Question: help answer all problems, please make sure no answers are cut off. Also disregard numbers in bottom part those are just for a visual of

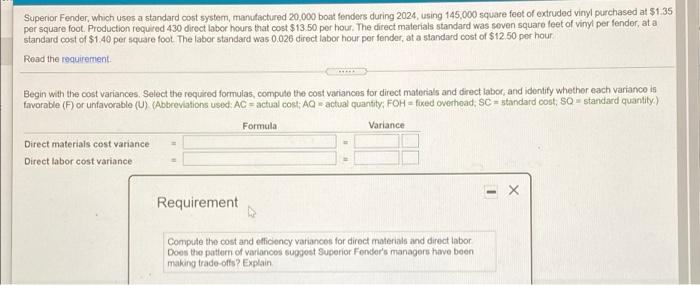

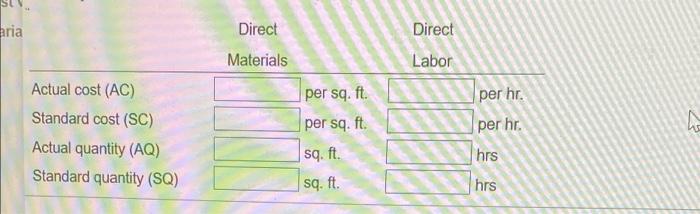

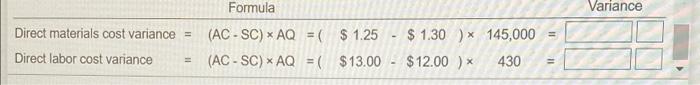

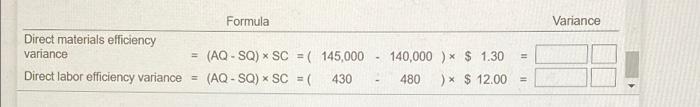

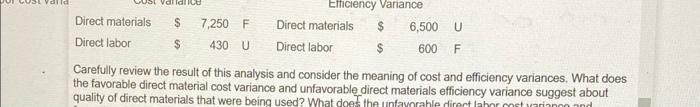

Superior Fonder, which uses a standard cost system, manufactured 20,000 boat fonders during 2024, using 145,000 square feet of extruded vinyl purchased at $1.35 per square foot Production required 430 direct labor hours that cost $13.50 per hour. The direct materials standard was soven square feet of vinyl per fender, at a standard cost of $1.40 per square foot The labor standard was 0.026 direct labor hour por fender, at a standard cost of $12,50 per hour Read the requirement Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U) (Abbreviations used: AC actual cost; AQ actual quantity: FOH = faxed overhead, SC - standard cost, so standard quantity) Formula Variance Direct materials cost variance Direct labor cost variance Requirement Compute the cost and efficiency variances for direct materials and direct labor Does the pattern of varioncos suggost Superior Fondor's managers have been making trade-offs? Explain aria Direct Materials Direct Labor Actual cost (AC) Standard cost (SC) Actual quantity (AQ) Standard quantity (SQ) per sq. ft. per sq. ft. per hr. per hr. | hrs hrs sq. ft. sq. ft. Variance Direct materials cost variance = Formula (AC-SC) * AQ =( $ 1.25 - $ 1.30 )* 145,000 = (AC-SC) * AQ =( $13.00 - $12.00 ) 430 Direct labor cost variance a ={ $1300 - $1 11 Formula Variance Direct materials efficiency variance Direct labor efficiency variance = = (AQ - SQ) * SC = ( 145,000 (AQ - SQ) * SC =( 430 140,000) 1.30 480 > * $ 12.00 Valldico S Efficiency Variance Direct materials 7,250 F Direct materials $ 6,500U Direct labor $ 430U Direct labor $ 600 F Carefully review the result of this analysis and consider the meaning of cost and efficiency variances. What does the favorable direct material cost variance and unfavorable direct materials efficiency variance suggest about quality of direct materials that were being used? What doethe unfavorable direct lahor mi Superior Fonder, which uses a standard cost system, manufactured 20,000 boat fonders during 2024, using 145,000 square feet of extruded vinyl purchased at $1.35 per square foot Production required 430 direct labor hours that cost $13.50 per hour. The direct materials standard was soven square feet of vinyl per fender, at a standard cost of $1.40 per square foot The labor standard was 0.026 direct labor hour por fender, at a standard cost of $12,50 per hour Read the requirement Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U) (Abbreviations used: AC actual cost; AQ actual quantity: FOH = faxed overhead, SC - standard cost, so standard quantity) Formula Variance Direct materials cost variance Direct labor cost variance Requirement Compute the cost and efficiency variances for direct materials and direct labor Does the pattern of varioncos suggost Superior Fondor's managers have been making trade-offs? Explain aria Direct Materials Direct Labor Actual cost (AC) Standard cost (SC) Actual quantity (AQ) Standard quantity (SQ) per sq. ft. per sq. ft. per hr. per hr. | hrs hrs sq. ft. sq. ft. Variance Direct materials cost variance = Formula (AC-SC) * AQ =( $ 1.25 - $ 1.30 )* 145,000 = (AC-SC) * AQ =( $13.00 - $12.00 ) 430 Direct labor cost variance a ={ $1300 - $1 11 Formula Variance Direct materials efficiency variance Direct labor efficiency variance = = (AQ - SQ) * SC = ( 145,000 (AQ - SQ) * SC =( 430 140,000) 1.30 480 > * $ 12.00 Valldico S Efficiency Variance Direct materials 7,250 F Direct materials $ 6,500U Direct labor $ 430U Direct labor $ 600 F Carefully review the result of this analysis and consider the meaning of cost and efficiency variances. What does the favorable direct material cost variance and unfavorable direct materials efficiency variance suggest about quality of direct materials that were being used? What doethe unfavorable direct lahor mi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts