Question: Please show work in excel formulas, thank you! A 1 fx Accessibility tab summary: Students please use the information below to complete the question completing

Please show work in excel formulas, thank you!

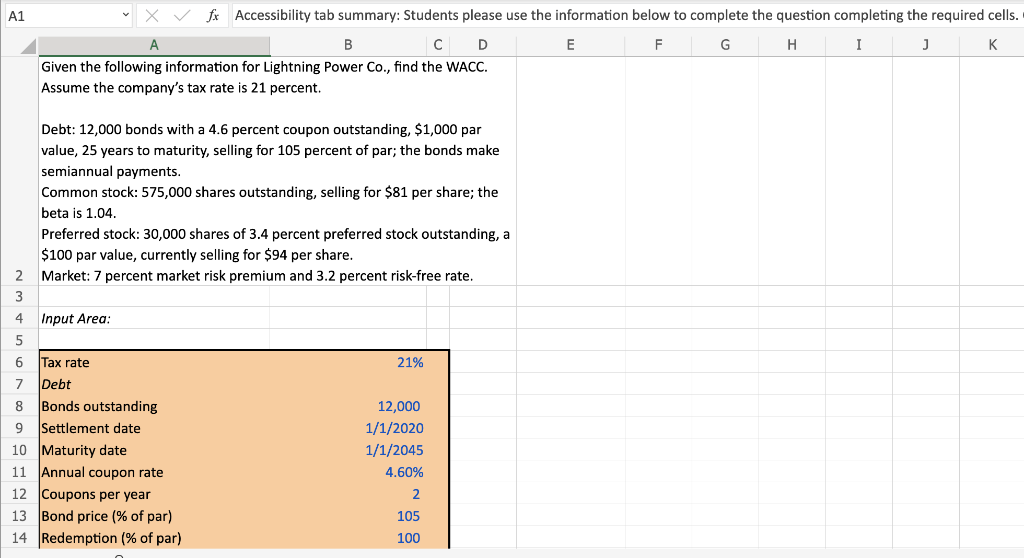

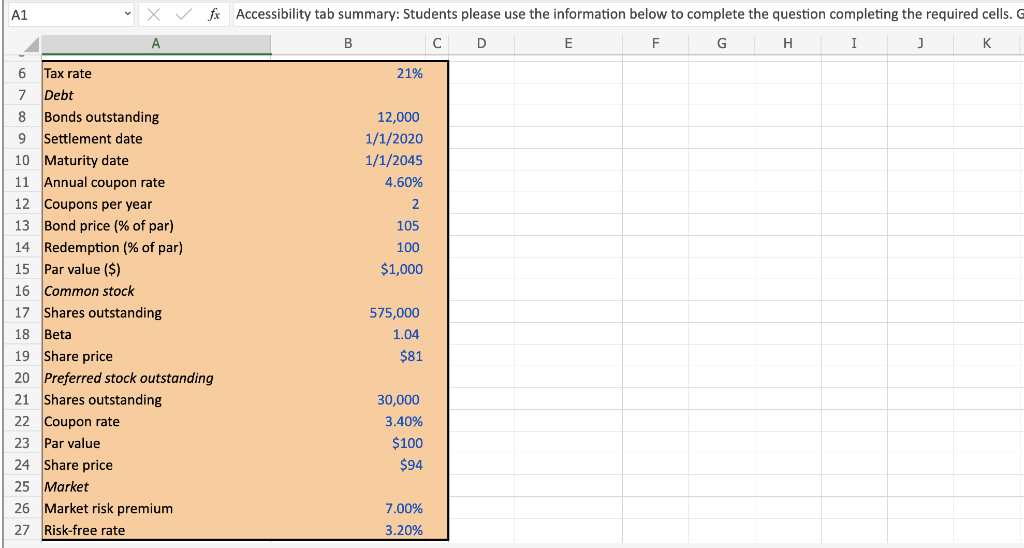

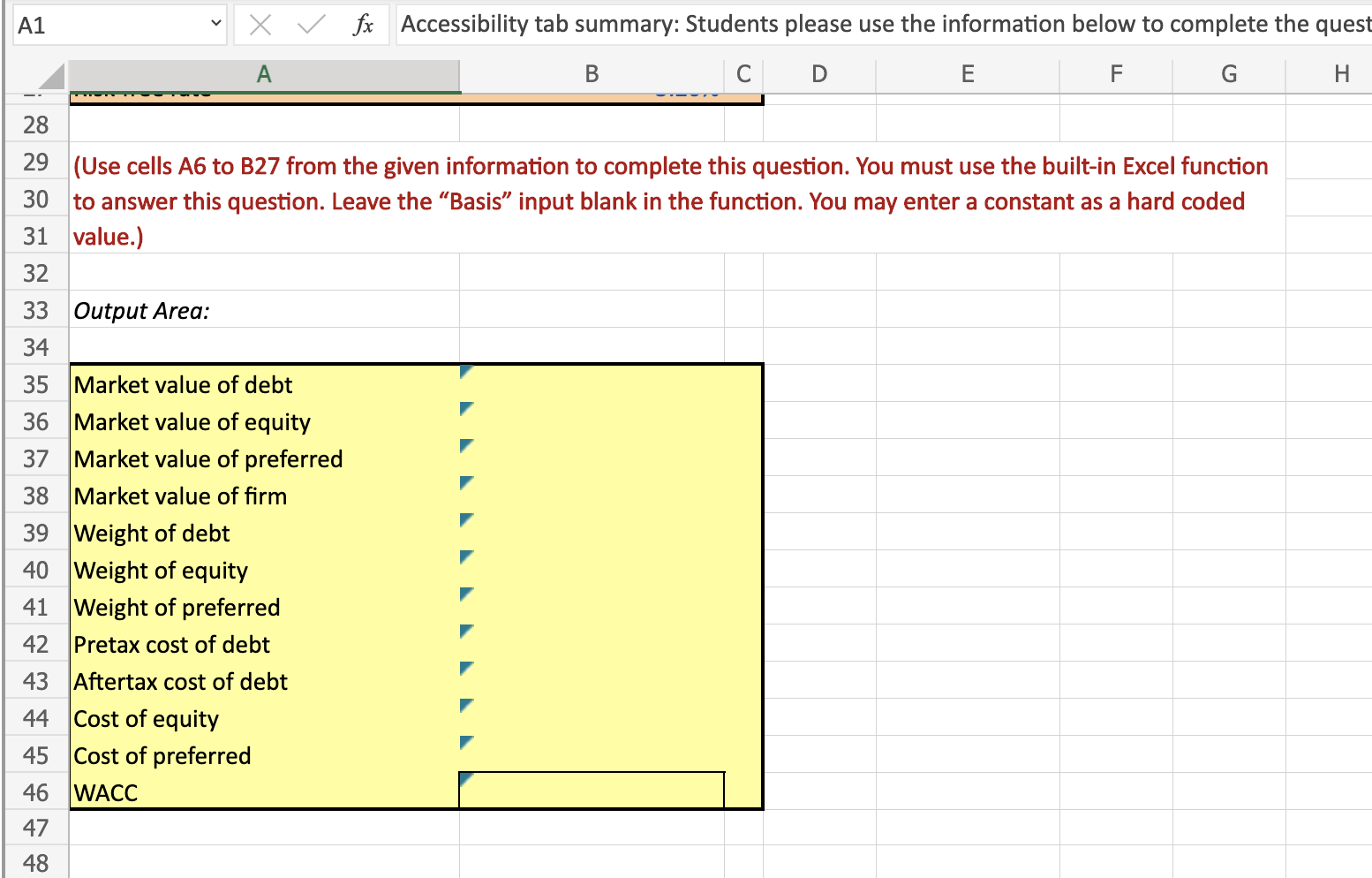

A 1 fx Accessibility tab summary: Students please use the information below to complete the question completing the required cells. A B C D E G Given the following information for Lightning Power Co., find the WACC. Assume the company's tax rate is 21 percent. Debt: 12,000 bonds with a 4.6 percent coupon outstanding, $1,000 par value, 25 years to maturity, selling for 105 percent of par; the bonds make semiannual payments. Common stock: 575,000 shares outstanding, selling for $81 per share; the beta is 1.04. Preferred stock: 30,000 shares of 3.4 percent preferred stock outstanding, a $100 par value, currently selling for $94 per share. 2 Market: 7 percent market risk premium and 3.2 percent risk-free rate. 4 Input Area: \begin{tabular}{c|lr} 5 & & \\ \cline { 2 - 3 } 7 & Tax rate & 21% \\ 7 & Debt & \\ 8 & Bonds outstanding & 12,000 \\ 9 & Settlement date & 1/1/2020 \\ 10 & Maturity date & 1/1/2045 \\ 11 & Annual coupon rate & 4.60% \\ 12 & Coupons per year & 2 \\ 13 & Bond price (\% of par) & 105 \\ 14 & Redemption (\% of par) & 100 \end{tabular} A1 fx Accessibility tab summary: Students please use the information below to complete the question completing the required cells. A1 fx Accessibility tab summary: Students please use the information below to complete the quest \begin{tabular}{|l|l|l|} \hline 28 & \multicolumn{1}{|c|}{ (Use cells A6 to B27 from the given information to complete this qu } \\ \hline 30 & to answer this question. Leave the "Basis" input blank in the functic \\ \hline 31 & value.) \\ \hline 32 & & \\ \hline 33 & Output Area: \\ \hline 34 & \\ \hline 35 & Market value of debt \\ \hline 36 & Market value of equity \\ \hline 37 & Market value of preferred \\ \hline 38 & Market value of firm \\ \hline 39 & Weight of debt \\ \hline 40 & Weight of equity \\ \hline 41 & Weight of preferred \\ \hline 42 & Pretax cost of debt \\ \hline 43 & Aftertax cost of debt \\ \hline 44 & Cost of equity \\ \hline 45 & Cost of preferred \\ \hline 46 & WACC \\ \hline 47 & \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts