Question: help me study and i will give a good rating! Ashton Corporation is headquartered in Pennsylvania and has a state income tax base there of

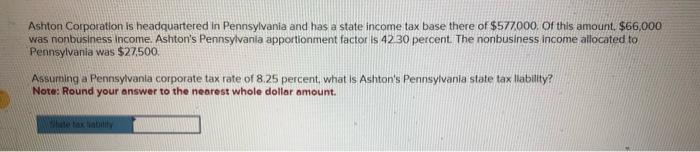

Ashton Corporation is headquartered in Pennsylvania and has a state income tax base there of $577,000.0 this amount, $66,000 was nonbusiness income. Ashton's Pennsyivania apportionment factor is 4230 percent. The nonbusiness income allocated to Pennsylvania was $27,500 Assuming a Pennsylvania corporate tax rate of 8.25 percent, what is Ashton's Pennsylvania state tax llability? Note: Round your answer to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts