Question: help me please if u can !!! Shown below is the adjusted Trial Balance for Simon Inc. on December 31, after the first year of

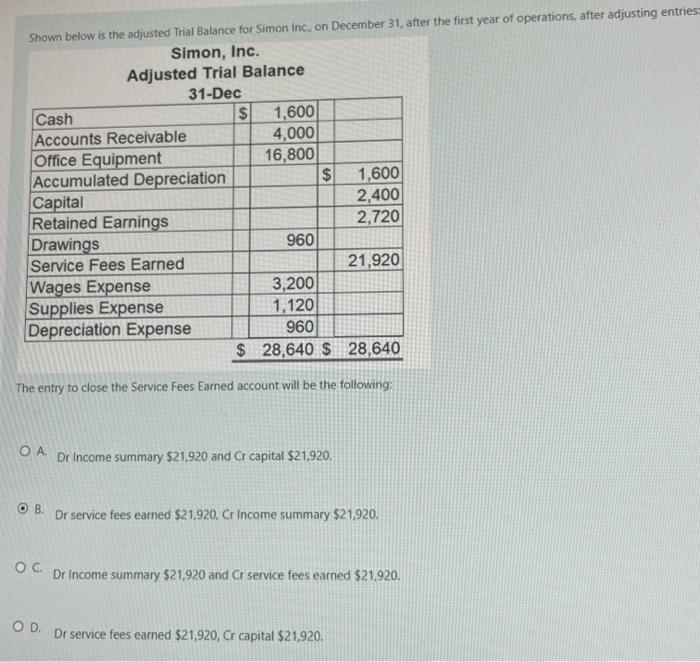

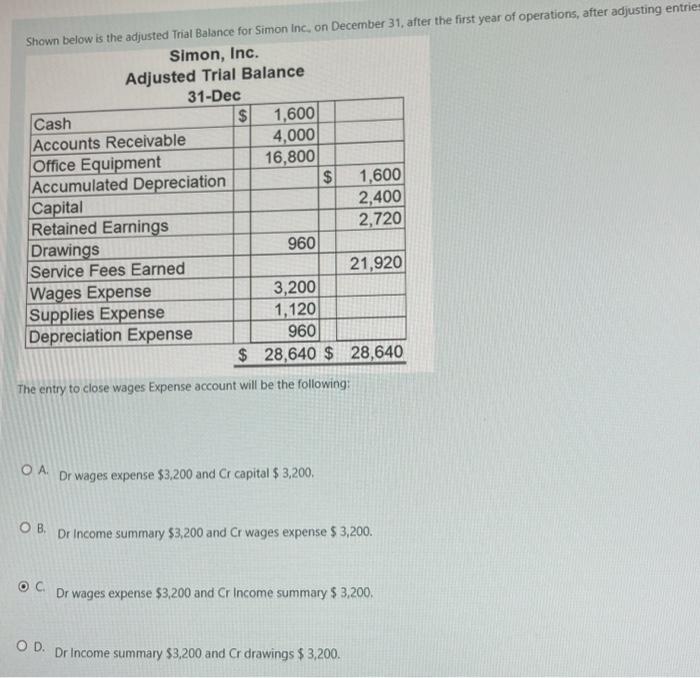

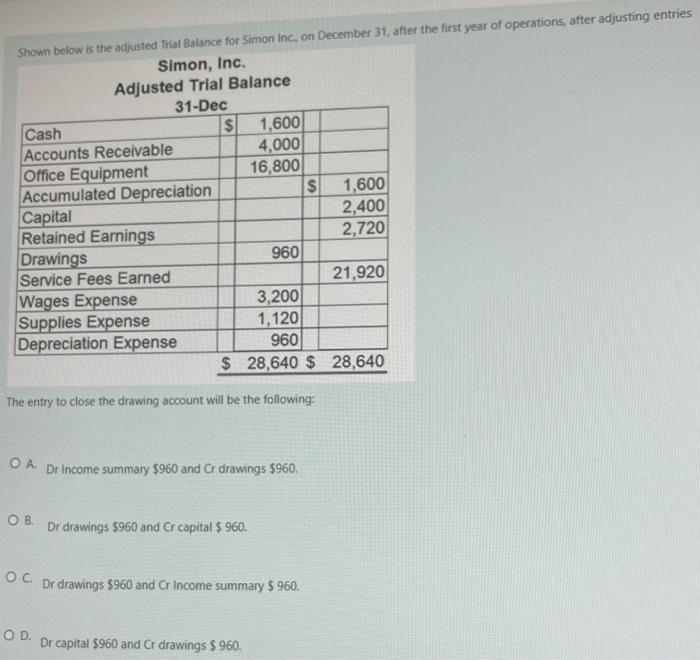

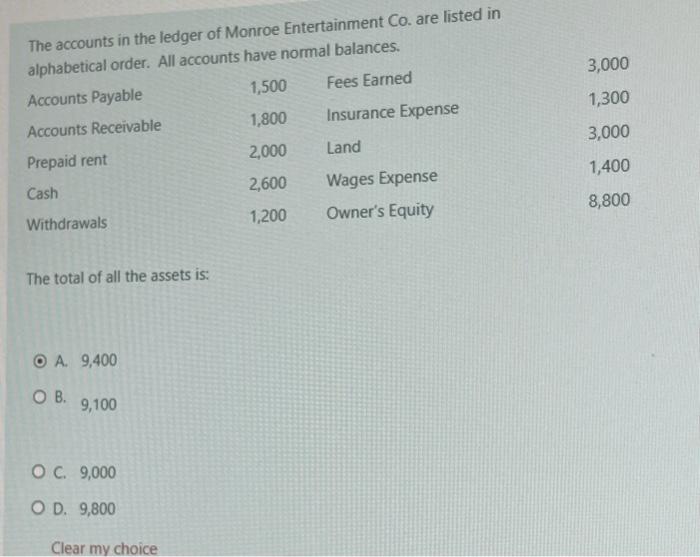

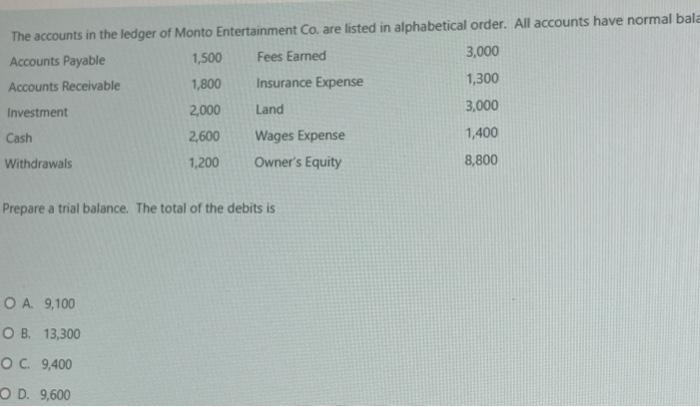

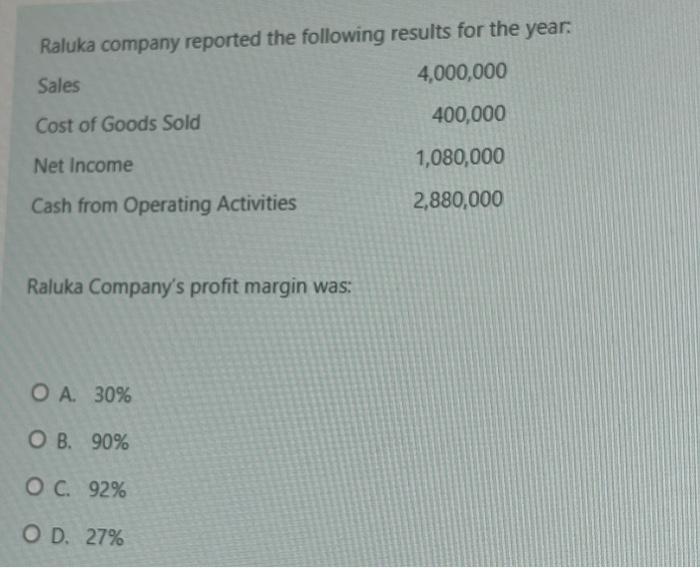

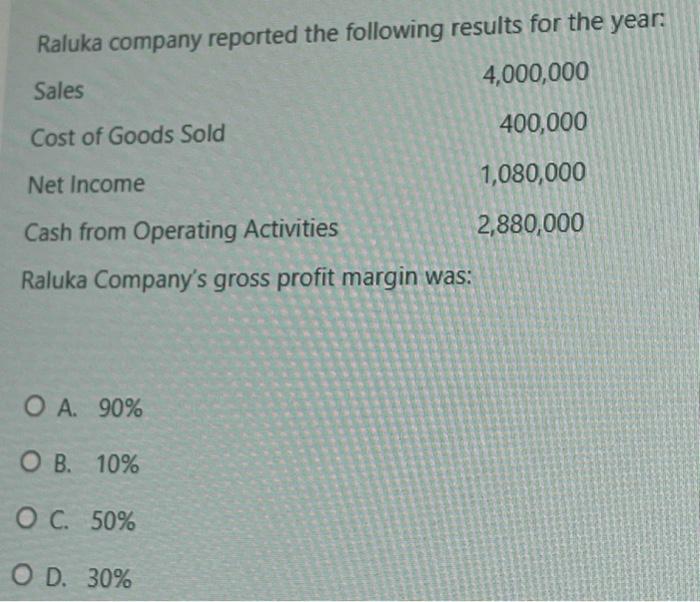

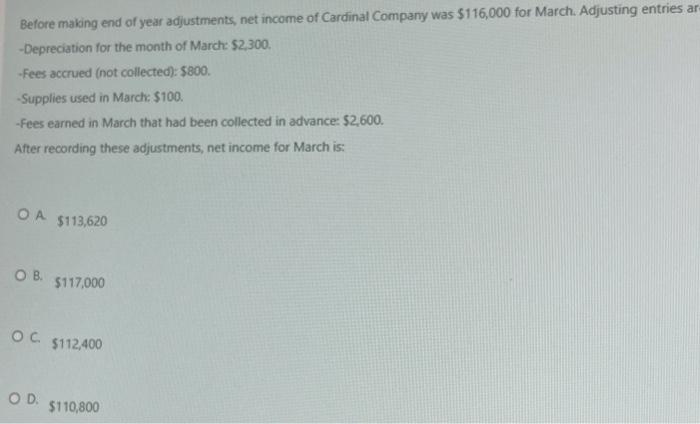

Shown below is the adjusted Trial Balance for Simon Inc. on December 31, after the first year of operations, after adjusting entries Simon, Inc. Adjusted Trial Balance 31-Dec Cash $ 1,600 Accounts Receivable 4,000 Office Equipment 16,800 Accumulated Depreciation $ 1,600 Capital 2,400 Retained Earnings 2,720 Drawings 960 Service Fees Earned 21,920 Wages Expense 3,200 Supplies Expense 1,120 Depreciation Expense 960 $ 28,640 $ 28,640 The entry to close the Service Fees Earned account will be the following: . Dr Income summary $21.920 and Cr capital $21.920. OB. Dr service fees earned $21,920, Cr Income summary $21.920. . Dr Income summary $21.920 and Cr service fees earned $21.920. OD. Dr service fees earned $21,920, Cr capital $21.920, Shown below is the adjusted Trial Balance for Simon Inc, on December 31, after the first year of operations, after adjusting entries Simon, Inc. Adjusted Trial Balance 31-Dec Cash $ 1,600 Accounts Receivable 4,000 Office Equipment 16,800 Accumulated Depreciation $ 1,600 Capital 2,400 Retained Earnings 2,720 Drawings 960 Service Fees Earned 21,920 Wages Expense 3,200 Supplies Expense 1,120 Depreciation Expense 960 $ 28,640 $ 28,640 The entry to close wages Expense account will be the following: . Dr wages expense $3,200 and Cr capital $ 3,200. . Dr Income summary $3,200 and Cr wages expense $ 3,200. OC Dr wages expense $3,200 and Cr Income summary $ 3,200. OD Dr Income summary $3,200 and Cr drawings $3,200. Shown below is the adjusted Trial Balance for Simon Inc, on December 31, after the first year of operations, after adjusting entries Simon, Inc. Adjusted Trial Balance 31-Dec Cash $ 1,600 Accounts Receivable 4,000 Office Equipment 16,800 Accumulated Depreciation $ 1,600 Capital 2,400 Retained Earnings 2,720 Drawings 960 Service Fees Earned 21,920 Wages Expense 3,200 Supplies Expense 1,120 Depreciation Expense 960 $ 28,640 $ 28,640 The entry to close the drawing account will be the following: OA Dr Income summary $960 and Cr drawings $960, . Dr drawings 5960 and Cr capital $ 960. OC Dr drawings $960 and Cr Income summary $ 960. OD Dr capital $960 and Cr drawings $ 960. 3,000 The accounts in the ledger of Monroe Entertainment Co. are listed in alphabetical order. All accounts have normal balances. Accounts Payable 1,500 Fees Earned Accounts Receivable 1,800 Insurance Expense Prepaid rent 2,000 Land 1,300 3,000 1,400 Cash 2,600 Wages Expense Owner's Equity 8,800 Withdrawals 1,200 The total of all the assets is: O A 9,400 . 9,100 O C. 9,000 OD. 9,800 Clear my choice The accounts in the ledger of Monto Entertainment Co. are listed in alphabetical order. All accounts have normal bala Accounts Payable 1,500 Fees Eamed 3,000 Accounts Receivable 1,800 Insurance Expense 1,300 Investment 2,000 Land 3,000 Cash 2,600 Wages Expense 1,400 Withdrawals 1,200 Owner's Equity 8,800 Prepare a trial balance. The total of the debits is O A 9,100 OB 13,300 OC 9,400 O D. 9,600 Raluka company reported the following results for the year. Sales 4,000,000 Cost of Goods Sold 400,000 Net Income 1,080,000 Cash from Operating Activities 2,880,000 Raluka Company's profit margin was: O A. 30% OB. 90% OC. 92% OD. 27% Raluka company reported the following results for the year: 4,000,000 Sales Cost of Goods Sold 400,000 Net Income 1,080,000 Cash from Operating Activities 2,880,000 Raluka Company's gross profit margin was: O A. 90% OB. 10% O C. 50% O D. 30% Before making end of year adjustments, net income of Cardinal Company was $116,000 for March. Adjusting entries ar -Depreciation for the month of March: $2,300, -Fees accrued (not collected): $800. -Supplies used in March: $100 -Fees earned in March that had been collected in advance: $2,600. After recording these adjustments, net income for March is: $113,620 O B. $117,000 . $112,400 OD $110,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts