during the period. The units have a selling price of $285 per unit. Sales Apr. 1 550 units Dec. 11 425 units Bandola Company uses a perpetual inventory system. Required 1. Calculate the dollar value of cost of goods sold and ending inventory using (40 marks) a. FIFO b. Moving weighted average method. Round to two decimal places. 2. Calculate the dollar value of cost of goods sold and ending inventory using specific identification assuming the sales were specifically identified as follows: (22 marks) Apr. 1 220 units from beginning inventory 330 units from the February 22 purchase Dec. 11 25 units from beginning inventory 100 units from the February 22 purchase units from the July 10 purchase 3. Using information from your answers in Parts 1 and 2, journalize the credit sale on December 11 for each of: (10 marks) a. FIFO b. Moving weighted average c. Specific identification 300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts