Question: help me know if my answers are correct Question 31 1 pts Consider the information for Stock A and Stock B below. The risk-free interest

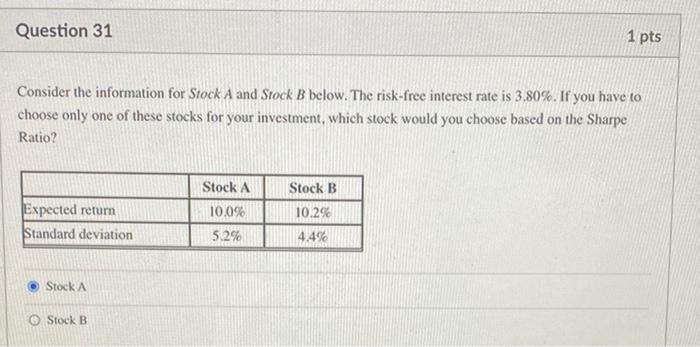

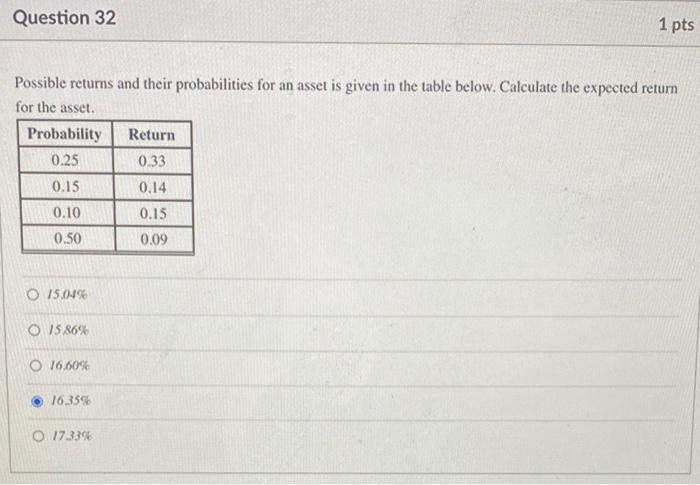

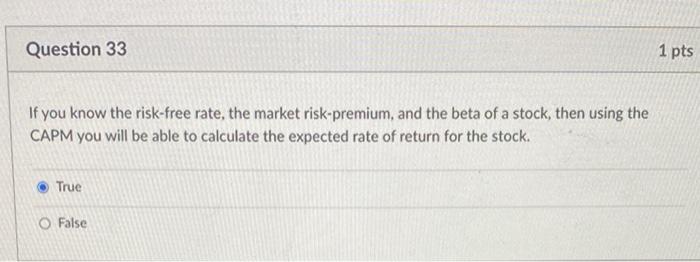

Question 31 1 pts Consider the information for Stock A and Stock B below. The risk-free interest rate is 3.80%. If you have to choose only one of these stocks for your investment, which stock would you choose based on the Sharpe Ratio? Stock A Stock B 10.2% Expected return Standard deviation 10.0% 5.2% 4.4% Stock A Stock B Question 32 1 pts Possible returns and their probabilities for an asset is given in the table below. Calculate the expected return for the asset Probability Return 0.25 0.33 0.15 0.14 0.10 0.15 0.50 0.09 O 15.04% O 15.86% O 16,60% 16.35% O 17.33% Question 33 1 pts If you know the risk-free rate, the market risk-premium, and the beta of a stock, then using the CAPM you will be able to calculate the expected rate of return for the stock. True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts