Question: Need help with all 9 questions Using the married filing jointly status and their income and expense statement, calculate the 2017 tax liability for Shameka

Need help with all 9 questions

Using the married filing jointly status and their income and expense statement, calculate the 2017 tax liability for Shameka and Curtis Williams. First, use the standard deduction, and then use the following itemized deductions:

| Income | Expenses | |||

| Earned income | $54,000.00 | Home mortgage interest | $8,500.00 | |

| Interest income | 2,000.00 | Real estate and state income taxes | 3,800.00 | |

| Miscellaneous deductions | 600.00 |

Explain to the Williams which method they should use and why.

Part 1

Shameka and Curtis' total gross income for the 2017 tax year is $???????? (Round to the nearest cent.)

Part 2

Assuming Shameka and Curtis are filing jointly, their exemption amount for the 2017 tax year is $???????? (Round to the nearest cent.)

Part 3

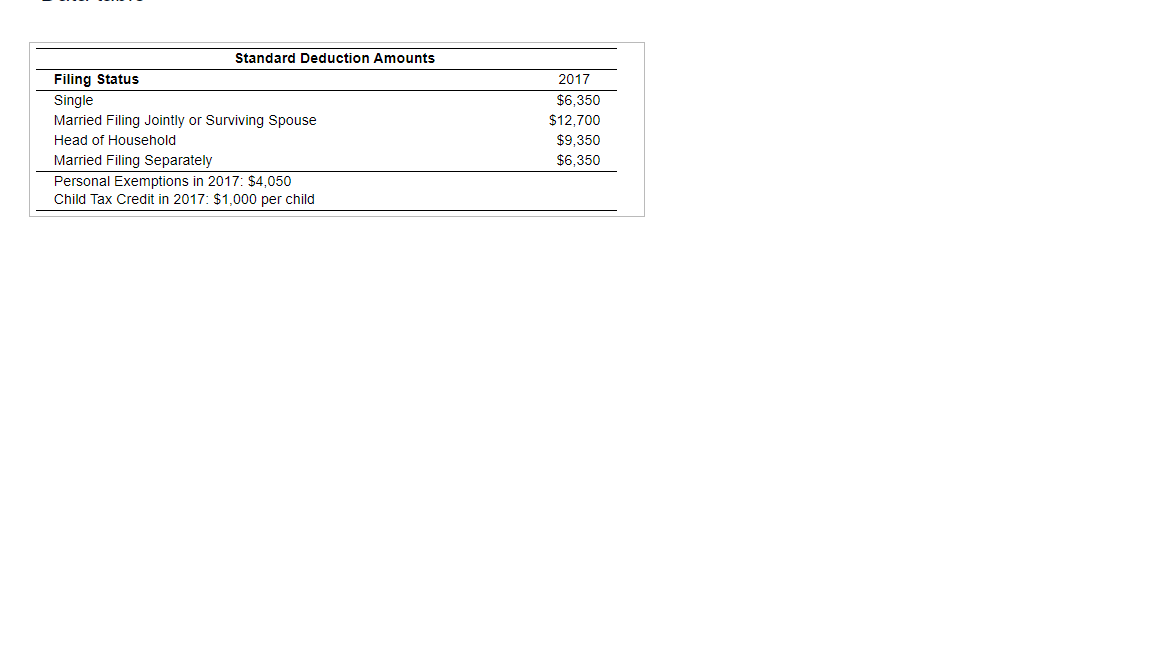

If Shameka and Curtis use the standard deduction, their standard deduction amount for the 2017 tax year is $??????? (Round to the nearest dollar.)

Part 4

Their taxable income for the 2017 tax year is $???????? (Round to the nearest cent.)

Part 5

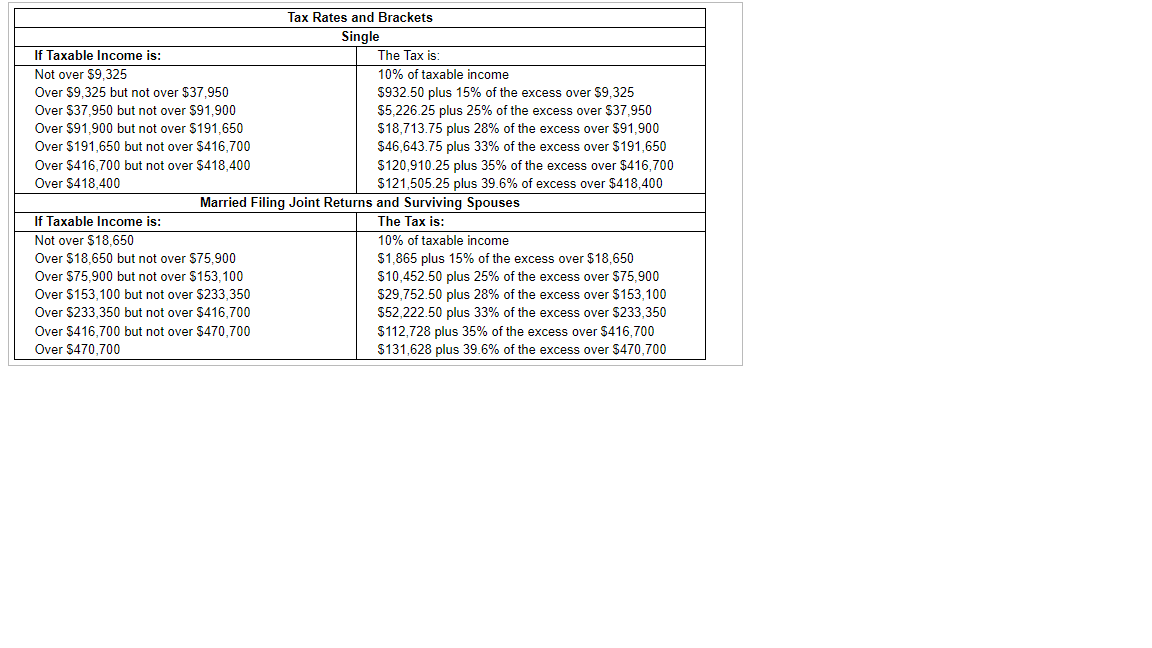

If Shameka and Curtis use the standard deduction, their total income tax due for the 2017 tax year is $??????? (Round to the nearest cent.) Click the following link for the tax rates and brackets table.

Part 6

If Shameka and Curtis itemize their deductions, their itemized deduction amount for the 2017 tax year is $????????

Part 7

If Shameka and Curtis itemize their deductions, their taxable income for the 2017 tax year is $???????????

Part 8

If Shameka and Curtis itemize their deductions, their total income tax due for the 2017 tax year is $???????

Part 9

Which method should they use?(Select the best answer below.)

A. Itemized deduction.

B. Standard deduction.

Part 5 Graph

\begin{tabular}{lr} \hline \multicolumn{2}{c}{ Standard Deduction Amounts } \\ \hline Filing Status & 2017 \\ \hline Single & $6,350 \\ Married Filing Jointly or Surviving Spouse & $12,700 \\ Head of Household & $9,350 \\ Married Filing Separately & $6,350 \\ \hline Personal Exemptions in 2017: $4,050 & \\ Child Tax Credit in 2017: $1,000 per child & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Tax Rates and Brackets } \\ \hline \multicolumn{2}{|c|}{ Single } \\ \hline If Taxable Income is: & The Tax is: \\ \hline Not over $9,325 & 10% of taxable income \\ Over $9,325 but not over $37,950 & $932.50 plus 15% of the excess over $9,325 \\ Over $37,950 but not over $91,900 & $5,226.25 plus 25% of the excess over $37,950 \\ Over $91,900 but not over $191,650 & $18,713.75 plus 28% of the excess over $91,900 \\ Over $191,650 but not over $416,700 & $46,643.75 plus 33% of the excess over $191,650 \\ Over $416,700 but not over $418,400 & $120,910.25 plus 35% of the excess over $416,700 \\ Over $418,400 & $121,505.25 plus 39.6% of excess over $418,400 \\ \hline \multicolumn{2}{|c|}{ Married Filing Joint Returns and Surviving Spouses } \\ \hline If Taxable Income is: & The Tax is: \\ \hline Not over $18,650 & 10% of taxable income \\ Over $18,650 but not over $75,900 & $1,865 plus 15% of the excess over $18,650 \\ Over $75,900 but not over $153,100 & $10,452.50 plus 25% of the excess over $75,900 \\ Over $153,100 but not over $233,350 & $29,752.50 plus 28% of the excess over $153,100 \\ Over $233,350 but not over $416,700 & $52,222.50 plus 33% of the excess over $233,350 \\ Over $416,700 but not over $470,700 & $112,728 plus 35% of the excess over $416,700 \\ Over $470,700 & $131,628 plus 39.6% of the excess over $470,700 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts