Question: Help on Part C You are attempting to value a put option with an exercise price of $150 and one year to expiration. The underlying

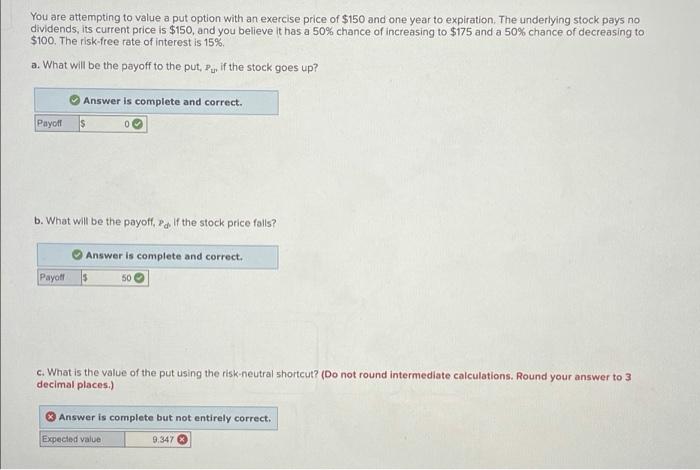

You are attempting to value a put option with an exercise price of $150 and one year to expiration. The underlying stock pays no dividends, its current price is $150, and you believe it has a 50% chance of increasing to $175 and a 50% chance of decreasing to $100. The risk-free rate of interest is 15% a. What will be the payoff to the put, Puif the stock goes up? Answer is complete and correct. Payoh b. What will be the payoff, if the stock price folls? Answer is complete and correct. Payoffs 50 c. What is the value of the put using the risk neutral shortcut? (Do not round intermediate calculations. Round your answer to 3 decimal places.) Answer is complete but not entirely correct. Expected value 9.3473

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts