Question: help please 1. Crystal Display Corp. (CDC) is considering two mutually exclusive investment projects. The cost of capital for these projects is r. The projects'

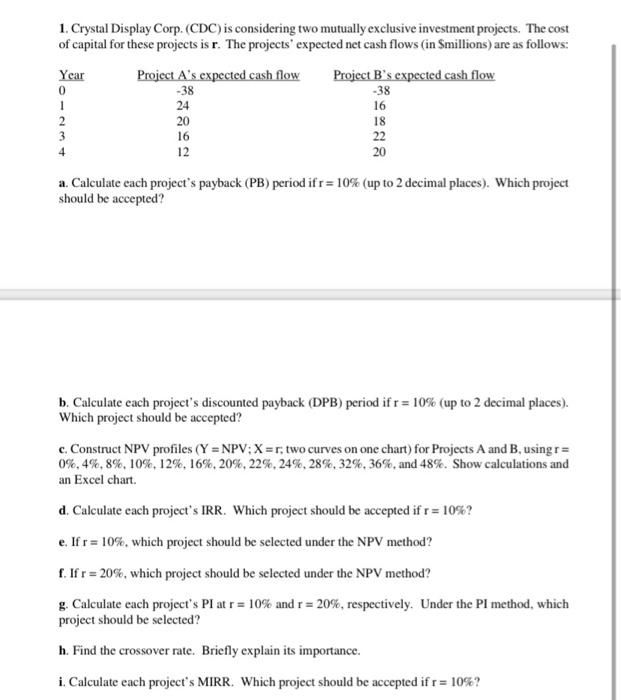

1. Crystal Display Corp. (CDC) is considering two mutually exclusive investment projects. The cost of capital for these projects is r. The projects' expected net cash flows (in Smillions) are as follows: Year Project A's expected cash flow Project B's expected cash flow 0 -38 -38 1 24 16 2 20 18 3 16 22 4 12 20 a. Calculate each project's payback (PB) period ifr=10% (up to 2 decimal places). Which project should be accepted? b. Calculate each project's discounted payback (DPB) period if r= 10% (up to 2 decimal places). Which project should be accepted? c. Construct NPV profiles (Y = NPV; X =r; two curves on one chart) for Projects A and B usingr = 0%, 4%, 8%, 10%, 12%, 16%, 20%, 22%, 24%, 28%, 32%, 36%, and 48%. Show calculations and an Excel chart. d. Calculate each project's IRR. Which project should be accepted if r= 10%? e. If r= 10%, which project should be selected under the NPV method? f. If r = 20%, which project should be selected under the NPV method? g. Calculate each project's Pl at r = 10% and r = 20%, respectively. Under the Pl method, which project should be selected? h. Find the crossover rate. Briefly explain its importance. i. Calculate each project's MIRR. Which project should be accepted ifr=10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts