Question: help me out and i will rate it. could you answer it please!! 3 Complete the Schedule of Cost of Goods Manufactured. Use the blue

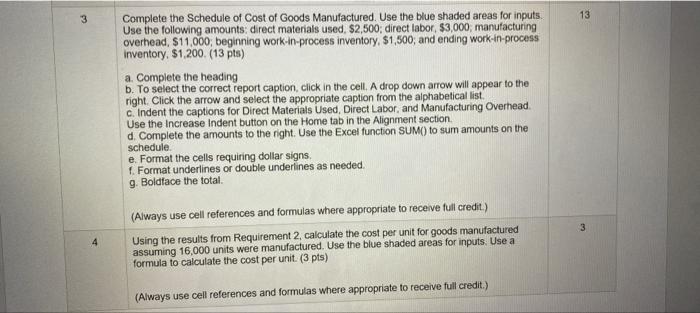

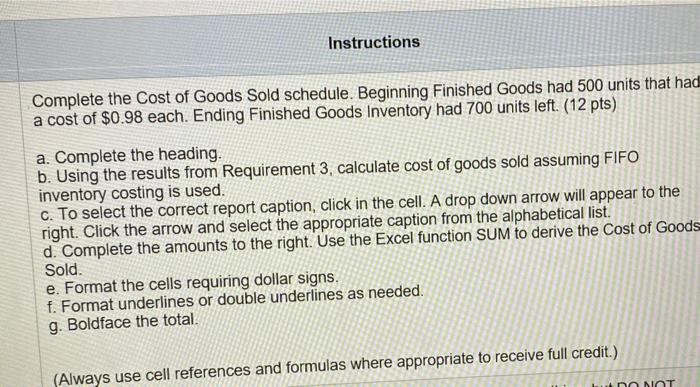

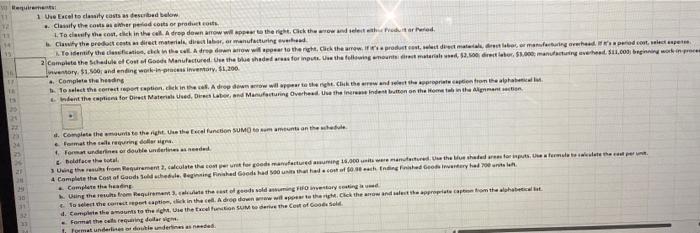

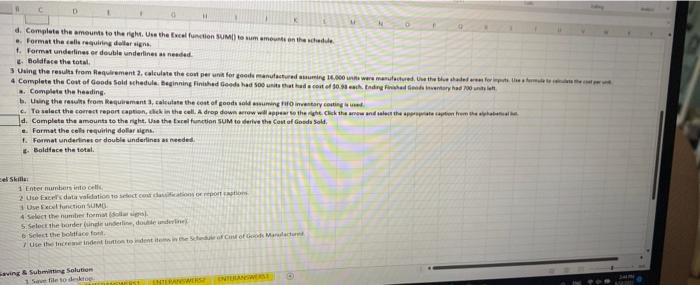

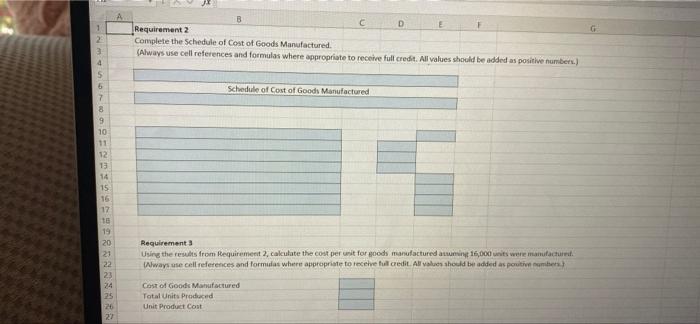

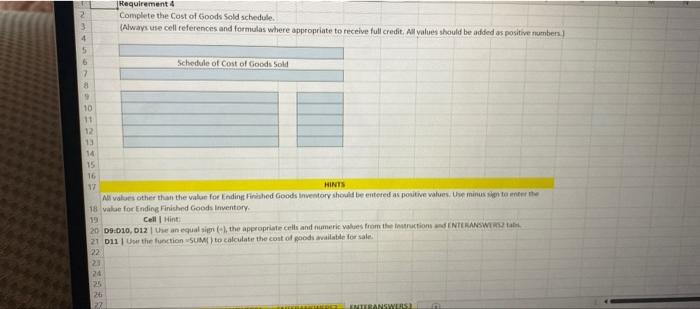

3 Complete the Schedule of Cost of Goods Manufactured. Use the blue shaded areas for inputs. Use the following amounts: direct materials used, $2,500; direct labor, $3,000, manufacturing overhead, $11,000; beginning work-in-process inventory, $1,500; and ending work-in-process inventory, $1,200. (13 pts) a. Complete the heading b. To select the correct report caption, click in the cell. A drop down arrow will appear to the right. Click the arrow and select the appropriate caption from the alphabetical list. c. Indent the captions for Direct Materials Used, Direct Labor, and Manufacturing Overhead. Use the Increase Indent button on the Home tab in the Alignment section. d. Complete the amounts to the right. Use the Excel function SUM() to sum amounts on the schedule. e. Format the cells requiring dollar signs. f. Format underlines or double underlines as needed. g. Boldface the total. (Always use cell references and formulas where appropriate to receive full credit.) Using the results from Requirement 2, calculate the cost per unit for goods manufactured assuming 16,000 units were manufactured. Use the blue shaded areas for inputs. Use a formula to calculate the cost per unit. (3 pts) (Always use cell references and formulas where appropriate to receive full credit.) 13 3 Instructions Complete the Cost of Goods Sold schedule. Beginning Finished Goods had 500 units that had a cost of $0.98 each. Ending Finished Goods Inventory had 700 units left. (12 pts) a. Complete the heading. b. Using the results from Requirement 3, calculate cost of goods sold assuming FIFO inventory costing is used. c. To select the correct report caption, click in the cell. A drop down arrow will appear to the right. Click the arrow and select the appropriate caption from the alphabetical list. d. Complete the amounts to the right. Use the Excel function SUM to derive the Cost of Goods Sold. e. Format the cells requiring dollar signs. f. Format underlines or double underlines as needed. g. Boldface the total. (Always use cell references and formulas where appropriate to receive full credit.) DO NOT 11 W Requirement 11 14 Classify the costs as either pelod costs or product costs 1.To classify the cost, click in the cell. A drop down amow will appear to the right. Click the arrow and select ethi Produit or Ped Classify the product costs as direct materials, direct labor, or manufacturing everhead 15 To identify the classification, chick in the cell. A drop down arrow will appear to the right, Click the arrow. If it's a product cost, select direct materials, direct labor, or manufacturing overhead. If 's a period cost, select expense 2 Complete the Schedule of Cost of Goods Manufactured. Use the blue shaded areas for inputs. Use the following amounts direct materials used, $2,500 direct labor, $3.000 manufacturing overhead $11,000 beginning work-in-proces Inventory, $1.500 and ending work-in-process inventory, $1,200. 36 17 Complete the heading 16 To select the correct report caption, click in the call. A drop down arrow will appear to the right. Click the arrow and select the appropriate caption from the alphabetical Indent the captions for Direct Materials Used, Derecs Labor, and Manufacturing Overhead. Use the increase indent button on the Home tab in the Alignment section d. Complete the amounts to the right. Use the Excel function SUMO to sum amounts on the schedule Format the cells requiring dollar signa 4. Format underlines or double underlines as needed. Eboldface the total 21 3 Using the results from Requirement 2, calculate the cost per uret for goods manufactured assuming 16.000 units were manufactured. Use the blue shaded areas for inputs. Use a formale to calculate the cast per un 4 Complete the Cost of Goods Sold schedule, Beginning Finished Goods had 500 units that had a cost of $0.00 each Ending Finished Goods inventory had 700 telef 29 Complete the heading Using the results from Requirement 3, calculate the cast of goods sold assuming FIFO inventory costing is used to select the correct report caption, click in the cell. A drop down arrow will appear to the right. Click the arrow and select the appropriate caption from the alphabetical t d. Complete the amounts to the right. Use the Excel function SUM to derive the Cost of Goods Sold Format the cells requiring dollar sig 1, format underlines or double underlines as needed 25 124 24 25 1 Use Excel to classify casts as described below ERRERA W D G d. Complete the amounts to the right. Use the Excel function SUM() to sum amounts on the schedule e. Format the calls requiring dollar signs f. Format underlines or double underlines as needed. Boldface the total. 3 Using the results from Requirement 2, calculate the cost per unit for goods manufactured assuming 16.000 unts were manufactured. Use the the shaded areas for inputs L 4. Complete the cost of Goods Sold schedule. Beginning Finished Goods had 500 units that had a cost of 30.98 each Ending finished Goods Inventory had 700 let a. Complete the heading. b. Using the results from Requirement 3, calculate the cost of goods sold assuming FIFO inventory costing is u c. To select the correct report caption, click in the cell. A drop down arrow will appear to the right. Click the arrow and select the appropriate caption from the alphabe d. Complete the amounts to the right. Use the Excel function SUM to derive the Cost of Goods Sold. e. Format the cells requiring dollar signs. f. Format underlines or double underlines as needed. - Boldface the total. 1 Enter numbers into cell 2 Use Excel's data validation to select cont classifications or report captions Use Excel function SUMO 4 Select the number format (dollar sign) 5. Select the border (single underline, double underline 6 Select the boltface font. Use the Increase indent button to indent items in the Schedule of Cont of Goods Manufactured ENTERANSWERS O ENGARST INTERANSWERS cel Skill Saving & Submitting Solution 1 Save file to desktop 2 3 4 5 6 7 8 10 11 12 13 A 14 15 16 17 18 19 20 21 22 Requirement 1 a. Identify the following as either a product cost or a period cost. b. Select the appropriate product cost category, or select expense. Description Coconut flakes used in the cookies. Depreciation on the ovens. Insurance on the computers used in the accounting office. Wages for the bakery security guard. Salaries of the bakers who make the cookies. Electricity for the bakery. Heating for the corporate headquarters. Freight for shipping the cookies to customers. Salary of the baking supervisor. Cost Classification D Category B C D Requirement 21 Complete the Schedule of Cost of Goods Manufactured. (Always use cell references and formulas where appropriate to receive full credit. All values should be added as positive numbers.) 4 Schedule of Cost of Goods Manufactured Requirement 3 21 Using the results from Requirement 2, calculate the cost per unit for goods manufactured assuming 16,000 units were manufactured. Always use cell references and formulas where appropriate to receive full credit. All values should be added as positive numbers) 22 23 24 Cost of Goods Manufactured Total Units Produced. Unit Product Cost 1 23 3 6 7 8 9 10 11 12 13 14 15 16 17 16 20 A 25 26 27 Requirement 4 2 Complete the Cost of Goods Sold schedule.. 3 (Always use cell references and formulas where appropriate to receive full credit. All values should be added as positive numbers.) 4 Schedule of Cost of Goods Sold 8 10 11 12 13 14 15 16 17 HINTS All values other than the value for Ending Finished Goods Inventory should be entered as positive values. Use minus sign to enter the 18 value for Ending Finished Goods Inventory. 19 Cell | Hint 09:010, D12 | Use an equal sign (-), the appropriate cells and numeric values from the Instructions and ENTERANSWERSZ tab 21 D11 | Use the function SUM() to calculate the cost of goods available for sale. TEREZ INTERANSWERS n 6 7 228523*** 24 26 27

Step by Step Solution

There are 3 Steps involved in it

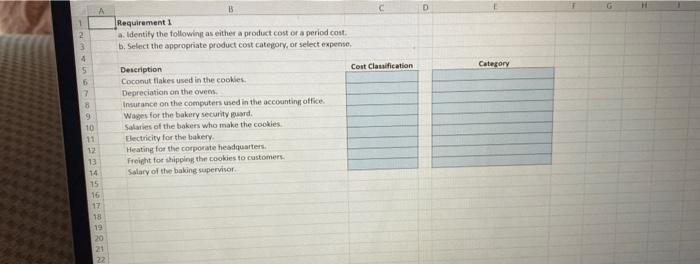

Get step-by-step solutions from verified subject matter experts