Question: Help me with this project today and I will give a thumbs up and recommend your answers to others to do the same!! 2 0

Help me with this project today and I will give a thumbs up and recommend your answers to others to do the same!!

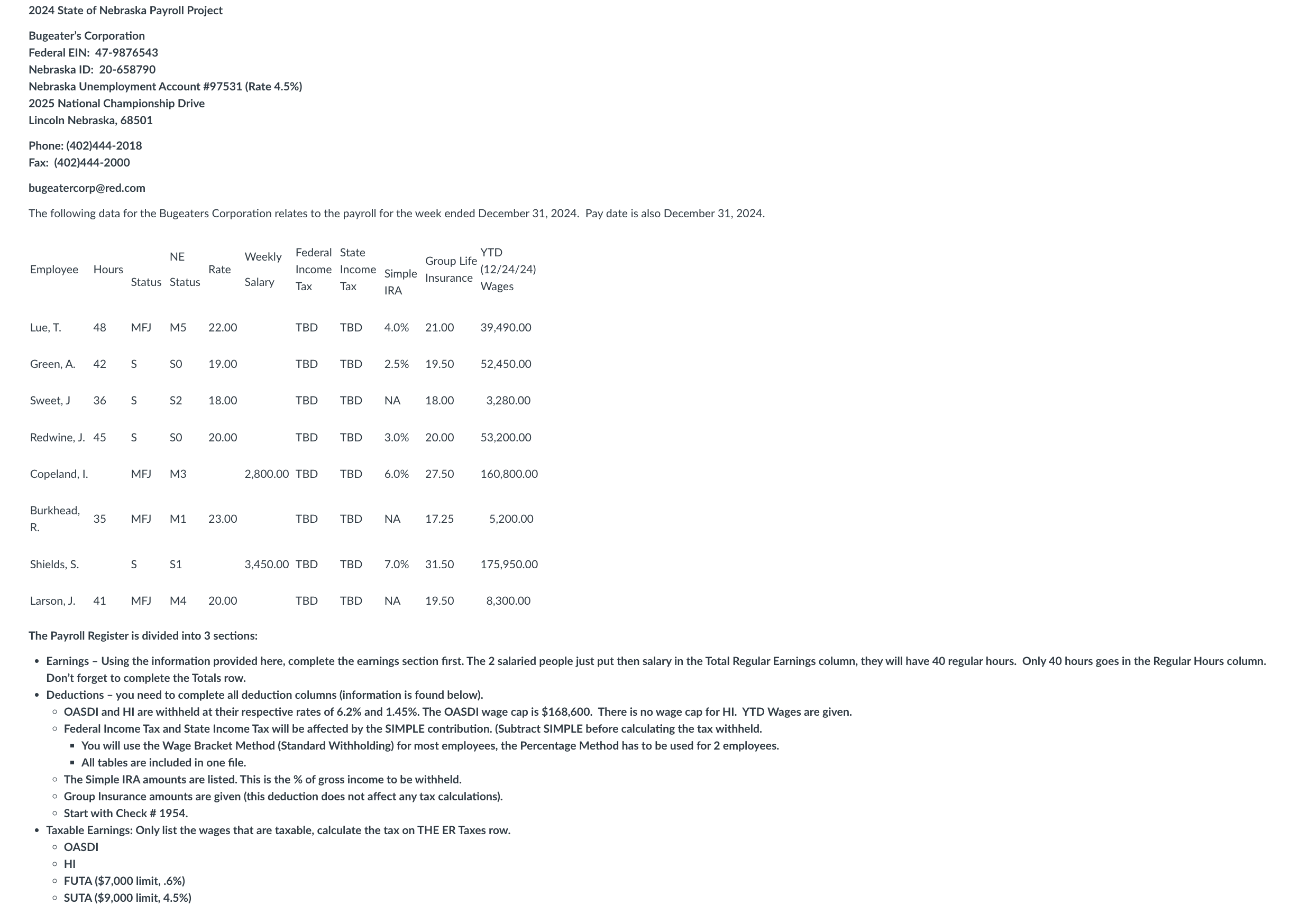

State of Nebraska Payroll Project

Bugeater's Corporation

Federal EIN:

Nebraska ID:

Nebraska Unemployment Account #Rate

National Championship Drive

Lincoln Nebraska,

Phone:

Fax:

bugeatercorp@red.com

The following data for the Bugeaters Corporation relates to the payroll for the week ended December Pay date is also December

The Payroll Register is divided into sections:

Don't forget to complete the Totals row.

Deductions you need to complete all deduction columns information is found below

OASDI and HI are withheld at their respective rates of and The OASDI wage cap is $ There is no wage cap for HI YTD Wages are given.

Federal Income Tax and State Income Tax will be affected by the SIMPLE contribution. Subtract SIMPLE before calculating the tax withheld.

You will use the Wage Bracket Method Standard Withholding for most employees, the Percentage Method has to be used for employees.

All tables are included in one file.

The Simple IRA amounts are listed. This is the of gross income to be withheld.

Group Insurance amounts are given this deduction does not affect any tax calculations

Start with Check #

Taxable Earnings: Only list the wages that are taxable, calculate the tax on THE ER Taxes row.

OASDI

HI

FUTA $ limit

SUTA $ limit BUGEATER'S CORPORATION PAYROLL REGISTER

FOR PAY PERIOD ENDING: December stXX

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock