Question: help Now it's time for you to practice what you've learned. Suppose your startup has $21.00 million in sales, $2.00 million of irventories, $4.00 million

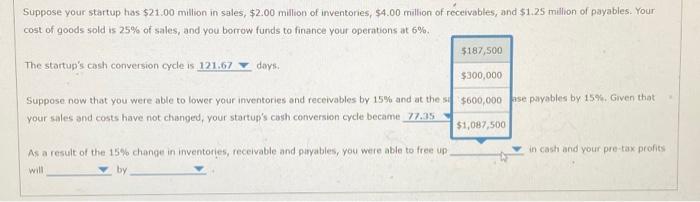

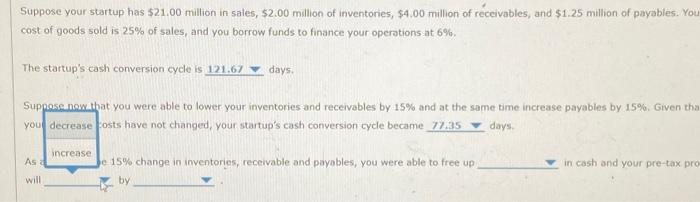

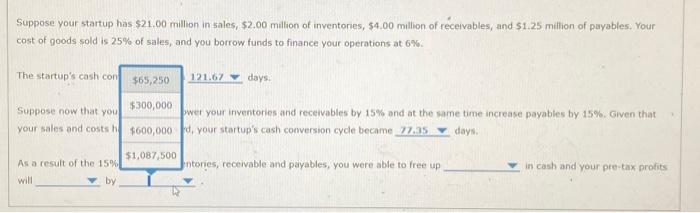

Now it's time for you to practice what you've learned. Suppose your startup has $21.00 million in sales, $2.00 million of irventories, $4.00 million of receivables, and $1.25 million of payables. Your cost of goods sold is 25% of sales, and you borrow funds to finance your operations at 6%. The startup's cash corversion cycle is dors. Suppose now that you were able to lower your inventories and receivables by 15% and at the same time increase poyables by is $. Given that your sales and costs have not changed, your startuph cash conversion cycle became dovs. As a result of the 15% change in irventories, receivable and parables, you were able to free up in cash and your pie-tax profiss Suppose your startup has $21.00 million in sales, $2.00 million of inventones, $4.00 million of receivables, and $1.25 million of payables. Your cost of goods sold is 25% of sales, and you borrow funds to finance your operations at 6%. The startup's cash conversion cycle is doys. Suppose. now that you were able to lower your inventories ond receivables by 15% and at the s ise parables by 15%. Given that your sales and costs have not changed, your startup's cash conversion cycle became 77.35 . As a result of the 15% change in inventories, receivable and pryables, you were able to free un in cash and your pre-tax peofits will by Suppose your startup has $21.00 milion in sales, $2.00 million of inventories, $4.00 million of receivables, and $1.25 million of payables. You cost of goods sold is 25% of sales, and you borrow funds to finance your operations at 6%. The startup's cash conversion cycle is days. Supoose now that you were able to lower your inventories and receivables by 15% and at the same time increase payables by 15%. Given th: you osts have not changed, your startup's cash conversion cycle became days. As e 15% change in inventories, receivable and payables, you were able to free up in cash and your pre-tax pro by Suppose your startup has $21.00 million in sales, $2.00 million of inventories, $4.00 million of receivables, and $1.25 million of parables, Your cost of goods sold is 25% of sales, and you borrow funds to finance your operations at 6%. The startup's cash cor Suppose now that you your sales and costs t days: wet your inventories and receivables by 15% and at the same time increase payables by 15%. Given that 1. your startup's cash corversion cycle became days. As a result of the 15% tories, receivable and payables, you were able to free up in cash and your pre-tax profits by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts