Question: help please A1 X fx Accessibility tab summary: Students please use the in A B C D 1 Dani Corp. has 5.5 million shares of

help please

help please

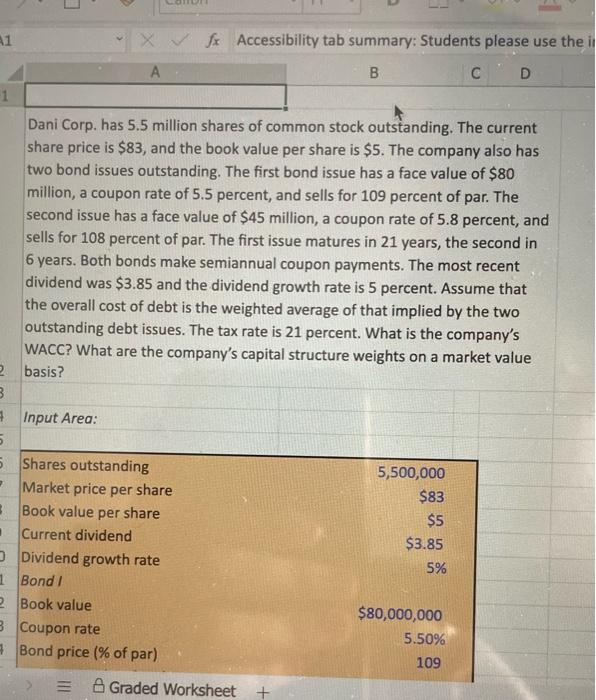

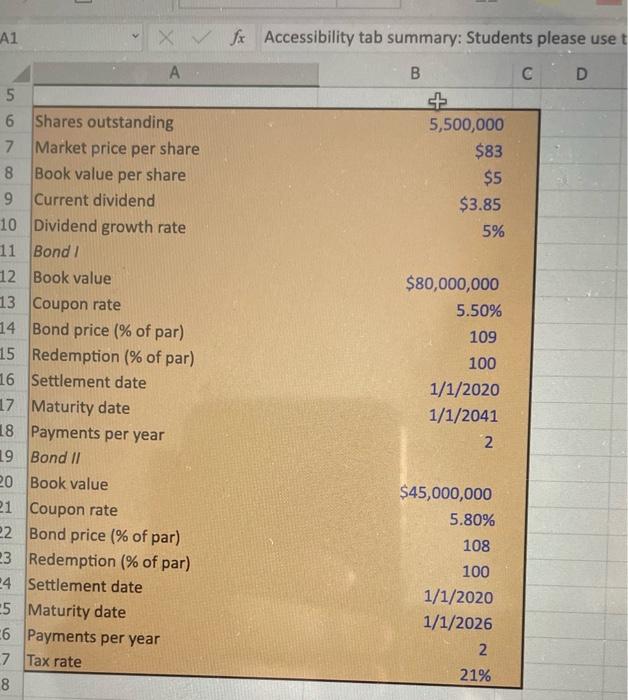

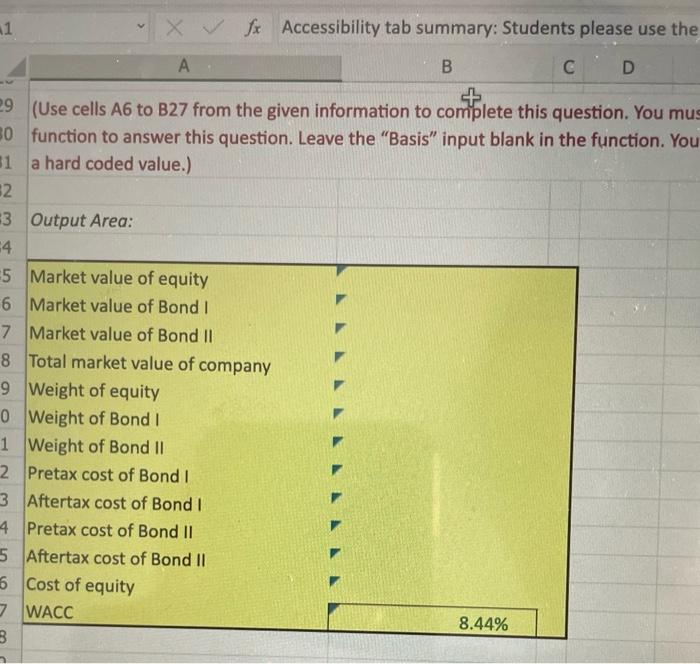

A1 X fx Accessibility tab summary: Students please use the in A B C D 1 Dani Corp. has 5.5 million shares of common stock outstanding. The current share price is $83, and the book value per share is $5. The company also has two bond issues outstanding. The first bond issue has a face value of $80 million, a coupon rate of 5.5 percent, and sells for 109 percent of par. The second issue has a face value of $45 million, a coupon rate of 5.8 percent, and sells for 108 percent of par. The first issue matures in 21 years, the second in 6 years. Both bonds make semiannual coupon payments. The most recent dividend was $3.85 and the dividend growth rate is 5 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. The tax rate is 21 percent. What is the company's WACC? What are the company's capital structure weights on a market value basis? 2 3 Input Area: Shares outstanding 5,500,000 Market price per share $83 3 Book value per share $5 Current dividend $3.85 O Dividend growth rate 5% 1 Bond I 2 Book value $80,000,000 3 Coupon rate 5.50% Bond price (% of par) 109 5 5 2 M A Graded Worksheet + A1 X fx Accessibility tab summary: Students please use t A B C D 5 + 6 Shares outstanding 5,500,000 7 Market price per share $83 $5 8 Book value per share 9 Current dividend $3.85 10 Dividend growth rate 5% 11 Bond I 12 Book value $80,000,000 13 Coupon rate 5.50% 109 14 Bond price (% of par) 15 Redemption (% of par) 100 16 Settlement date 1/1/2020 17 Maturity date 1/1/2041 2 18 Payments per year 19 Bond II 20 Book value $45,000,000 21 Coupon rate 5.80% 22 Bond price (% of par) 108 23 Redemption (% of par) 100 24 Settlement date 1/1/2020 25 Maturity date 1/1/2026 26 Payments per year 7 Tax rate 2 21% 8 1 fx Accessibility tab summary: Students please use the A B C D 29 (Use cells A6 to B27 from the given information to complete this question. You mus 30 function to answer this question. Leave the "Basis" input blank in the function. You a hard coded value.) 1 $2 #3 Output Area: =4 5 Market value of equity 6 Market value of Bond I 7 Market value of Bond II 8 Total market value of company 9 Weight of equity 0 Weight of Bond I 1 Weight of Bond II Pretax cost of Bond I 2 3 Aftertax cost of Bond I Pretax cost of Bond II 4 5 Aftertax cost of Bond II 6 Cost of equity WACC 8.44% B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts