Question: HELP ME PLEASE !! i will like yiur answer !! Question 1 (1,5 points) The figure provides the yield spreads of the long-term corporate bonds

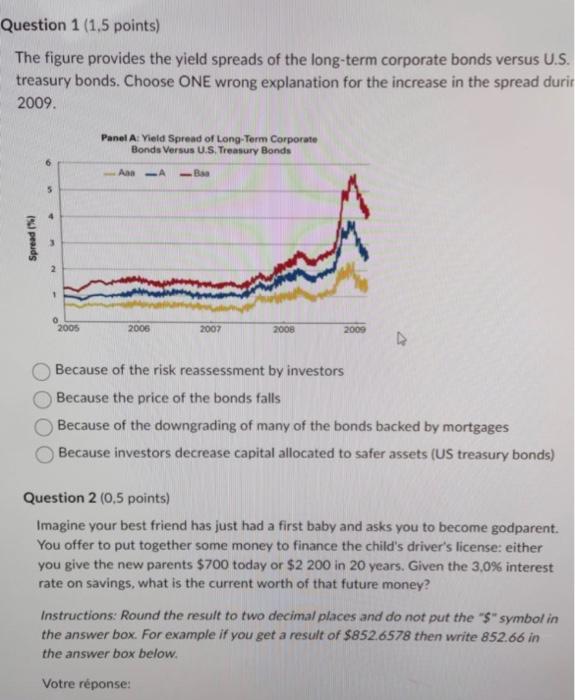

Question 1 (1,5 points) The figure provides the yield spreads of the long-term corporate bonds versus U.S. treasury bonds. Choose ONE wrong explanation for the increase in the spread duri 2009. Because of the risk reassessment by investors Because the price of the bonds falls Because of the downgrading of many of the bonds backed by mortgages Because investors decrease capital allocated to safer assets (US treasury bonds) Question 2 ( 0.5 points) Imagine your best friend has just had a first baby and asks you to become godparent. You offer to put together some money to finance the child's driver's license: either you give the new parents $700 today or $2.200 in 20 years. Given the 3,0% interest rate on savings, what is the current worth of that future money? Instructions: Round the result to two decimal places and do not put the " $ " symbol in the answer box. For example if you get a result of $852.6578 then write 852.66 in the answer box below. Votre rponse

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts