Question: Hi, Would like help with this question thanks. TLDR: First picture is the required reading, followed by 5 multiple choice questions. 1. Mr Michael Maguire

Hi, Would like help with this question thanks. TLDR: First picture is the required reading, followed by 5 multiple choice questions.

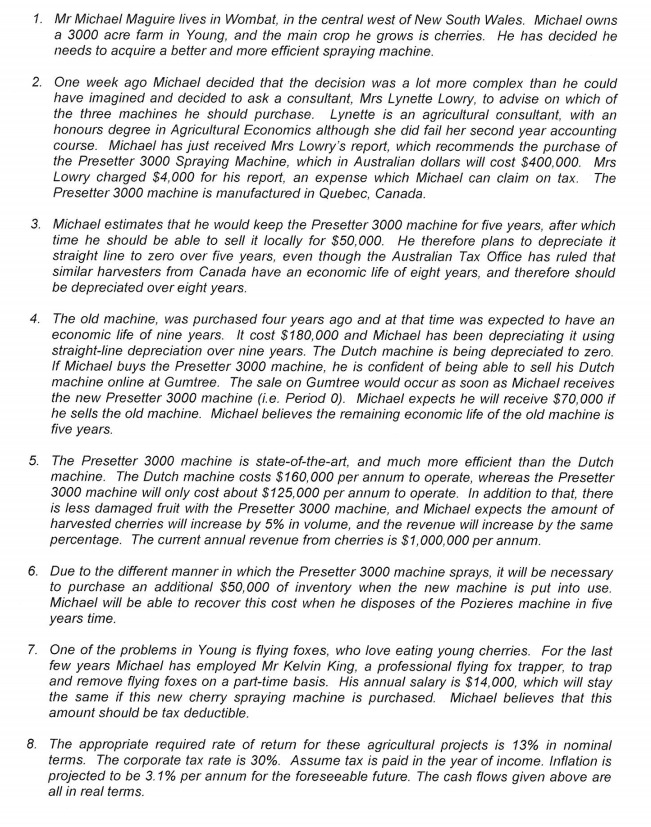

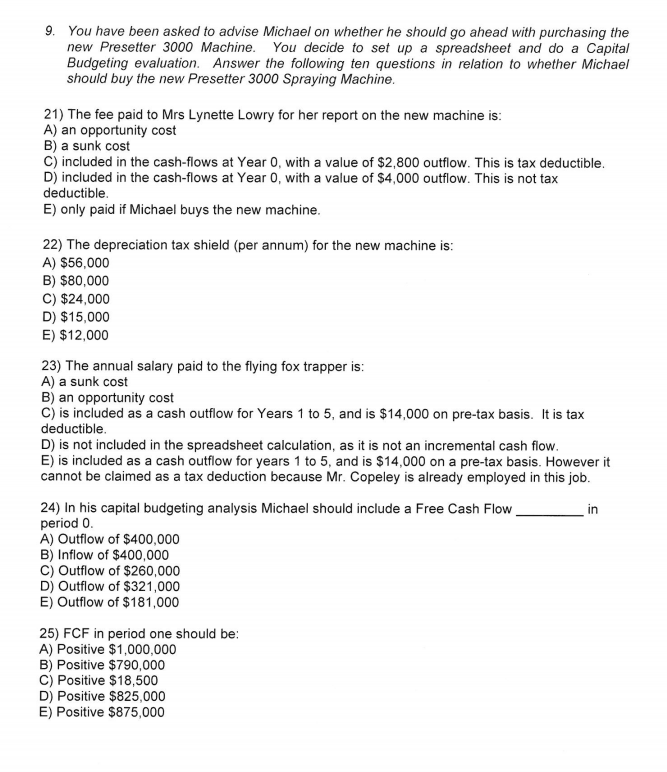

1. Mr Michael Maguire lives in Wombat, in the central west of New South Wales. Michael owns a 3000 acre farm in Young, and the main crop he grows is cherries. He has decided he needs to acquire a better and more efficient spraying machine. 2. One week ago Michael decided that the decision was a lot more complex than he could have imagined and decided to ask a consultant, Mrs Lynette Lowry, to advise on which of the three machines he should purchase. Lynette is an agricultural consultant, with an honours degree in Agricultural Economics although she did fail her second year accounting course. Michael has just received Mrs Lowry's report, which recommends the purchase of the Presetter 3000 Spraying Machine, which in Australian dollars will cost $400,000. Mrs Lowry charged $4,000 for his report, an expense which Michael can claim on tax. The Presetter 3000 machine is manufactured in Quebec, Canada. 3. Michael estimates that he would keep the Presetter 3000 machine for five years, after which time he should be able to sell it locally for $50,000. He therefore plans to depreciate it straight line to zero over five years, even though the Australian Tax Office has ruled that similar harvesters from Canada have an economic life of eight years, and therefore should be depreciated over eight years, 4. The old machine, was purchased four years ago and at that time was expected to have an economic life of nine years. It cost $180,000 and Michael has been depreciating it using straight-line depreciation over nine years. The Dutch machine is being depreciated to zero. If Michael buys the Presetter 3000 machine, he is confident of being able to sell his Dutch machine online at Gumtree. The sale on Gumtree would occur as soon as Michael receives the new Presetter 3000 machine (i.e. Period 0). Michael expects he will receive $70,000 if he sells the old machine. Michael believes the remaining economic life of the old machine is five years. 5. The Presetter 3000 machine is state-of-the-art, and much more efficient than the Dutch machine. The Dutch machine costs $160,000 per annum to operate, whereas the Presetter 3000 machine will only cost about $125,000 per annum to operate. In addition to that, there is less damaged fruit with the Presetter 3000 machine, and Michael expects the amount of harvested cherries will increase by 5% in volume, and the revenue will increase by the same percentage. The current annual revenue from cherries is $1,000,000 per annum. 6. Due to the different manner in which the Presetter 3000 machine sprays, it will be necessary to purchase an additional $50,000 of inventory when the new machine is put into use. Michael will be able to recover this cost when he disposes of the Pozieres machine in five years time. 7. One of the problems in Young is flying foxes, who love eating young cherries. For the last few years Michael has employed Mr Kelvin King, a professional flying fox trapper, to trap and remove flying foxes on a part-time basis. His annual salary is $14,000, which will stay the same if this new cherry spraying machine is purchased. Michael believes that this amount should be tax deductible. 8. The appropriate required rate of return for these agricultural projects is 13% in nominal terms. The corporate tax rate is 30%. Assume tax is paid in the year of income. Inflation is projected to be 3.1% per annum for the foreseeable future. The cash flows given above are all in real terms. 9. You have been asked to advise Michael on whether he should go ahead with purchasing the new Presetter 3000 Machine. You decide to set up a spreadsheet and do a Capital Budgeting evaluation. Answer the following ten questions in relation to whether Michael should buy the new Presetter 3000 Spraying Machine. 21) The fee paid to Mrs Lynette Lowry for her report on the new machine is: A) an opportunity cost B) a sunk cost C) included in the cash-flows at Year 0, with a value of $2,800 outflow. This is tax deductible. D) included in the cash-flows at Year 0, with a value of $4,000 outflow. This is not tax deductible. E) only paid if Michael buys the new machine. 22) The depreciation tax shield (per annum) for the new machine is: A) $56,000 B) $80,000 C) $24,000 D) $15,000 E) $12,000 23) The annual salary paid to the flying fox trapper is: A) a sunk cost B) an opportunity cost C) is included as a cash outflow for Years 1 to 5, and is $14,000 on pre-tax basis. It is tax deductible. D) is not included in the spreadsheet calculation, as it is not an incremental cash flow. E) is included as a cash outflow for years 1 to 5, and is $14,000 on a pre-tax basis. However it cannot be claimed as a tax deduction because Mr. Copeley is already employed in this job. 24) In his capital budgeting analysis Michael should include a Free Cash Flow in period 0. A) Outflow of $400,000 B) Inflow of $400,000 C) Outflow of $260,000 D) Outflow of $321,000 E) Outflow of $181,000 25) FCF in period one should be: A) Positive $1,000,000 B) Positive $790,000 C) Positive $18,500 D) Positive $825,000 E) Positive $875,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts