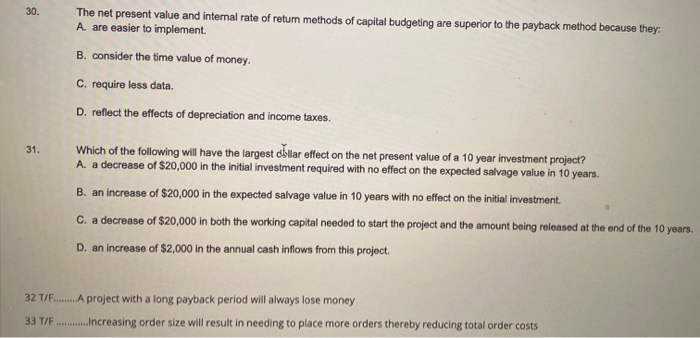

Question: help asap pls 30. The net present value and internal rate of return methods of capital budgeting are superior to the payback method because they.

30. The net present value and internal rate of return methods of capital budgeting are superior to the payback method because they. A. are easier to implement. B. consider the time value of money. C. require less data. D. reflect the effects of depreciation and income taxes. 31. Which of the following will have the largest dollar effect on the net present value of a 10 year investment project? A. a decrease of $20,000 in the initial investment required with no effect on the expected salvage value in 10 years. B. an increase of $20,000 in the expected salvage value in 10 years with no effect on the initial investment. C. a decrease of $20,000 in both the working capital needed to start the project and the amount being released at the end of the 10 years. D. an increase of $2,000 in the annual cash inflows from this project. 32 T/F.....A project with a long payback period will always lose money 33 T/F ...Increasing order size will result in needing to place more orders thereby reducing total order costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts