Question: help me please Instructions Prepare the general journal entries that should be made at December 31, 2018, to record these events. (Ignore tax effects.) E22-12

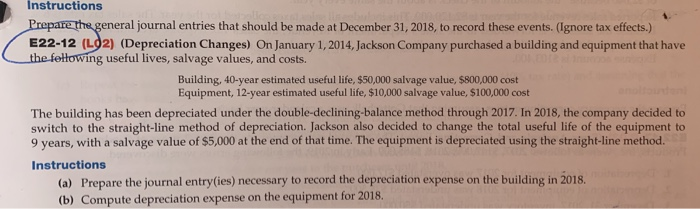

Instructions Prepare the general journal entries that should be made at December 31, 2018, to record these events. (Ignore tax effects.) E22-12 (L92) (Depreciation Changes) On January 1, 2014, Jackson Company purchased a building and equipment that have the following useful lives, salvage values, and costs. Building, 40-year estimated useful life, $50,000 salvage value, $800,000 cost Equipment, 12-year estimated useful life, $10,000 salvage value, $100,000 cost The building has been depreciated under the double-declining-balance method through 2017. In 2018, the company decided to switch to the straight-line method of depreciation. Jackson also decided to change the total useful life of the equipment to 9 years, with a salvage value of $5,000 at the end of that time. The equipment is depreciated using the straight-line method. Instructions (a) Prepare the journal entry(ies) necessary to record the depreciation expense on the building in 2018. (b) Compute depreciation expense on the equipment for 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts