Question: 1. Clear Display Corp. (CDC) is considering two mutually exclusive investment projects. The cost of capital for these projects is r. The projects' expected net

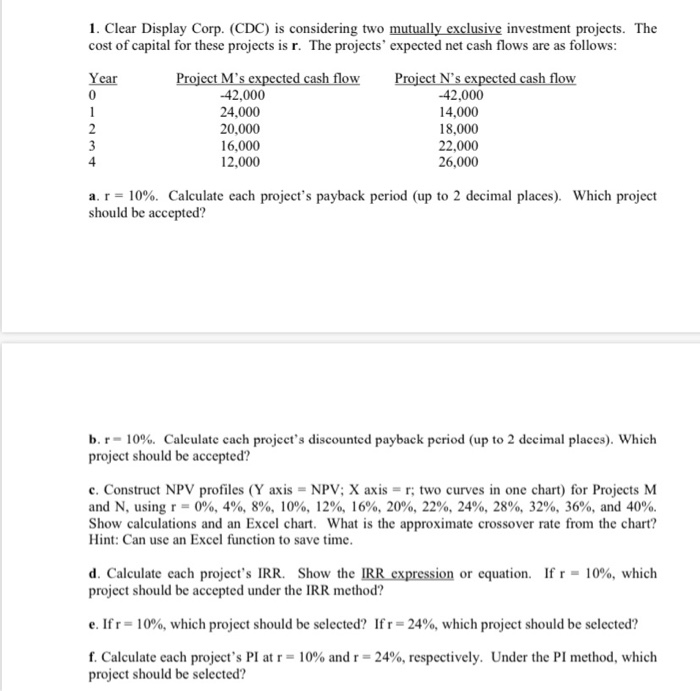

1. Clear Display Corp. (CDC) is considering two mutually exclusive investment projects. The cost of capital for these projects is r. The projects' expected net cash flows are as follows: Year Project M's expected cash flow Project N's expected cash flow 0 -42,000 -42,000 1 24,000 14,000 2 20,000 18,000 3 16,000 22,000 4 12,000 26,000 a. r = 10%. Calculate each project's payback period (up to 2 decimal places). Which project should be accepted? b.r-10%. Calculate cach project's discounted payback period (up to 2 decimal places). Which project should be accepted? c. Construct NPV profiles (Y axis = NPV; X axis = r; two curves in one chart) for Projects M and N, using r = 0%, 4%, 8%, 10%, 12%, 16%, 20%, 22%, 24%, 28%, 32%, 36%, and 40%. Show calculations and an Excel chart. What is the approximate crossover rate from the chart? Hint: Can use an Excel function to save time. d. Calculate each project's IRR. Show the IRR expression or equation. If r - 10%, which project should be accepted under the IRR method? e. Ifr=10%, which project should be selected? Ifr= 24%, which project should be selected? f. Calculate each project's PI at r = 10% and r = 24%, respectively. Under the PI method, which project should be selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts