Question: Help me practice for my final these are the old questions 3. You are considering entering into a 3-year lease to rent space in Scottsdale

Help me practice for my final

these are the old questions

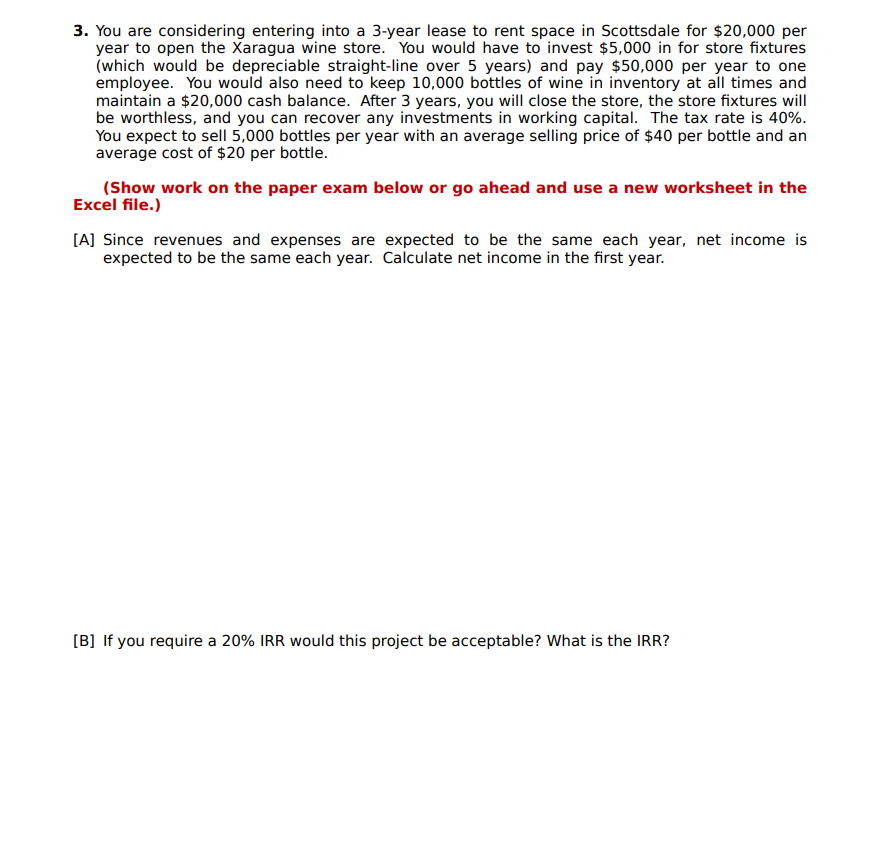

3. You are considering entering into a 3-year lease to rent space in Scottsdale for $20,000 per year to open the Xaragua wine store. You would have to invest $5,000 in for store fixtures (which would be depreciable straight-line over 5 years) and pay $50,000 per year to one employee. You would also need to keep 10,000 bottles of wine in inventory at all times and maintain a $20,000 cash balance. After 3 years, you will close the store, the store fixtures will be worthless, and you can recover any investments in working capital. The tax rate is 40%. You expect to sell 5,000 bottles per year with an average selling price of $40 per bottle and an average cost of $20 per bottle. (Show work on the paper exam below or go ahead and use a new worksheet in the Excel file.) [A] Since revenues and expenses are expected to be the same each year, net income is expected to be the same each year. Calculate net income in the first year. [B] If you require a 20% IRR would this project be acceptable? What is the IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts