Question: Help help help ASAP please please please please You work for Bluth Company, a constant growth firm which recently paid a dividend of $1.75. Bluth

Help help help ASAP please please please please

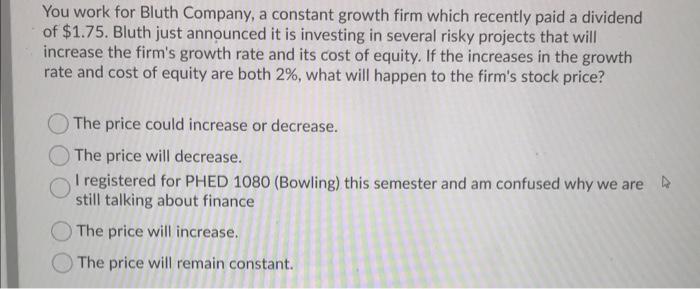

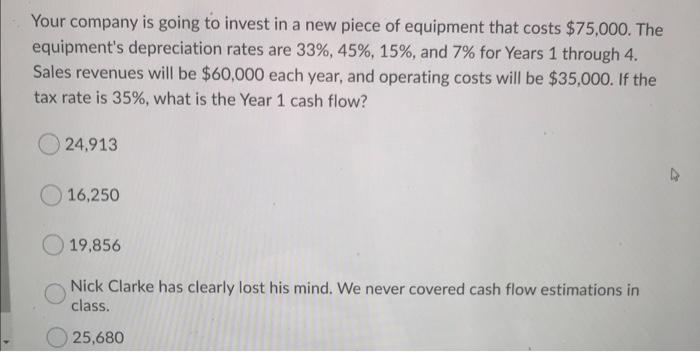

You work for Bluth Company, a constant growth firm which recently paid a dividend of $1.75. Bluth just announced it is investing in several risky projects that will increase the firm's growth rate and its cost of equity. If the increases in the growth rate and cost of equity are both 2%, what will happen to the firm's stock price? The price could increase or decrease. The price will decrease. I registered for PHED 1080 (Bowling) this semester and am confused why we are still talking about finance The price will increase. The price will remain constant. Your company is going to invest in a new piece of equipment that costs $75,000. The equipment's depreciation rates are 33%, 45%, 15%, and 7% for Years 1 through 4. Sales revenues will be $60,000 each year, and operating costs will be $35,000. If the tax rate is 35%, what is the Year 1 cash flow? 24.913 16,250 19,856 Nick Clarke has clearly lost his mind. We never covered cash flow estimations in class. 25,680

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts