Question: Help E9-8 (Algo) Reporting Notes Payable and Calculating Interest Expense LO 9-3 0.5 points South End is one of the world's most popular outdoor apparel

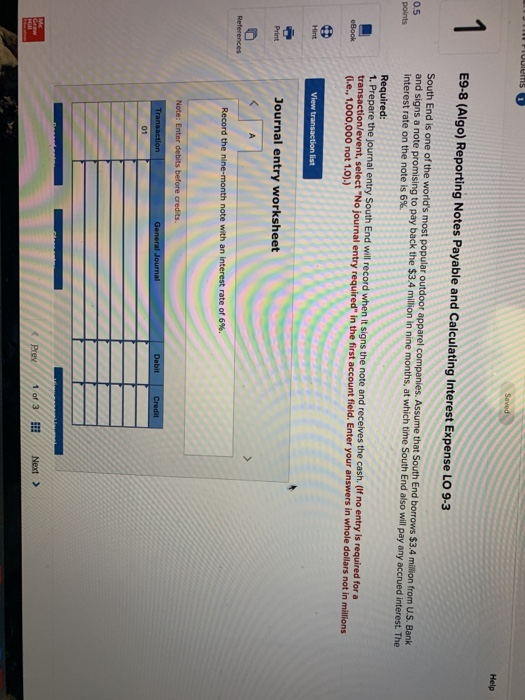

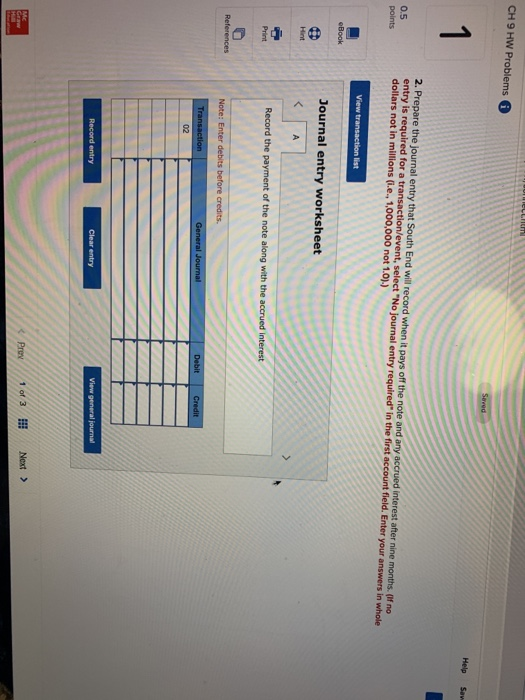

Help E9-8 (Algo) Reporting Notes Payable and Calculating Interest Expense LO 9-3 0.5 points South End is one of the world's most popular outdoor apparel companies. Assume that South End borrows $3.4 million from U.S. Bank and signs a note promising to pay back the $3.4 million in nine months, at which time South End also will pay any accrued interest. The interest rate on the note is 6% Required: 1. Prepare the journal entry South End will record when it signs the note and receives the cash. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars not in millions (.e., 1,000,000 not 1.0).) eBook View transaction list Journal entry worksheet Record the nine-month note with an interest rate of 6%. Note: Enter debits before credits Transaction General Journal Debit Credit rey 1 of 3 !! Next > CH 9 HW Problems Help Sav 1 0.5 points 2. Prepare the journal entry that South End will record when it pays off the note and any accrued interest after nine months. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in whole dollars not in millions (i.e., 1,000,000 not 1.0).) View transaction list Journal entry worksheet Record the payment of the note along with the accrued interest Note: Enter debits before credits. Transaction General Journal Debit Credit 02 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts