Question: help please: accounting question- please help! Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1-a. Calculate

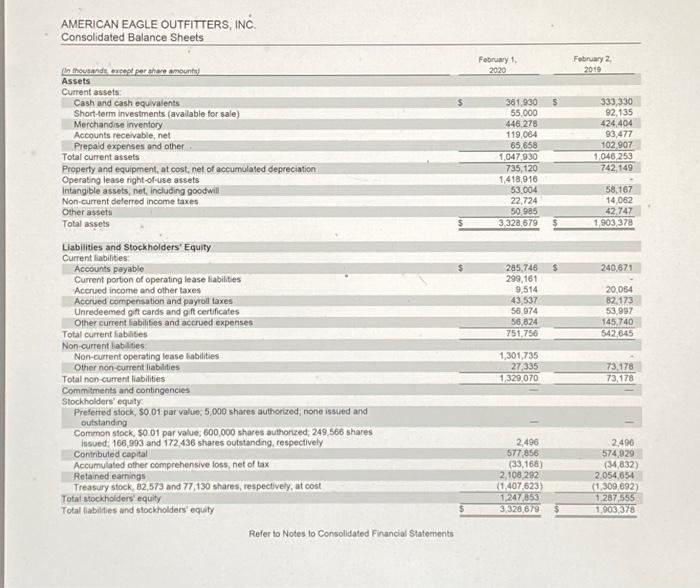

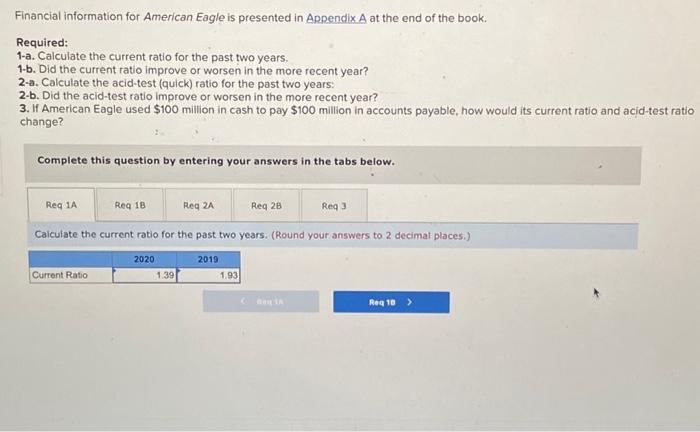

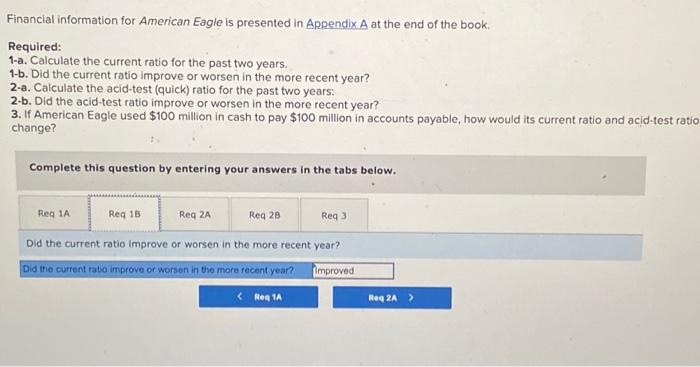

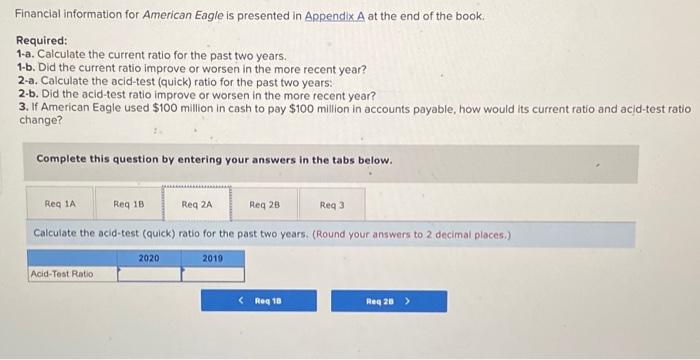

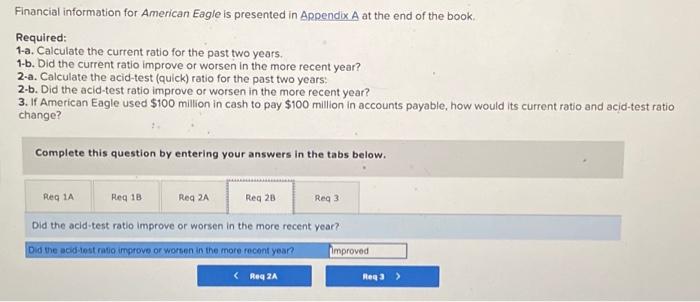

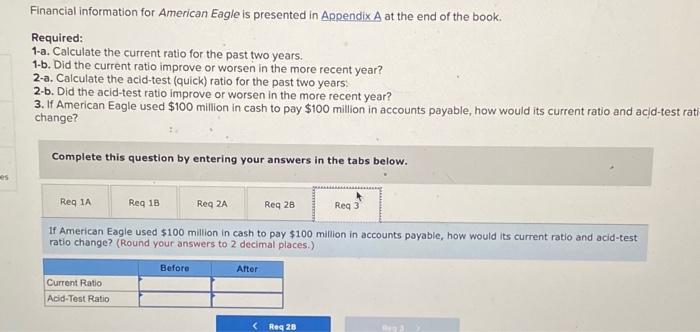

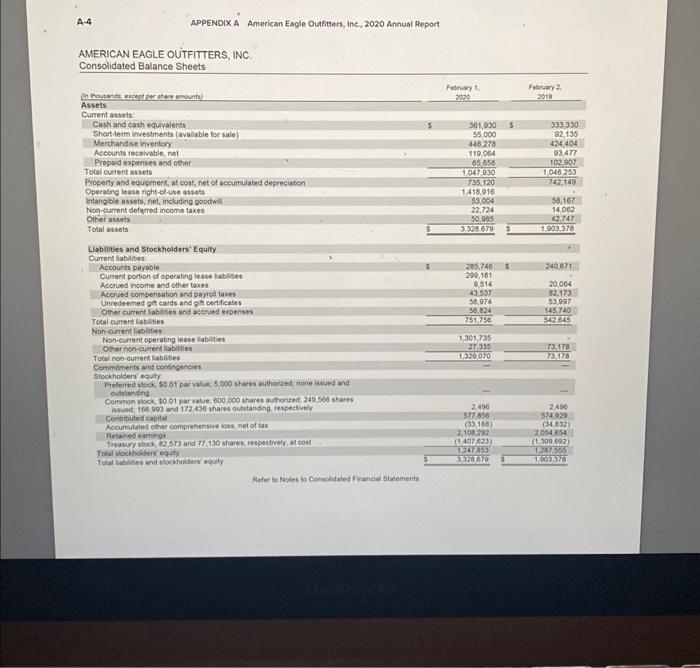

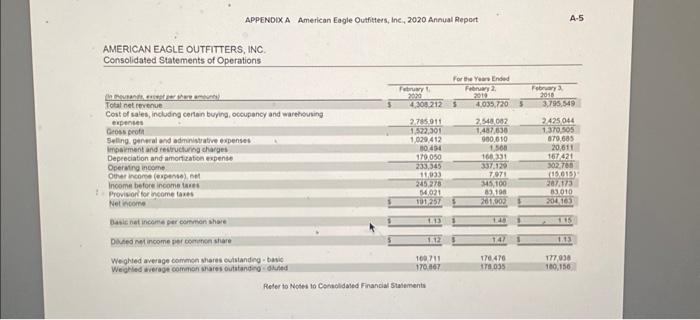

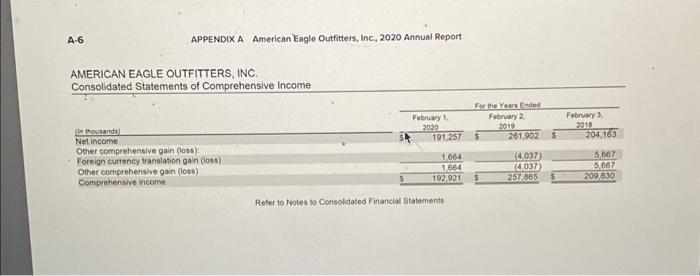

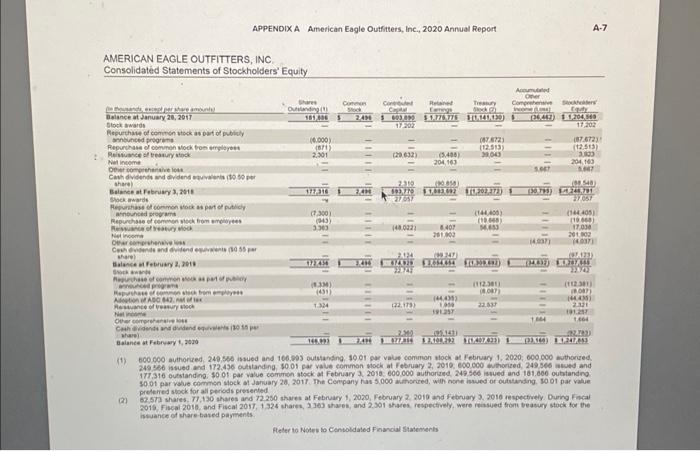

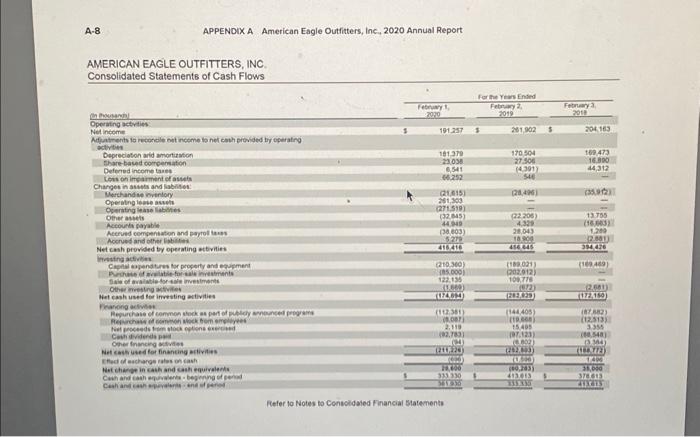

Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1-a. Calculate the current ratio for the past two years. 1-b. Did the current ratio improve or worsen in the more recent year? 2-a. Calculate the acid test (quick) ratio for the past two years: 2.b. Did the acid-test ratio improve or worsen in the more recent year? 3. If American Eagle used $100 milion in cash to pay $100 million in accounts payable, how would its current ratio and acid-test ratio change? AMERICAN EAGLE OUTFITTERS, IN. Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1-a. Calculate the current ratio for the past two years. 1-b. Did the current ratio improve or worsen in the more recent year? 2-a. Calculate the acid-test (quick) ratio for the past two years: 2-b. Did the acid-test ratio improve or worsen in the more recent year? 3. If American Eagle used $100 million in cash to pay $100 million in accounts payable, how would its current ratio and acid-test ratic change? Complete this question by entering your answers in the tabs below. Caiculate the current ratio for the past two years. (Round your answers to 2 decimat places.) Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1-a. Calculate the current ratio for the past two years. 1-b. Did the current ratio improve or worsen in the more recent year? 2-a. Calculate the acid-test (quick) ratio for the past two years: 2-b. Did the acid-test ratio improve or worsen in the more recent year? 3. If American Eagle used $100 million in cash to pay $100 million in accounts payable, how would its current ratio and acid-test rati change? Complete this question by entering your answers in the tabs below. Did the current ratio improve or worsen in the more recent year? Did the current ratio improve or worsen in the more recent year? improved Financial information for American Eagle is presented in Appendix.A at the end of the book. Required: 1-a. Calculate the current ratio for the past two years. 1-b. Did the current ratio improve or worsen in the more recent year? 2-a. Calculate the acid-test (quick) ratio for the past two years: 2-b. Did the acid-test ratio improve or worsen in the more recent year? 3. If American Eagle used $100 million in cash to pay $100 million in accounts payable, how would its current ratio and acid-test ratio change? Complete this question by entering your answers in the tabs below. Calculate the acid-test (quick) ratio for the past two years. (Round your answers to 2 decimal places.) Financial information for American Eagle is presented in ARpendix A at the end of the book. Required: 1-a. Calculate the current ratio for the past two years. 1-b. Did the current ratio improve or worsen in the more recent year? 2-a. Calculate the acid-test (quick) ratio for the past two years: 2-b. Did the acid-test ratio improve or worsen in the more recent year? 3. If American Eagle used $100 million in cash to pay $100 million in accounts payable, how would its current ratio and acid-test ratio change? Complete this question by entering your answers in the tabs below. Did the acid-test ratio improve or worsen in the more recent year? Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1-a. Calculate the current ratio for the past two years. 1-b. Did the current ratio improve or worsen in the more recent year? 2-a. Calculate the acid-test (quick) ratio for the past two years: 2-b. Did the acid-test ratio improve or worsen in the more recent year? 3. If American Eagle used $100 million in cash to pay $100 million in accounts payable, how would its current ratio and acid-test ra change? Complete this question by entering your answers in the tabs below. If American Eagle used $100 million in cash to pay $100 million in accounts payable, how would its current ratio and acid-test ratio change? (Round your answers to 2 decimal places.) A. 4 APPENDIX A American Eagle Outitiers, Inc, 2020 Annual Report AMERICAN EAGLE OUTFITTERS, INC. APPENDDX A American Eagle Outfiters; Inc, 2020 Annual Repoet S, INC. ations APPENDIX A American Eagle Outfitters, Inc, 2020 Annual Report TFITTERS, INC. 5 of Comprehensive Income Refer to Noles to Consolidated Financial Statements APPENDIX A American Eagle Outfiters, Inc., 2020 Annual Report A. AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Stockholders' Equity 9001 par volue common slock at Jahuary 26,2017 . The Cempany has 5,000 asthorited, with none isuces or outalasding. 10 of par value (2) prelened soock for all peridods presented istuance of share tated payments. Aeter to Notes ts Centoldaled Financial Statemerls Fefer to Notes to Censoldased Financial Btatements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts