Question: help for both questions please. Question 4(9 marks): Assume that you arrange a mortgage loan of $100,000 at J2 = 15% (i.e. 15% nominal annual

help for both questions please.

help for both questions please.

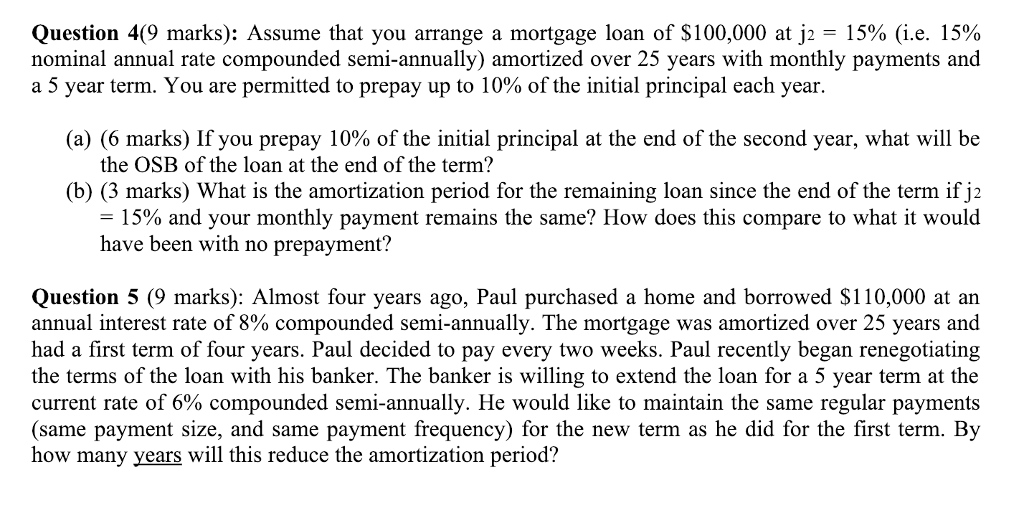

Question 4(9 marks): Assume that you arrange a mortgage loan of $100,000 at J2 = 15% (i.e. 15% nominal annual rate compounded semi-annually) amortized over 25 years with monthly payments and a 5 year term. You are permitted to prepay up to 10% of the initial principal each year. (a) (6 marks) If you prepay 10% of the initial principal at the end of the second year, what will be the OSB of the loan at the end of the term? (b) (3 marks) What is the amortization period for the remaining loan since the end of the term if j2 -15% and your monthly payment remains the same? How does this compare to what it would have been with no prepayment? Question 5 (9 marks): Almost four years ago, Paul purchased a home and borrowed $110,000 at arn annual interest rate of 8% compounded semi-annually. The mortgage was amortized over 25 years and had a first term of four years. Paul decided to pay every two weeks. Paul recently began renegotiating the terms of the loan with his banker. The banker is willing to extend the loan for a 5 year term at the current rate of 6% compounded semi-annually. He would like to maintain the same regular payments (same payment size, and same payment frequency) for the new term as he did for the first term. By how many years will this reduce the amortization period? Question 4(9 marks): Assume that you arrange a mortgage loan of $100,000 at J2 = 15% (i.e. 15% nominal annual rate compounded semi-annually) amortized over 25 years with monthly payments and a 5 year term. You are permitted to prepay up to 10% of the initial principal each year. (a) (6 marks) If you prepay 10% of the initial principal at the end of the second year, what will be the OSB of the loan at the end of the term? (b) (3 marks) What is the amortization period for the remaining loan since the end of the term if j2 -15% and your monthly payment remains the same? How does this compare to what it would have been with no prepayment? Question 5 (9 marks): Almost four years ago, Paul purchased a home and borrowed $110,000 at arn annual interest rate of 8% compounded semi-annually. The mortgage was amortized over 25 years and had a first term of four years. Paul decided to pay every two weeks. Paul recently began renegotiating the terms of the loan with his banker. The banker is willing to extend the loan for a 5 year term at the current rate of 6% compounded semi-annually. He would like to maintain the same regular payments (same payment size, and same payment frequency) for the new term as he did for the first term. By how many years will this reduce the amortization period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts