Question: Now it's time for you to practice what you've learned. Suppose your startup has $15.00 million in sales, $2.00 million of inventories, $3.50 million

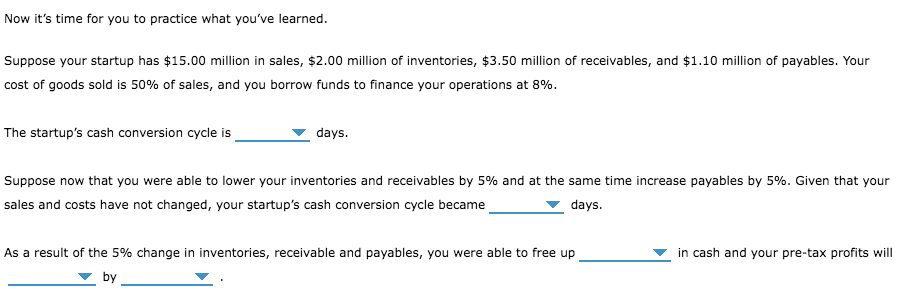

Now it's time for you to practice what you've learned. Suppose your startup has $15.00 million in sales, $2.00 million of inventories, $3.50 million of receivables, and $1.10 million of payables. Your cost of goods sold is 50% of sales, and you borrow funds to finance your operations at 8%. The startup's cash conversion cycle is days. Suppose now that you were able to lower your inventories and receivables by 5% and at the same time increase payables by 5%. Given that your sales and costs have not changed, your startup's cash conversion cycle became days. As a result of the 5% change in inventories, receivable and payables, you were able to free up by in cash and your pre-tax profits will

Step by Step Solution

There are 3 Steps involved in it

To solve the problem you will need to use the following formulas Cash conversion cycle Inventory Rec... View full answer

Get step-by-step solutions from verified subject matter experts