Question: help me with these three problems with their steps that are included Preferred stock valuation Jones Design wishes to estimate the value of its outstanding

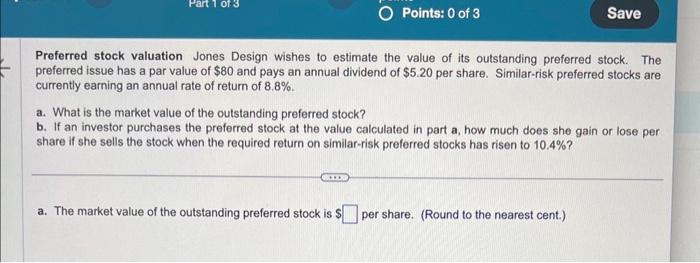

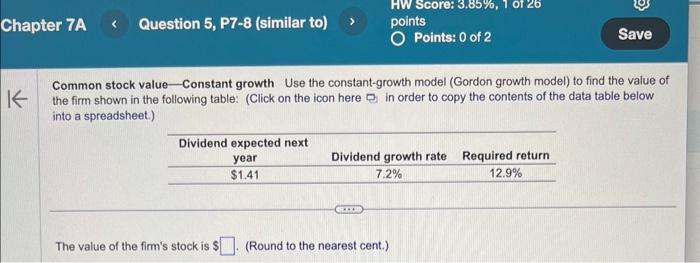

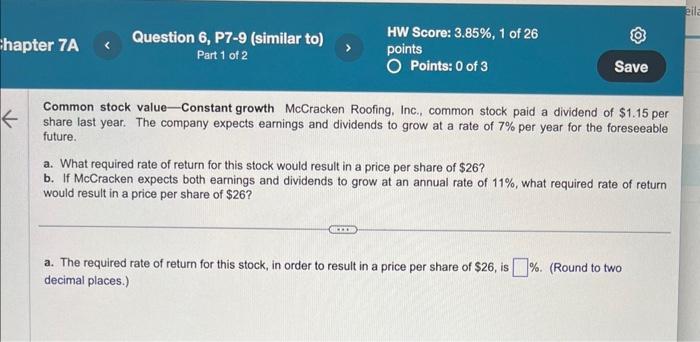

Preferred stock valuation Jones Design wishes to estimate the value of its outstanding preferred stock. The preferred issue has a par value of $80 and pays an annual dividend of $5.20 per share. Similar-risk preferred stocks are currently earning an annual rate of return of 8.8%. a. What is the market value of the outstanding preferred stock? b. If an investor purchases the preferred stock at the value calculated in part a, how much does she gain or lose per share if she sells the stock when the required return on similar-risk preferred stocks has risen to 10.4% ? a. The market value of the outstanding preferred stock is $ per share. (Round to the nearest cent.) Common stock value - Constant growth Use the constant-growth model (Gordon growth model) to find the value of the firm shown in the following table: (Click on the icon here p. in order to copy the contents of the data table below into a spreadsheet.) The value of the firm's stock is $ (Round to the nearest cent.) Common stock value-Constant growth McCracken Roofing, Inc., common stock paid a dividend of $1.15 per share last year. The company expects earnings and dividends to grow at a rate of 7% per year for the foreseeable future. a. What required rate of return for this stock would result in a price per share of $26 ? b. If McCracken expects both earnings and dividends to grow at an annual rate of 11%, what required rate of return would result in a price per share of $26? a. The required rate of return for this stock, in order to result in a price per share of $26, is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts