Question: help help Question 33 (2 points) It is a vital part of the whole underwriting process that an underwriter adhere to Tevel of underwriting authority

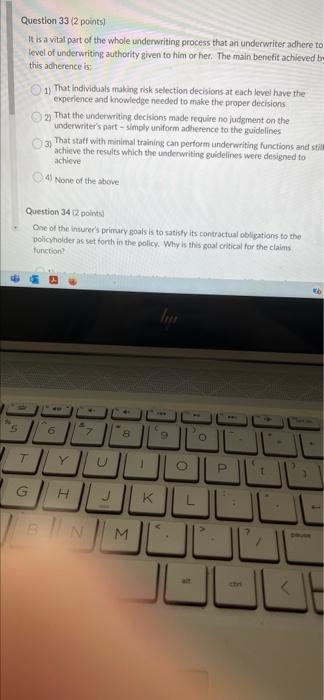

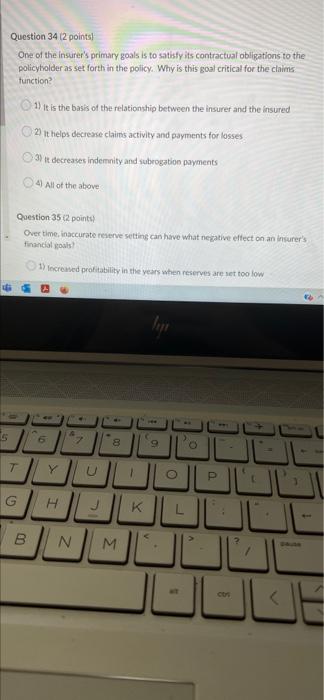

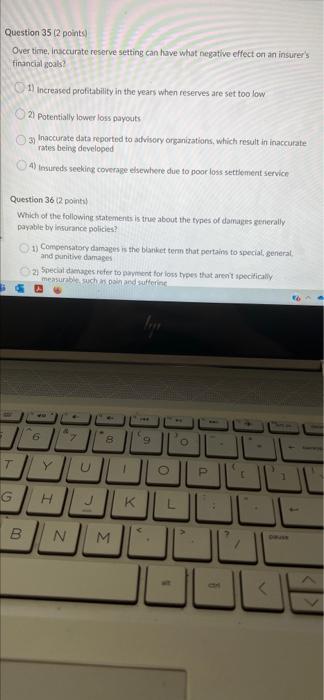

Question 33 (2 points) It is a vital part of the whole underwriting process that an underwriter adhere to Tevel of underwriting authority given to him or her. The main benefit achieved be this adherence is: 1) That individuals making risk selection decisions at each level have the experience and knowledge needed to make the proper decisions 2) That the underwriting decisions made require no judgment on the underwriter's part - simply uniform adherence to the guidelines 3 That statt with minimal training can perform underwriting functions and stil achieve the results which the underwriting guidelines were designed to achieve 4 None of the above Question 342 points One of the insurer's primary goal is to satisfy its contractual obligations to the policyholder as set forth in the policy. Why is this goal critical for the claims function ta 6 7 8 9 IGH BIN M Question 34 12 points! One of the insurer's primary goals is to satisfy its contractual obligations to the policyholder as set forth in the policy. Why is this goal critical for the claims function 1) it is the basis of the relationship between the insurer and the insured 2) it helps decrease claims activity and payments for losses Mit decreases indemnity and subrogation payments 4) All of the above Question 352 points) Over time, inaccurate reserve setting can have what negative effect on an insurer's Financial 1) Increased profitability in the years when reserves are set too low 5 5 00 8 9 T y P G || H B N M con Question 35 (2 points Over time, inaccurate reserve setting can have what negative effect on an insurer's financial goals 1) Increased profitability in the years when reserves are set too low 21 Potentially lower loss payouts 3) Inaccurate data reported to acheisory organizations, which result in inaccurate rates being developed 4) Imureds seeking coverage elsewhere due to poor loss settlement service Question 36 12 points) Which of the following statements is true about the types of damages generally payable by Insurance policies? 1) Compensatory damages is the better that pertains to special general and punitive damages 2 Special damages refer to payment for loss types that aren't specifically measurable, such and suffering + 6 7 8 9 O U o G H - B N M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts