Question: help me figure out the 6 steps to this problem Cost of capital Edna Recording Studios, Inc., reported earnings available to common stock of $4,200,000

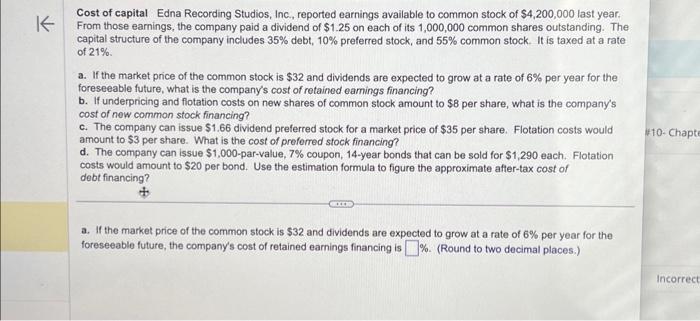

Cost of capital Edna Recording Studios, Inc., reported earnings available to common stock of $4,200,000 last year. From those earnings, the company paid a dividend of $1.25 on each of its 1,000,000 common shares outstanding. The capital structure of the company includes 35% debt, 10% preferred stock, and 55% common stock. It is taxed at a rate of 21% a. If the market price of the common stock is $32 and dividends are expected to grow at a rate of 6% per year for the foreseeable future, what is the company's cost of retained eamings financing? b. If underpricing and flotation costs on new shares of common stock amount to $8 per share, what is the company's cost of now common stock financing? c. The company can issue $1.66 dividend preferred stock for a market price of $35 per share. Flotation costs would amount to $3 per share. What is the cost of preforred stock financing? d. The company can issue $1,000-par-value, 7% coupon, 14-year bonds that can be sold for $1,290 each. Flotation costs would amount to $20 per bond. Use the estimation formula to figure the approximate after-tax cost of debt financing? a. If the market price of the common stock is $32 and dividends are expected to grow at a rate of 6% per year for the foreseeable future, the company's cost of retained earnings financing is \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts