Question: Help me , I ' m putting in the numbers for the differences yet it's still saying it's incorrect. The cash one is just an

Help me Im putting in the numbers for the differences yet it's still saying it's incorrect. The cash one is just an example but it says it for the others. Help would be greatly appreciated

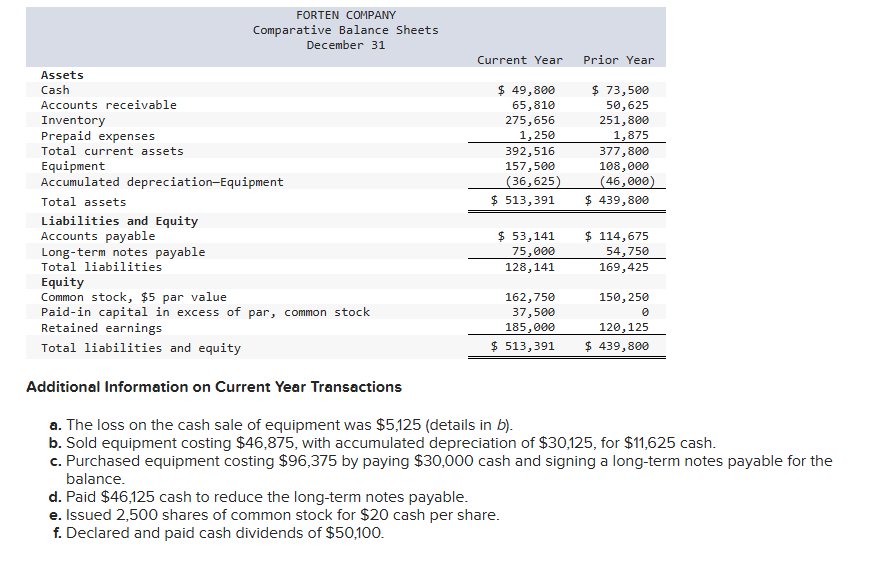

FORTEN COMPANY Comparative Balance Sheets December Current Year Prior Year Assets Cash $ $ Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accumulated depreciationEquipment Total assets $ $ Liabilities and Equity Accounts payable $ $ Longterm notes payable Total liabilities Equity Common stock, $ par value Paidin capital in excess of par, common stock Retained earnings Total liabilities and equity $ $

Additional Information on Current Year Transactions

a The loss on the cash sale of equipment was $details in b

b Sold equipment costing $ with accumulated depreciation of $ for $ cash.

c Purchased equipment costing $ by paying $ cash and signing a longterm notes payable for the balance.

d Paid $ cash to reduce the longterm notes payable.

e Issued shares of common stock for $ cash per share.

f Declared and paid cash dividends of $

Use the following information for the Problems below. Static

The following information applies to the questions displayed below.

Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the

year, all sales are credit sales, all credits to Accounts Receivable reflect cash receipts from customers, all

purchases of inventory are on credit, and all debits to Accounts Payable reflect cash payments for inventory.

FORTEN COMPANY

Income Statement

For Current Year Ended December

Operating expenses excluding depreciation

$

Depreciation expense

Other gains losses

FORTEN COMPANY Spreadsheet for Statement of Cash Flows For Current Year Ended December December Prior Year Analysis of Changes December Current Year Debit Credit Balance sheetdebit Cash $ xx $ Accounts receivable $ Inventory Prepaid expenses $ Equipment $ $ Balance sheetcredit Accumulated depreciationEquipment $ Accounts payable Longterm notes payable Common stock, $ par value Paidin capital in excess of par value, common stock Retained earnings $ $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock