Question: help please 62. Suppose five years ago a borrower borrowed a FRM loan at 9,5% interest rate with monthly payments for an initial balance of

help please

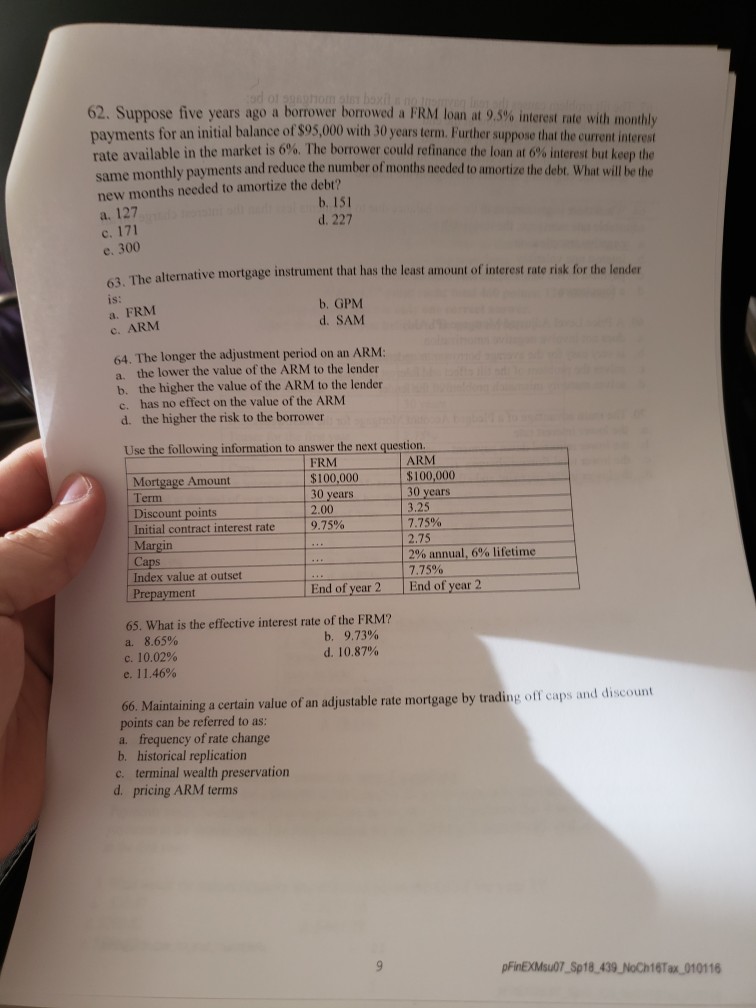

62. Suppose five years ago a borrower borrowed a FRM loan at 9,5% interest rate with monthly payments for an initial balance of $95,000 with 30 years term. Further suppose that the current interest rate available in the market is 6%. The borrower could refinance the loan at 6% interest but keep the emonthly payments and reduce the number of months needed to amortize the debt. What will be the sam new months needed to amortize the debt? a. 127 b. 151 d. 227 e. 300 Iternative mortgage instrument that has the least amount of interest rate risk for the lender 63. The al is a. FRM c. ARM b. GPM d. SAM 64. The longer the adjustment period on an ARM a. the lower the value of the ARM to the lender b. the higher the value of the ARM to the lender c. has no effect on the value of the ARM d. the higher the risk to the borrower Use the following information to answer the next question. ARM FRM $100,000 $100,000 30 years 2.00 Mortgage Amount 30 years 3.25 1.75% 2.75 0%annual,6% lifetime 7,75% Term Discount points initial contract interest rate 9.75% Mar in Caps Index value at outset End of year 2 End of year 2 Prepayment 65. What is the effective interest rate of the FRM? a. 8.65% c. 10.02% e. 11.46% b. 9.73% d. 10.87% 66. Maintaining a certain value of an adjustable rate mortgage by trading off caps and discount points can be referred to as a. frequency of rate change b. historical replication c. terminal wealth preservation d. pricing ARM terms pFinEXMsu0T Sp18,439 NoCh16Tax 010116

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts