Question: Help, answer: a) annual net operating income is wrong. Sarrett Boone, Bramble Enterprises' vice president of operations, needs to replace an automatic lathe on the

Help, answer: a) annual net operating income is wrong.

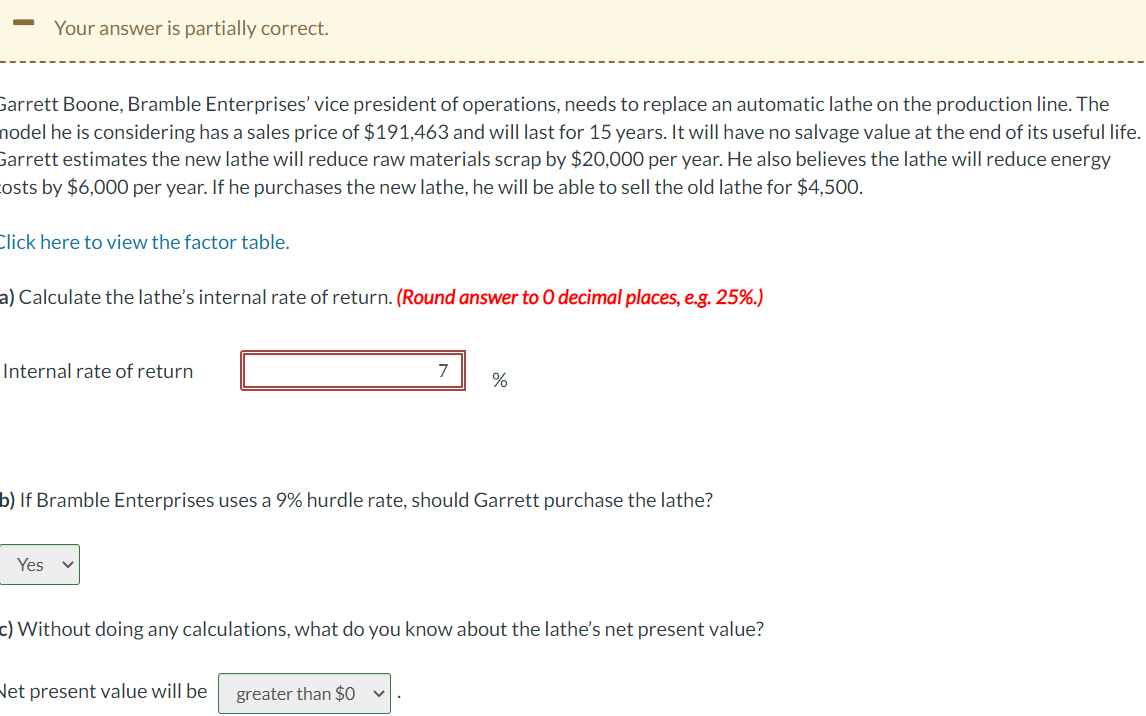

Sarrett Boone, Bramble Enterprises' vice president of operations, needs to replace an automatic lathe on the production line. The nodel he is considering has a sales price of $191,463 and will last for 15 years. It will have no salvage value at the end of its useful life. Garrett estimates the new lathe will reduce raw materials scrap by $20,000 per year. He also believes the lathe will reduce energy osts by $6,000 per year. If he purchases the new lathe, he will be able to sell the old lathe for $4,500. Click here to view the factor table. a) Calculate the lathe's internal rate of return. (Round answer to 0 decimal places, e.g. 25\%.) Internal rate of return % b) If Bramble Enterprises uses a 9\% hurdle rate, should Garrett purchase the lathe? c) Without doing any calculations, what do you know about the lathe's net present value? Vet present value will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts