Question: How is this wrong? Also how do I calculate it? The following information is extracted from Shelton Corporation's accounting records at the beginning of 2019:

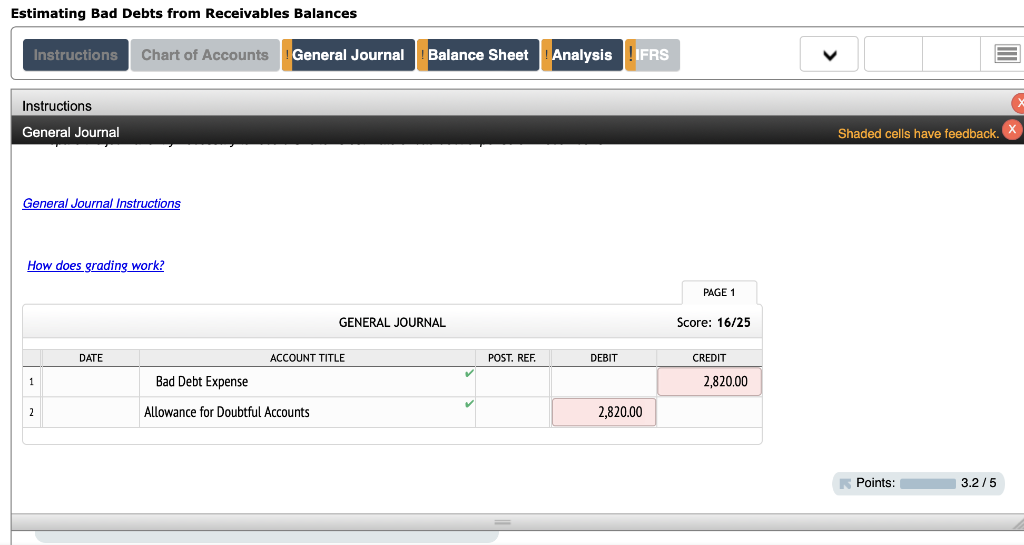

How is this wrong? Also how do I calculate it?

How is this wrong? Also how do I calculate it?

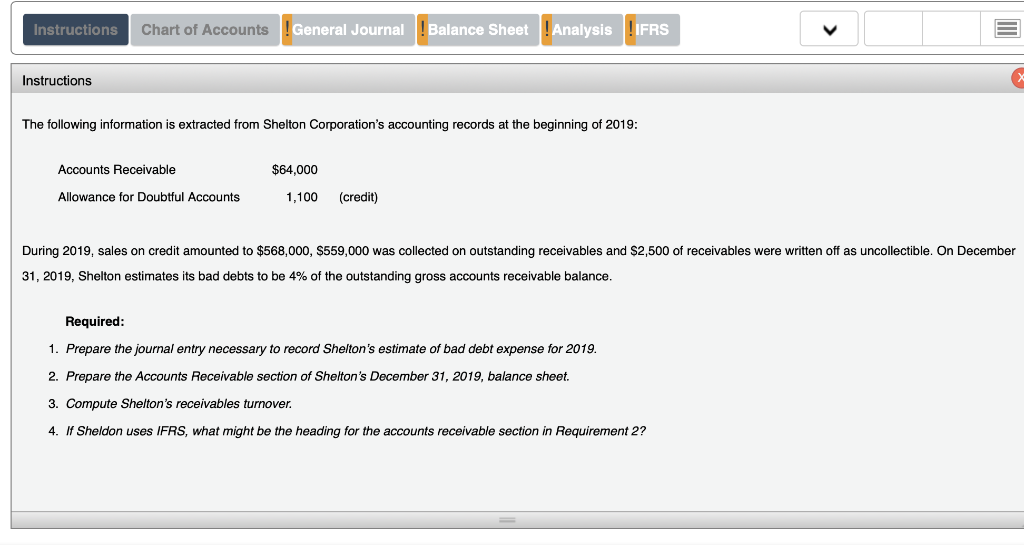

The following information is extracted from Shelton Corporation's accounting records at the beginning of 2019: During 2019, sales on credit amounted to $568,000, $559,000 was collected on outstanding receivables and $2,500 of receivables were written off as uncollectible. On December 31,2019 , Shelton estimates its bad debts to be 4% of the outstanding gross accounts receivable balance. Required: 1. Prepare the journal entry necessary to record Shelton's estimate of bad debt expense for 2019. 2. Prepare the Accounts Receivable section of Shelton's December 31, 2019, balance sheet. 3. Compute Shelton's receivables turnover. 4. If Sheldon uses IFRS, what might be the heading for the accounts receivable section in Requirement 2? Estimating Bad Debts from Receivables Balances Instructions General Journal How does grading work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts