Question: Help please A machine was purchased during 2013 for $2,740,000. At the time of purchase, it was estimated that the machine would have a useful

Help please

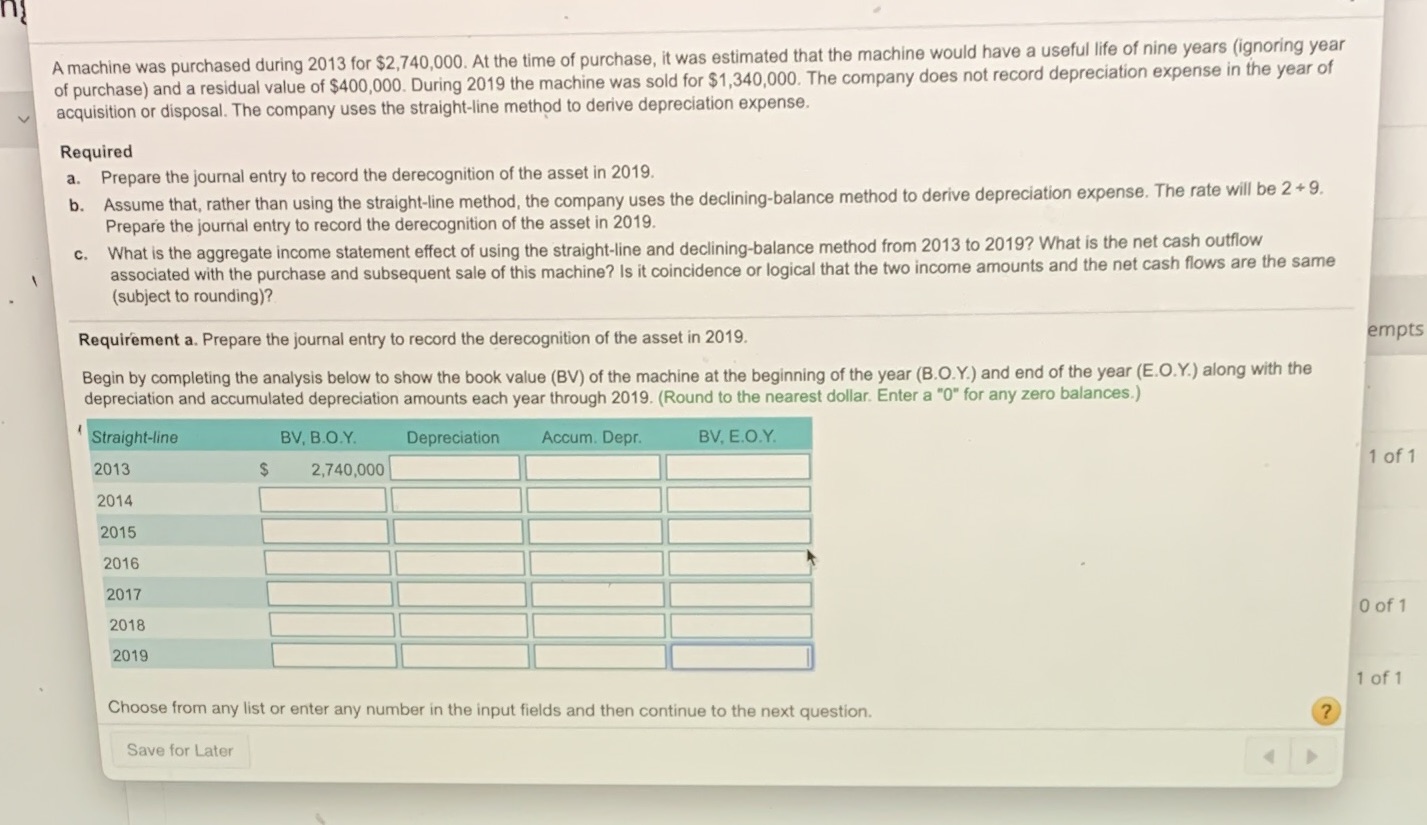

A machine was purchased during 2013 for $2,740,000. At the time of purchase, it was estimated that the machine would have a useful life of nine years (ignoring year of purchase) and a residual value of $400,000. During 2019 the machine was sold for $1,340,000. The company does not record depreciation expense in the year of acquisition or disposal. The company uses the straight-line method to derive depreciation expense. Required . Prepare the journal entry to record the derecognition of the asset in 2019. b. Assume that, rather than using the straight-line method, the company uses the declining-balance method to derive depreciation expense. The rate will be 2 + 9. Prepare the journal entry to record the derecognition of the asset in 2019. C. What is the aggregate income statement effect of using the straight-line and declining-balance method from 2013 to 2019? What is the net cash outflow associated with the purchase and subsequent sale of this machine? Is it coincidence or logical that the two income amounts and the net cash flows are the same (subject to rounding)? Requirement a. Prepare the journal entry to record the derecognition of the asset in 2019. empts Begin by completing the analysis below to show the book value (BV) of the machine at the beginning of the year (B.O.Y.) and end of the year (E.O.Y.) along with the depreciation and accumulated depreciation amounts each year through 2019. (Round to the nearest dollar. Enter a "0" for any zero balances.) Straight-line BV, B.O.Y. Depreciation Accum. Depr. BV, E.O.Y. 2013 $ 2,740,000 1 of 1 2014 2015 2016 2017 2018 0 of 1 2019 1 of 1 Choose from any list or enter any number in the input fields and then continue to the next question. ? Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts