Question: help journalize exercise 2 please help journalize exercise 3 please Exercise 2 On January 1, 2022, LeBlanc Corporation had the following shareholders' equity accounts. Shareholders'

help journalize exercise 2 please

help journalize exercise 2 please

help journalize exercise 3 please

help journalize exercise 3 please

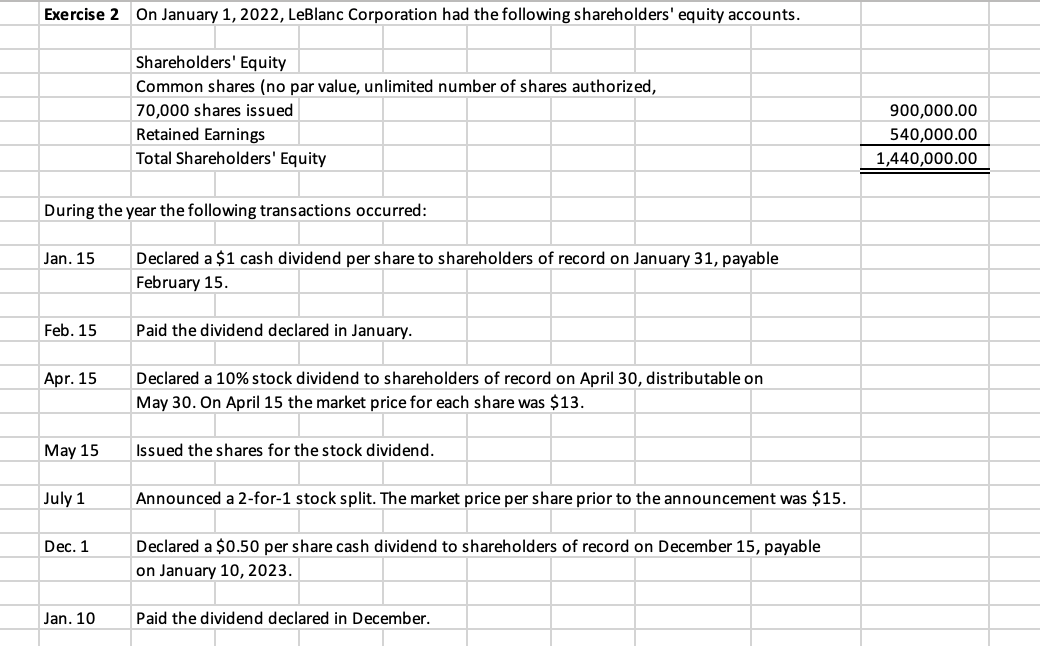

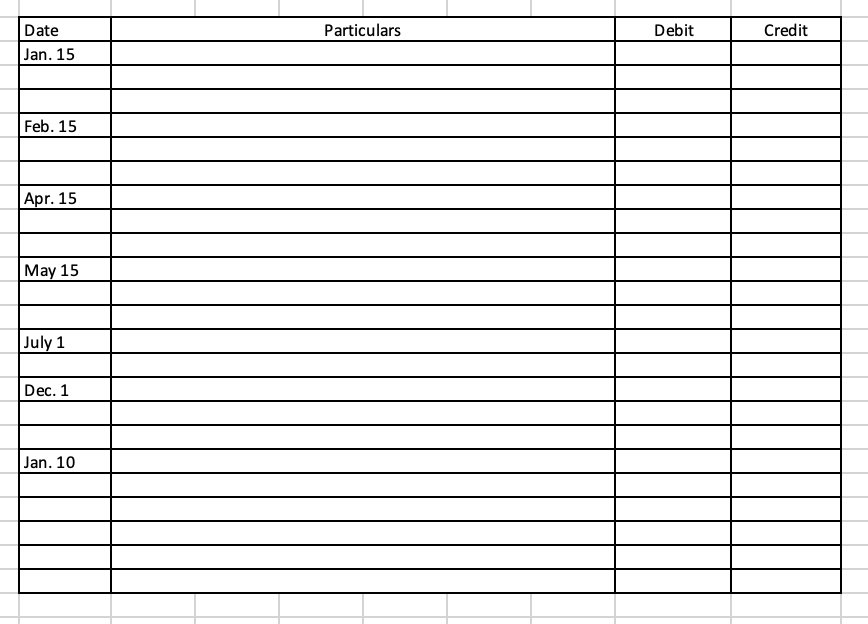

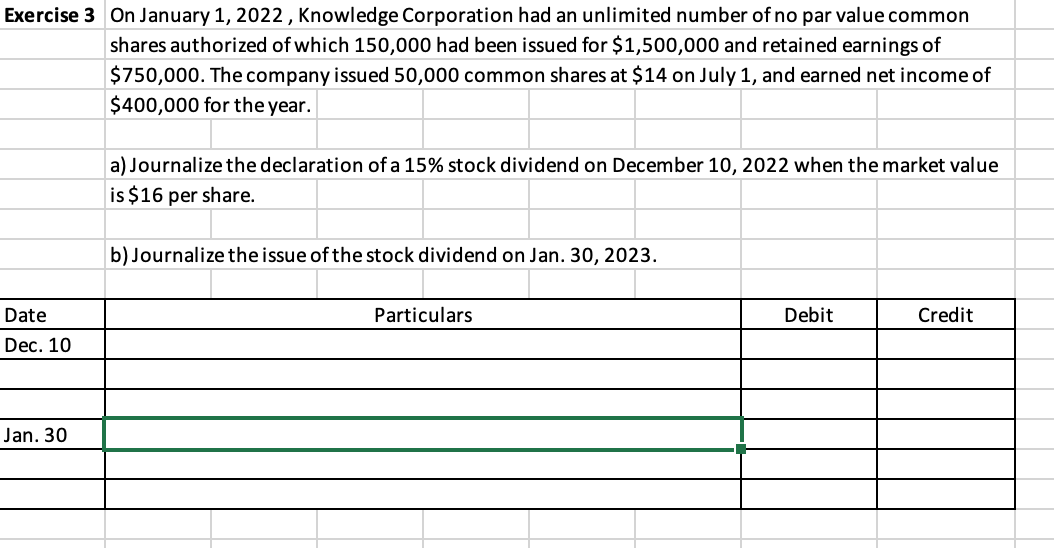

Exercise 2 On January 1, 2022, LeBlanc Corporation had the following shareholders' equity accounts. Shareholders' Equity Common shares (no par value, unlimited number of shares authorized, 70,000 shares issued Retained Earnings Total Shareholders' Equity During the year the following transactions occurred: Jan. 15 Feb. 15 Apr. 15 May 15 July 1 Dec. 1 Jan. 10 Declared a $1 cash dividend per share to shareholders of record on January 31, payable February 15. Paid the dividend declared in January. Declared a 10% stock dividend to shareholders of record on April 30, distributable on May 30. On April 15 the market price for each share was $13. Issued the shares for the stock dividend. Announced a 2-for-1 stock split. The market price per share prior to the announcement was $15. Declared a $0.50 per share cash dividend to shareholders of record on December 15, payable on January 10, 2023. Paid the dividend declared in December. 900,000.00 540,000.00 1,440,000.00 Date Jan. 15 Feb. 15 Apr. 15 May 15 July 1 Dec. 1 Jan. 10 Particulars Debit Credit Exercise 3 On January 1, 2022, Knowledge Corporation had an unlimited number of no par value common shares authorized of which 150,000 had been issued for $1,500,000 and retained earnings of $750,000. The company issued 50,000 common shares at $14 on July 1, and earned net income of $400,000 for the year. Date Dec. 10 Jan. 30 a) Journalize the declaration of a 15% stock dividend on December 10, 2022 when the market value is $16 per share. b) Journalize the issue of the stock dividend on Jan. 30, 2023. Particulars Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts