Question: help me study, only the answers with a red 'x' are wrong. I will give a good rating! Several years ago Brant, Inc., sold $1,050,000

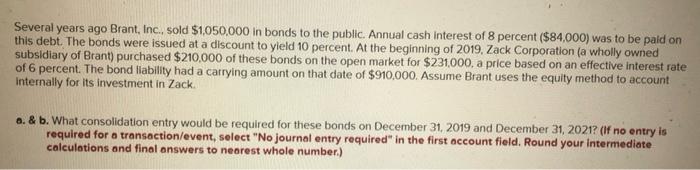

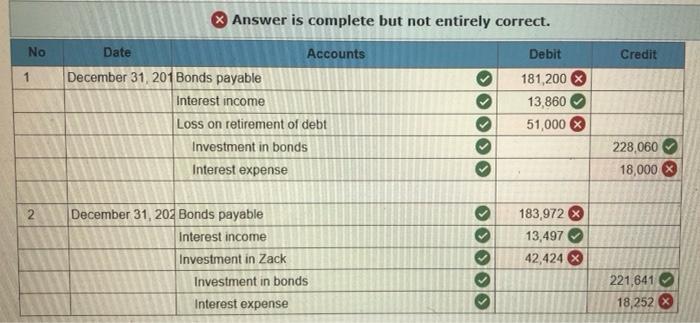

Several years ago Brant, Inc., sold $1,050,000 in bonds to the public. Annual cash interest of 8 percent ($84,000) was to be paid on this debt. The bonds were issued at a discount to yield 10 percent. At the beginning of 2019. Zack Corporation (a wholly owned subsidiary of Brant) purchased $210,000 of these bonds on the open market for $231,000, a price based on an effective interest rate of 6 percent. The bond llability had a carrying amount on that date of $910,000. Assume Brant uses the equity method to account internally for its investment in Zack. a. \& b. What consolidation entry would be required for these bonds on December 31, 2019 and December 31,2021 . (If no entry is required for o transaction/event, select "No journal entry required" in the first account field. Round your intermediate calculations and final answers to nearest whole number.) x Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts