Question: HELP NEEDED PLEASE Formula that I must follow Question 5 An insurance agent has been attempting to convince you to purchase a savings plan towards

HELP NEEDED PLEASE

Formula that I must follow

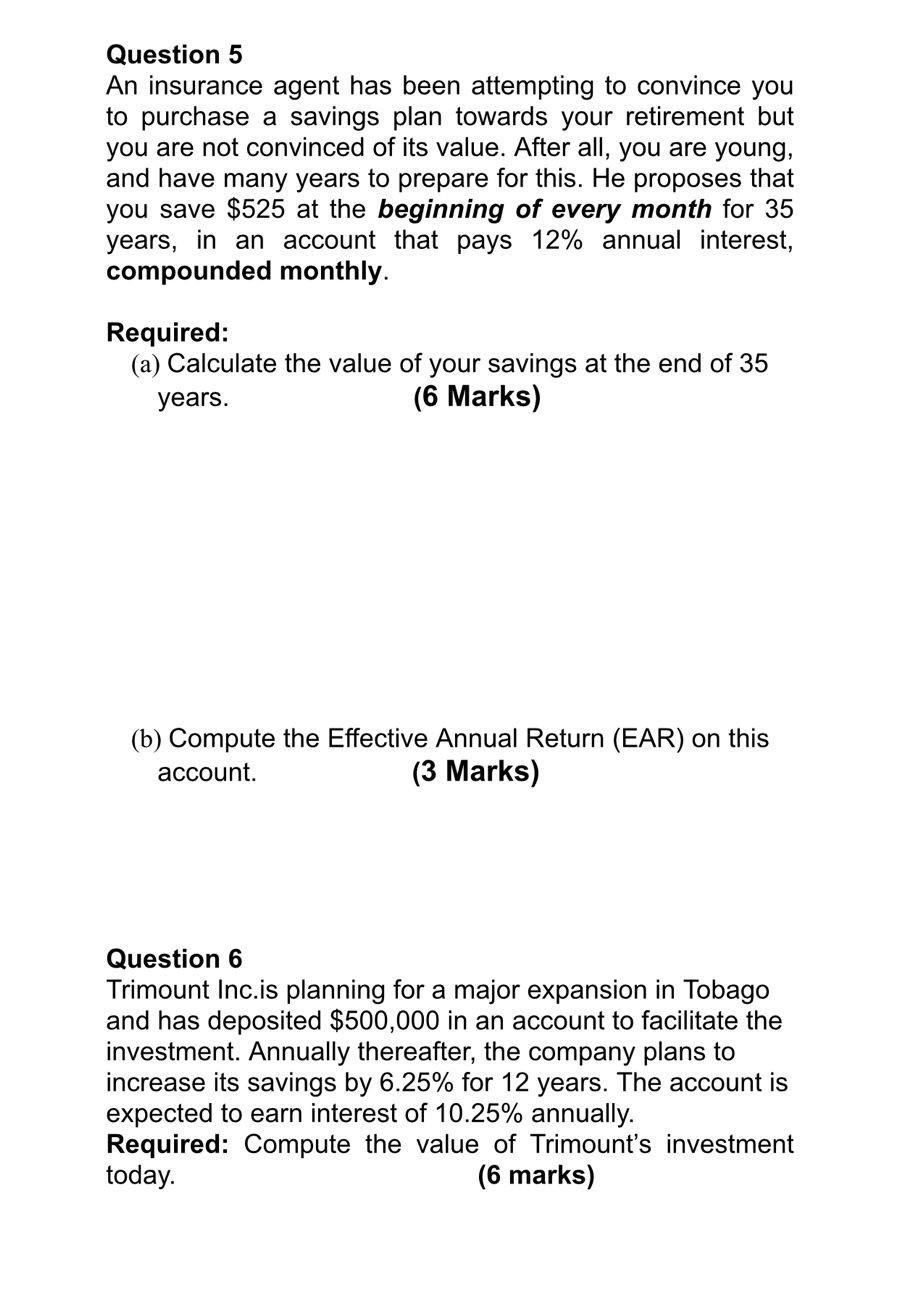

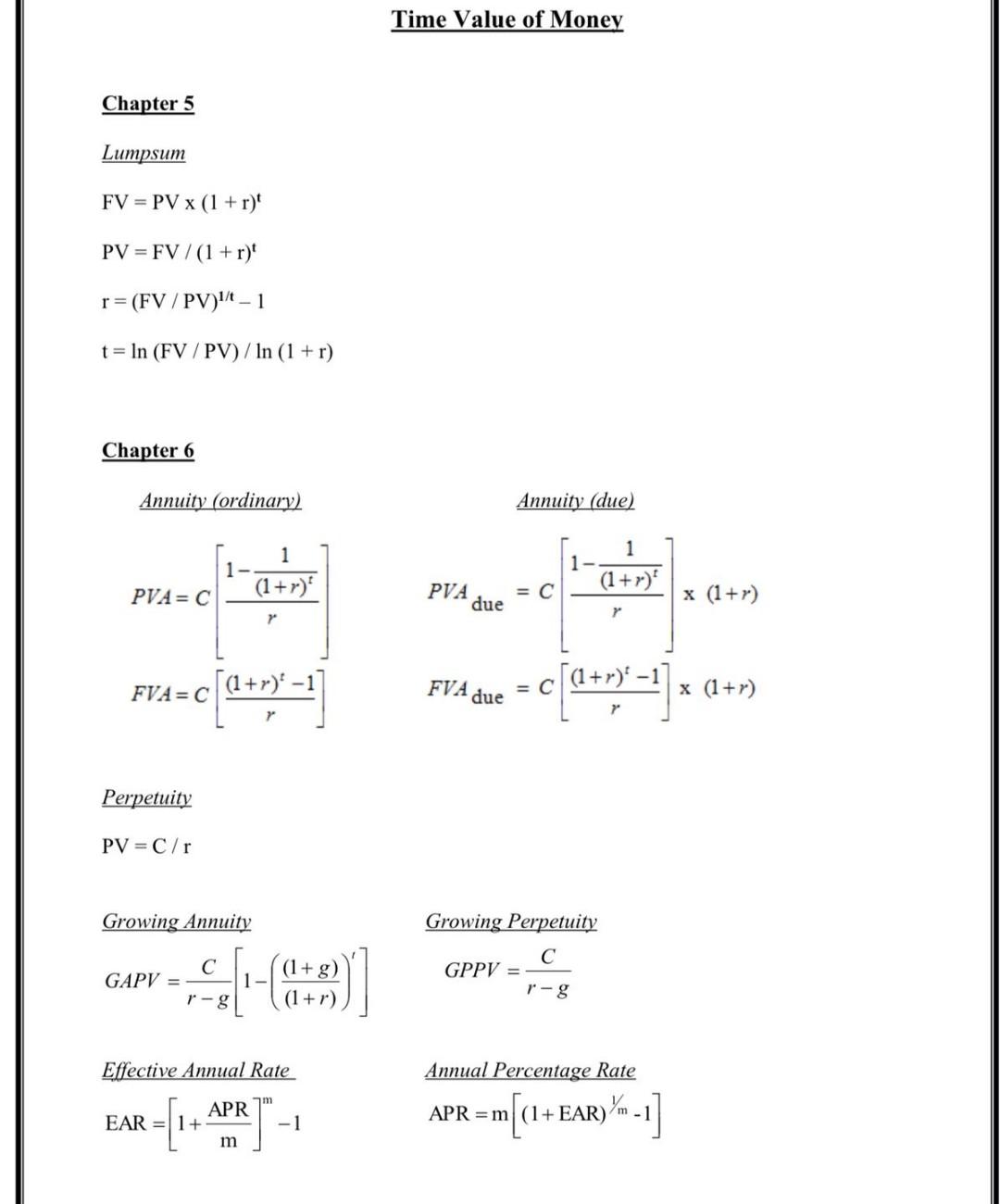

Question 5 An insurance agent has been attempting to convince you to purchase a savings plan towards your retirement but you are not convinced of its value. After all, you are young, and have many years to prepare for this. He proposes that you save $525 at the beginning of every month for 35 years, in an account that pays 12% annual interest, compounded monthly. Required: (a) Calculate the value of your savings at the end of 35 years. (6 Marks) (b) Compute the Effective Annual Return (EAR) on this account. (3 Marks) Question 6 Trimount Inc.is planning for a major expansion in Tobago and has deposited $500,000 in an account to facilitate the investment. Annually thereafter, the company plans to increase its savings by 6.25% for 12 years. The account is expected to earn interest of 10.25% annually. Required: Compute the value of Trimount's investment today. (6 marks) Time Value of Monev Chapter 5 Lumpsum FV=PVx(1+r)tPV=FV/(1+r)tr=(FV/PV)1/t1t=ln(FV/PV)/ln(1+r) Chapter 6 Annuity (ordinary) PVA=C[r1(1+r)t1]FVA=C[r(1+r)t1] Perpetuity PV=C/r Growing Annuity GAPV=rgC[1((1+r)(1+g))] Effective Annual Rate EAR=[1+mAPR]m1 Annuity (due) FVA due =C[r(1+r)t1](1+r) Growing Perpetuity GPPV=rgC Annual Percentage Rate APR=m[(1+EAR)1/m1]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts