Question: HELP ME PLEASE TO ANSWER THEM ALL CORRECTLY FOR AN UPVOTE AND POSITIVE RATINGS. Total Shares = 700,000 Find: Dividend per share Solution: Dividend per

HELP ME PLEASE TO ANSWER THEM ALL CORRECTLY FOR AN UPVOTE AND POSITIVE RATINGS.

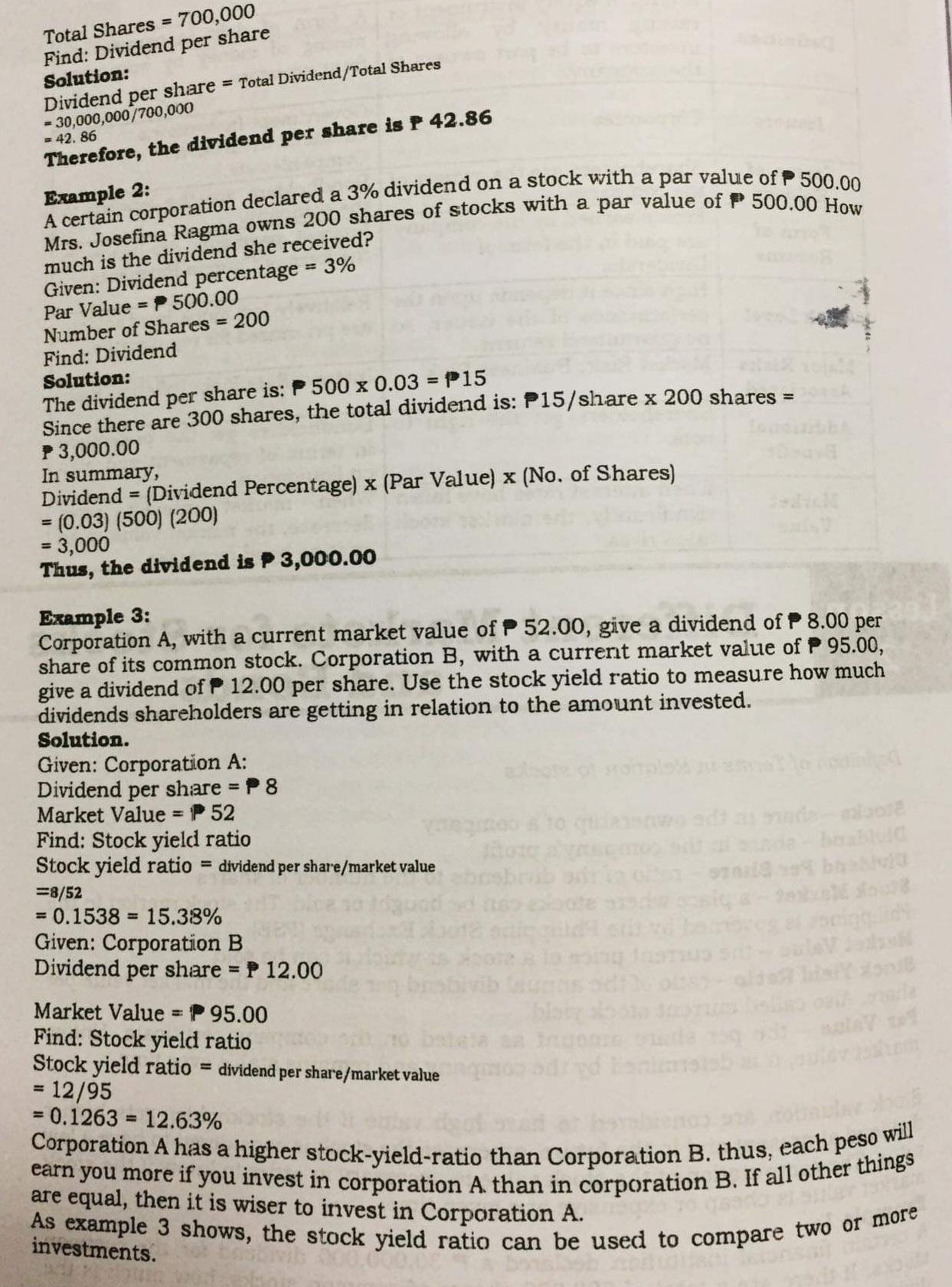

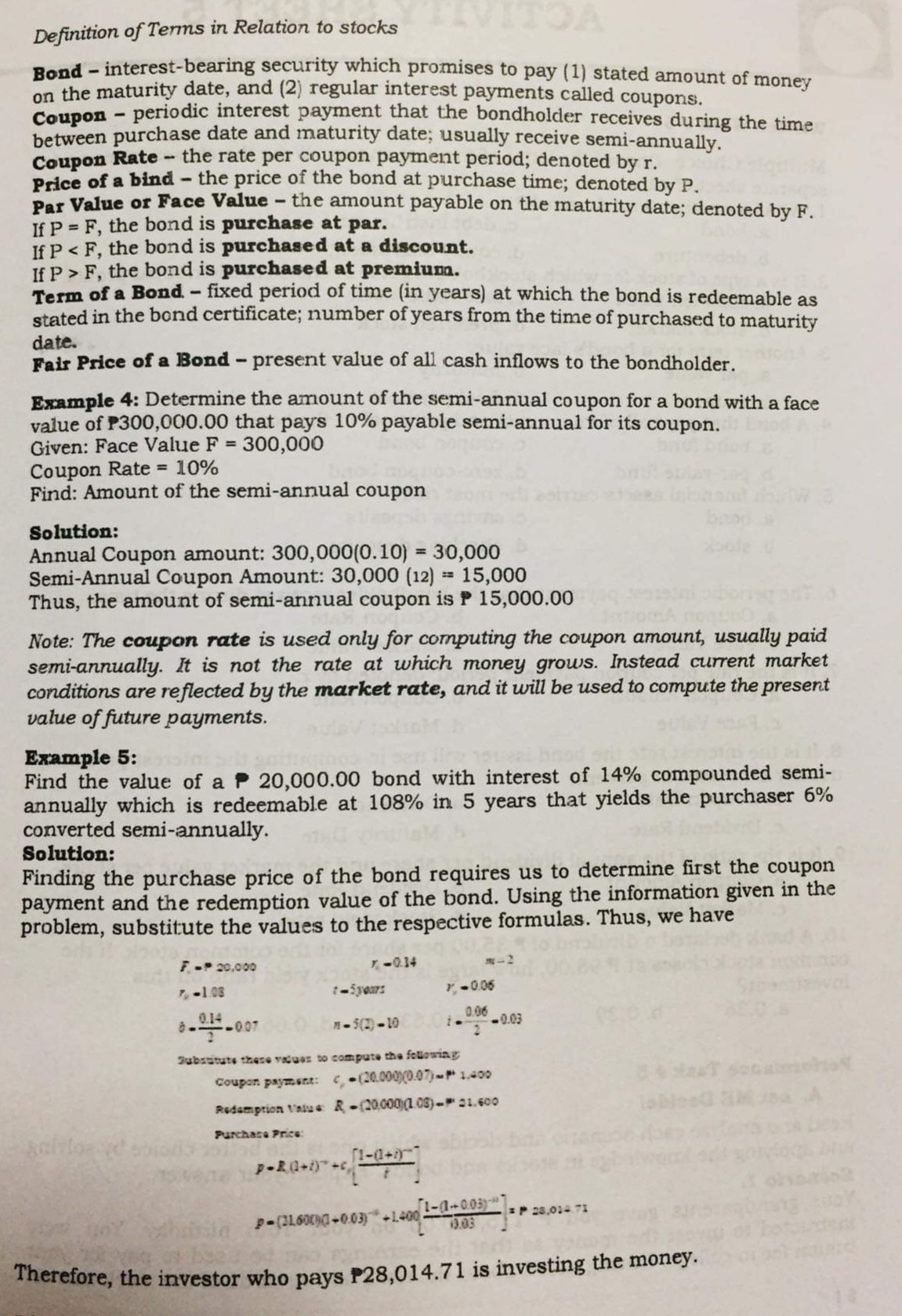

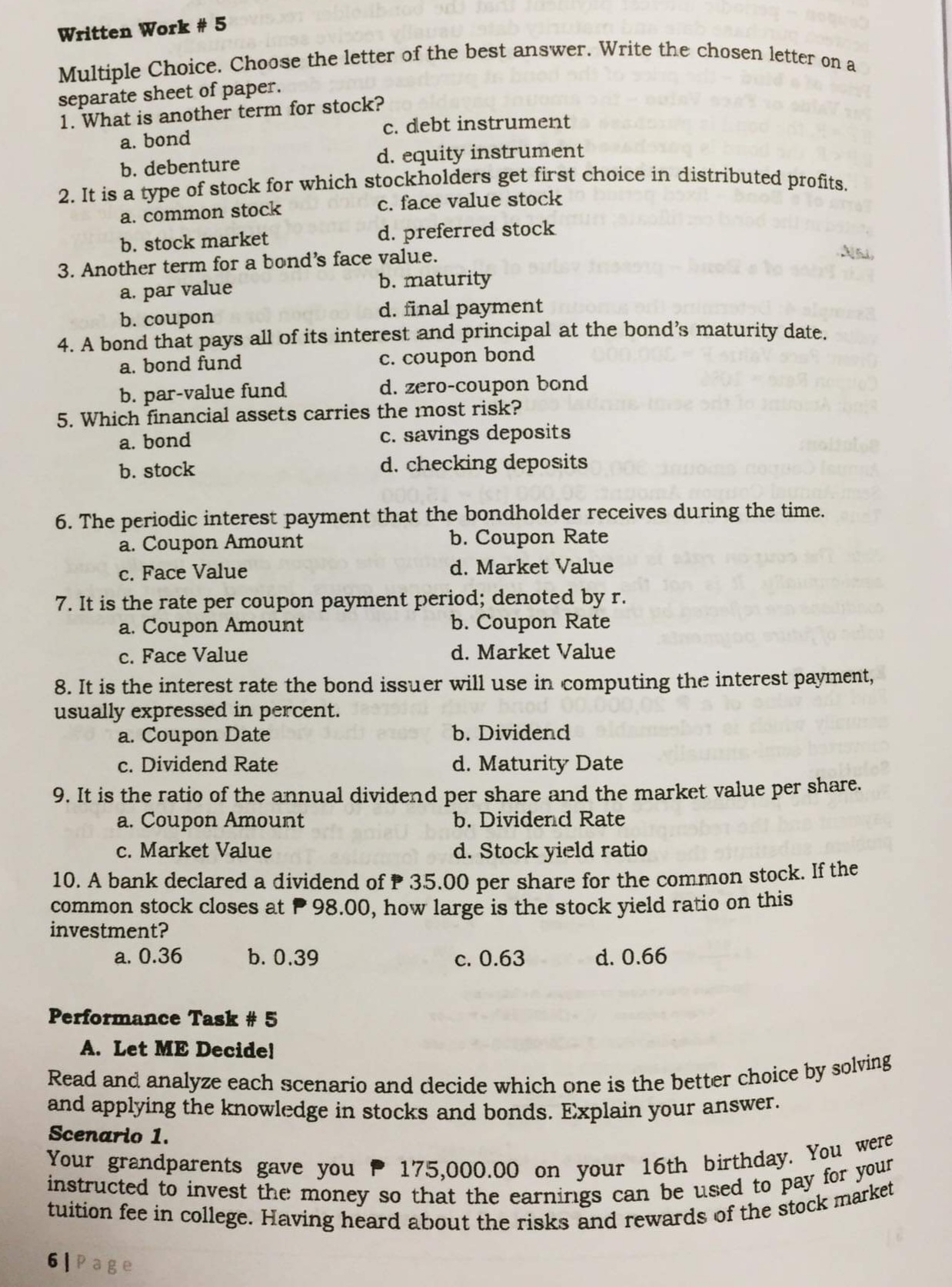

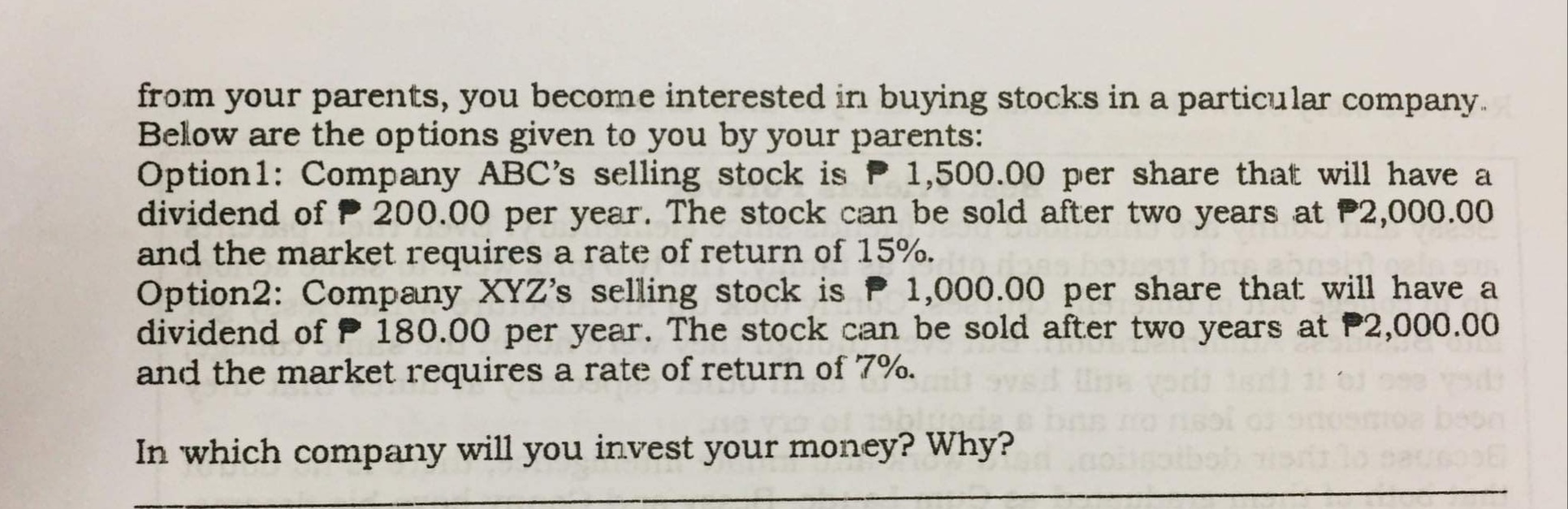

Total Shares = 700,000 Find: Dividend per share Solution: Dividend per share = Total Dividend/Total Shares = 30,000,000/700,000 = 42. 86 Therefore, the dividend per share is P 42.86 Example 2: A certain corporation declared a 3% dividend on a stock with a par value of P 500.00 Mrs. Josefina Ragma owns 200 shares of stocks with a par value of P 500.00 How much is the dividend she received? Given: Dividend percentage = 3% Par Value = P 500.00 Number of Shares = 200 Find: Dividend Solution: The dividend per share is: P 500 x 0.03 = P15 Since there are 300 shares, the total dividend is: P15/share x 200 shares = P 3,000.00 In summary, Dividend = (Dividend Percentage) x (Par Value) x (No. of Shares) = (0.03) (500) (200) = 3,000 Thus, the dividend is P 3,000.00 Example 3: Corporation A, with a current market value of P 52.00, give a dividend of P 8.00 per share of its common stock. Corporation B, with a current market value of P 95.00, give a dividend of P 12.00 per share. Use the stock yield ratio to measure how much dividends shareholders are getting in relation to the amount invested. Solution. Given: Corporation A: Dividend per share = P 8 Market Value = P 52 Find: Stock yield ratio Stock yield ratio = dividend per share/market value ade - baabloid =8/52 ebosbeab sarin of = 0.1538 = 15.38% togood ad nep expote ared Given: Corporation B Dividend per share = P 12.00 15 moing lasting s Market Value = P 95.00 Find: Stock yield ratio Stock yield ratio = dividend per share/market value = 12/95 = 0.1263 = 12.63% Corporation A has a higher stock-yield-ratio than Corporation B. thus, each peso will earn you more if you invest in corporation A than in corporation B. If all other things are equal, then it is wiser to invest in Corporation A. investments. As example 3 shows, the stock yield ratio can be used to compare two or moreDefinition of Terms in Relation to stocks Bond - interest-bearing security which promises to pay (1) stated amount of money on the maturity date, and (2) regular interest payments called coupons. Coupon - periodic interest payment that the bondholder receives during the time between purchase date and maturity date; usually receive semi-annually. Coupon Rate - the rate per coupon payment period; denoted by r. Price of a bind - the price of the bond at purchase time; denoted by P. Par Value or Face Value - the amount payable on the maturity date; denoted by F. If P = F, the bond is purchase at par. If P F, the bond is purchased at premium. Term of a Bond - fixed period of time (in years) at which the bond is redeemable as stated in the bond certificate; number of years from the time of purchased to maturity date. Fair Price of a Bond - present value of all cash inflows to the bondholder. Example 4: Determine the amount of the semi-annual coupon for a bond with a face value of P300,000.00 that pays 10% payable semi-annual for its coupon. Given: Face Value F = 300,000 Coupon Rate = 10% Find: Amount of the semi-annual coupon Solution: brood Annual Coupon amount: 300, 000(0.10) = 30,000 Semi-Annual Coupon Amount: 30,000 (12) == 15,000 Thus, the amount of semi-annual coupon is P 15,000.00 Note: The coupon rate is used only for computing the coupon amount, usually paid semi-annually. It is not the rate at which money grows. Instead current market conditions are reflected by the market rate, and it will be used to compute the present value of future payments. Example 5: Find the value of a P 20,000.00 bond with interest of 14% compounded semi- annually which is redeemable at 108% in 5 years that yields the purchaser 6% converted semi-annually. Solution: Finding the purchase price of the bond requires us to determine first the coupon payment and the redemption value of the bond. Using the information given in the problem, substitute the values to the respective formulas. Thus, we have F. - P 20,000 7 -0.14 7, -1.03 * -5years 1 -0.06 8- 2.k-907 1 - 3(2) -10 1 . 2-0.03 Subastute these values to compute the following Coupon payment: C . (20.000)(0.07) ~ P+ 1.400 Redemption Value R - (20,000)(1 03) - 21.600 Purchase Price: P- (216009)@-0.03)-1.400 1-(1-+0.03) =p 28.014.73 3.03 Therefore, the investor who pays P28,014.71 is investing the money.Written Work # 5 Multiple Choice. Choose the letter of the best answer. Write the chosen letter on a separate sheet of paper. 1. What is another term for stock? a. bond c. debt instrument b. debenture d. equity instrument 2. It is a type of stock for which stockholders get first choice in distributed profits. a. common stock c. face value stock b. stock market d. preferred stock 3. Another term for a bond's face value. a. par value b. maturity b. coupon d. final payment 4. A bond that pays all of its interest and principal at the bond's maturity date. a. bond fund c. coupon bond b. par-value fund d. zero-coupon bond 5. Which financial assets carries the most risk? a. bond c. savings deposits b. stock d. checking deposits 6. The periodic interest payment that the bondholder receives during the time. a. Coupon Amount b. Coupon Rate c. Face Value d. Market Value 7. It is the rate per coupon payment period; denoted by r a. Coupon Amount b. Coupon Rate c. Face Value d. Market Value 8. It is the interest rate the bond issuer will use in computing the interest payment, usually expressed in percent. a. Coupon Date b. Dividend c. Dividend Rate d. Maturity Date 9. It is the ratio of the annual dividend per share and the market value per share. a. Coupon Amount b. Dividend Rate c. Market Value d. Stock yield ratio 10. A bank declared a dividend of P 35.00 per share for the common stock. If the common stock closes at P 98.00, how large is the stock yield ratio on this investment? a. 0.36 b. 0.39 c. 0.63 d. 0.66 Performance Task # 5 A. Let ME Decide! Read and analyze each scenario and decide which one is the better choice by solving and applying the knowledge in stocks and bonds. Explain your answer. Scenario 1. Your grandparents gave you P 175,000.00 on your 16th birthday. You were instructed to invest the money so that the earnings can be used to pay for your tuition fee in college. Having heard about the risks and rewards of the stock market 6 |Pagefrom your parents, you become interested in buying stocks in a particular company. Below are the options given to you by your parents: Option1: Company ABC's selling stock is P 1,500.00 per share that will have a dividend of P 200.00 per year. The stock can be sold after two years at P2,000.00 and the market requires a rate of return of 15%. Option2: Company XYZ's selling stock is P 1,000.00 per share that will have a dividend of P 180.00 per year. The stock can be sold after two years at P2,000.00 and the market requires a rate of return of 7%. bas no 7180 In which company will you invest your money? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts