Question: help me with these pls Question 10 (0.2 points) A firm has $4 Billion in debt outstanding with a yield to maturity of 9%. The

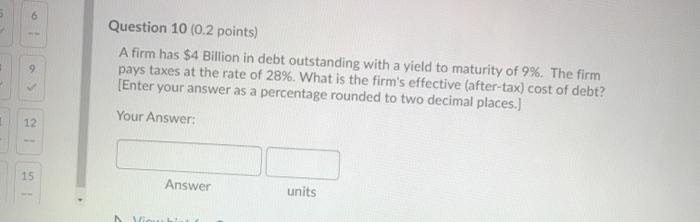

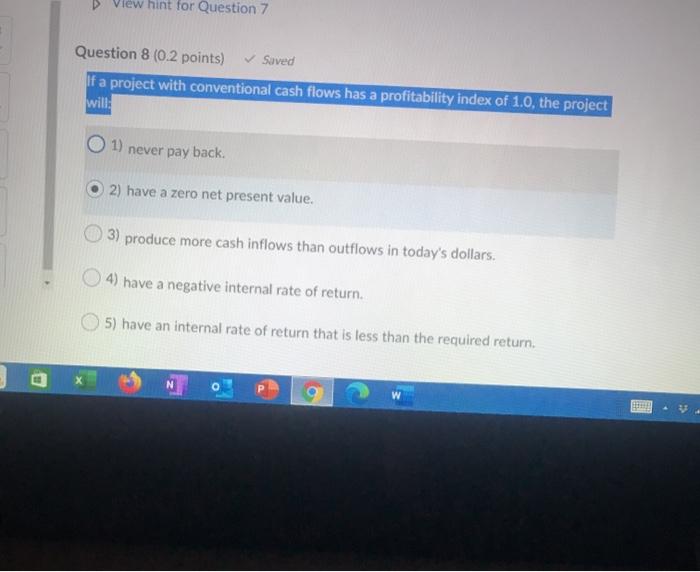

Question 10 (0.2 points) A firm has $4 Billion in debt outstanding with a yield to maturity of 9%. The firm pays taxes at the rate of 28%. What is the firm's effective (after-tax) cost of debt? [Enter your answer as a percentage rounded to two decimal places.) Your Answer: 12 15 Answer units > View hint for Question 7 Question 8 (0.2 points) Saved If a project with conventional cash flows has a profitability index of 1.0, the project will: 1) never pay back. 2) have a zero net present value. 3) produce more cash inflows than outflows in today's dollars. 4) have a negative internal rate of return. 5) have an internal rate of return that is less than the required return B N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts