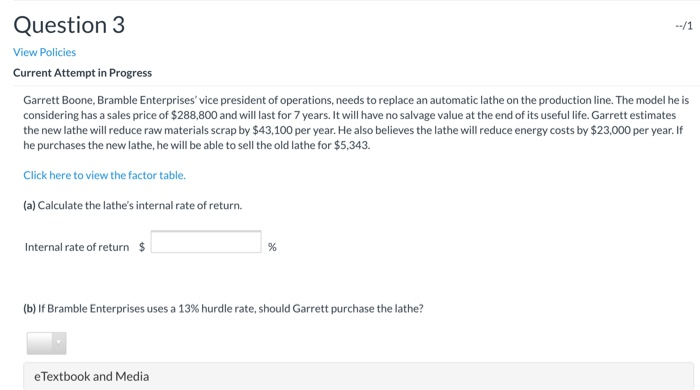

Question: Question 3 --/1 View Policies Current Attempt in Progress Garrett Boone, Bramble Enterprises' vice president of operations, needs to replace an automatic lathe on the

Question 3 --/1 View Policies Current Attempt in Progress Garrett Boone, Bramble Enterprises' vice president of operations, needs to replace an automatic lathe on the production line. The model he is considering has a sales price of $288,800 and will last for 7 years. It will have no salvage value at the end the new lathe will reduce raw materials scrap by $43,100 per year. He also believes the lathe will reduce energy costs by $23,000 per year. If he purchases the new lathe, he will be able to sell the old lathe for $5,343. Click here to view the factor table. (a) Calculate the lathe's internal rate of return. Internal rate of return $ (b) If Bramble Enterprises uses a 13% hurdle rate, should Garrett purchase the lathe? e Textbook and Media Ch 9: Homework --/1 unting dates Question 3 View Policies Current Attempt in Progress Garrett Boone, Bramble Enterprises' vice president of operations, needs to replace an automatic lathe on the production line. The model he is considering has a sales price of $288,800 and will last for 7 years. It will have no salvage value at the end of its useful life. Garrett estimates the new lathe will reduce raw materials scrap by $43,100 per year. He also believes the lathe will reduce energy costs by $23,000 per year. If he purchases the new lathe, he will be able to sell the old lathe for $5,343. ons -Support Click here to view the factor table. (a) Calculate the lathe's internal rate of return. es a 13% hurdle rate, should Garrett purchase the lathe? eTextbook and Media Save for Later Attempts: 0 of 12 used Submit Answer * Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts