Question: help me Question 163.0 marks: True or False 1. A government may have two or more General funds. 2. The term Proprietary funds applies to

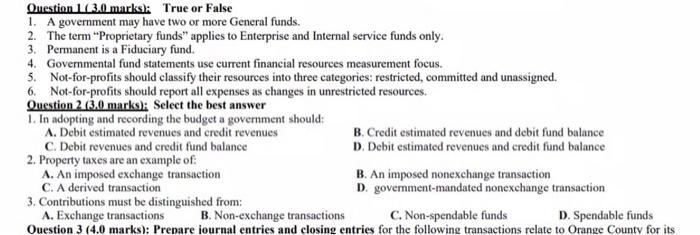

Question 163.0 marks: True or False 1. A government may have two or more General funds. 2. The term "Proprietary funds applies to Enterprise and Internal service funds only. 3. Permanent is a Fiduciary fund. 4. Governmental fund statements use current financial resources measurement focus. 5. Not-for-profits should classify their resources into three categories: restricted, committed and unassigned. 6. Not-for-profits should report all expenses as changes in unrestricted resources. Question 2 (3.0 marks): Select the best answer 1. In adopting and recording the budget a government should: A. Debit estimated revenues and credit revenues B. Credit estimated revenues and debit fund balance C. Debit revenues and credit fund balance D. Debit estimated revenues and credit fund balance 2. Property taxes are an example of: A. An imposed exchange transaction B. An imposed nonexchange transaction C. A derived transaction D. government-mandated nonexchange transaction 3. Contributions must be distinguished from: A. Exchange transactions B. Non-exchange transactions C. Non-spendable funds D. Spendable funds Ouestion 3 (4.0 marks): Prepare journal entries and closing entries for the following transactions relate to Orange County for its

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts